Commando News Aug16

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

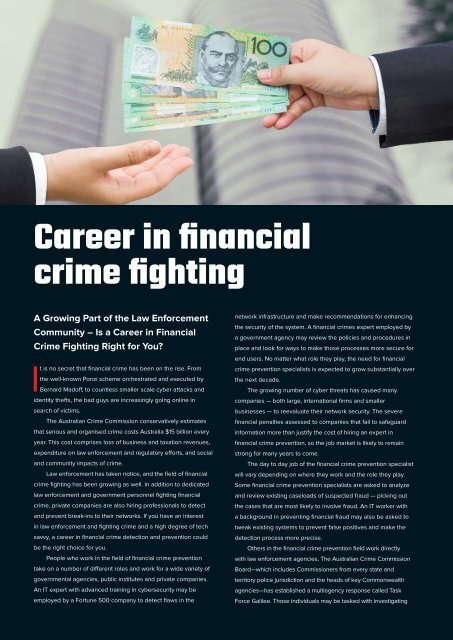

A Growing Part of the Law Enforcement<br />

Community – Is a Career in Financial<br />

Crime Fighting Right for You?<br />

It is no secret that financial crime has been on the rise. From<br />

the well-known Ponzi scheme orchestrated and executed by<br />

Bernard Madoff, to countless smaller scale cyber attacks and<br />

identity thefts, the bad guys are increasingly going online in<br />

search of victims.<br />

The Australian Crime Commission conservatively estimates<br />

that serious and organised crime costs Australia $15 billion every<br />

year. This cost comprises loss of business and taxation revenues,<br />

expenditure on law enforcement and regulatory efforts, and social<br />

and community impacts of crime.<br />

Law enforcement has taken notice, and the field of financial<br />

crime fighting has been growing as well. In addition to dedicated<br />

law enforcement and government personnel fighting financial<br />

crime, private companies are also hiring professionals to detect<br />

and prevent break-ins to their networks. If you have an interest<br />

in law enforcement and fighting crime and a high degree of tech<br />

savvy, a career in financial crime detection and prevention could<br />

be the right choice for you.<br />

People who work in the field of financial crime prevention<br />

take on a number of different roles and work for a wide variety of<br />

governmental agencies, public institutes and private companies.<br />

An IT expert with advanced training in cybersecurity may be<br />

employed by a Fortune 500 company to detect flaws in the<br />

network infrastructure and make recommendations for enhancing<br />

the security of the system. A financial crimes expert employed by<br />

a government agency may review the policies and procedures in<br />

place and look for ways to make those processes more secure for<br />

end users. No matter what role they play, the need for financial<br />

crime prevention specialists is expected to grow substantially over<br />

the next decade.<br />

The growing number of cyber threats has caused many<br />

companies — both large, international firms and smaller<br />

businesses — to reevaluate their network security. The severe<br />

financial penalties assessed to companies that fail to safeguard<br />

information more than justify the cost of hiring an expert in<br />

financial crime prevention, so the job market is likely to remain<br />

strong for many years to come.<br />

The day to day job of the financial crime prevention specialist<br />

will vary depending on where they work and the role they play.<br />

Some financial crime prevention specialists are asked to analyze<br />

and review existing caseloads of suspected fraud — picking out<br />

the cases that are most likely to involve fraud. An IT worker with<br />

a background in preventing financial fraud may also be asked to<br />

tweak existing systems to prevent false positives and make the<br />

detection process more precise.<br />

Others in the financial crime prevention field work directly<br />

with law enforcement agencies, The Australian Crime Commission<br />

Board—which includes Commissioners from every state and<br />

territory police jurisdiction and the heads of key Commonwealth<br />

agencies—has established a multiagency response called Task<br />

Force Galilee. Those individuals may be tasked with investigating