DEVRY ACCT 555 Entire Course

acct 555,devry acct 555,devry acct 555 entire course,devry acct 555 entire class,devry acct 555 course project and you decide,devry acct 555 final exam 100,devry acct 555 midterm,devry acct 555 week 1,devry acct 555 week 2,devry acct 555 week 3,devry acct 555week 4,devry acct 555 week 5,devry acct 555 week 6,devry acct 555 week 7,devry acct 555 tutorials,devry acct 555assignments,devry acct 555 help

acct 555,devry acct 555,devry acct 555 entire course,devry acct 555 entire class,devry acct 555 course project and you decide,devry acct 555 final exam 100,devry acct 555 midterm,devry acct 555 week 1,devry acct 555 week 2,devry acct 555 week 3,devry acct 555week 4,devry acct 555 week 5,devry acct 555 week 6,devry acct 555 week 7,devry acct 555 tutorials,devry acct 555assignments,devry acct 555 help

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

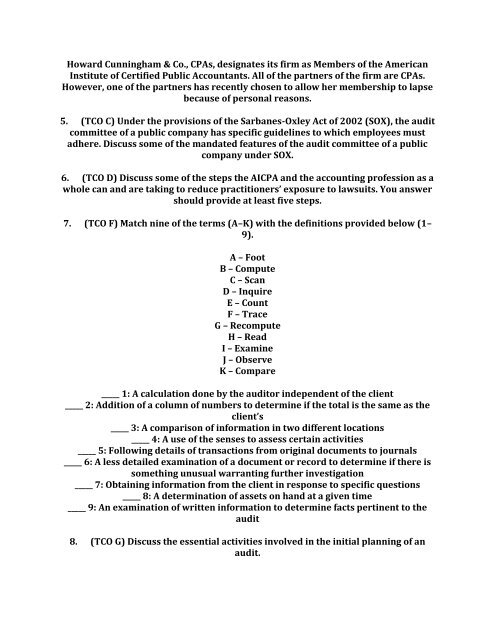

Howard Cunningham & Co., CPAs, designates its firm as Members of the American<br />

Institute of Certified Public Accountants. All of the partners of the firm are CPAs.<br />

However, one of the partners has recently chosen to allow her membership to lapse<br />

because of personal reasons.<br />

5. (TCO C) Under the provisions of the Sarbanes-Oxley Act of 2002 (SOX), the audit<br />

committee of a public company has specific guidelines to which employees must<br />

adhere. Discuss some of the mandated features of the audit committee of a public<br />

company under SOX.<br />

6. (TCO D) Discuss some of the steps the AICPA and the accounting profession as a<br />

whole can and are taking to reduce practitioners’ exposure to lawsuits. You answer<br />

should provide at least five steps.<br />

7. (TCO F) Match nine of the terms (A–K) with the definitions provided below (1–<br />

9).<br />

A – Foot<br />

B – Compute<br />

C – Scan<br />

D – Inquire<br />

E – Count<br />

F – Trace<br />

G – Recompute<br />

H – Read<br />

I – Examine<br />

J – Observe<br />

K – Compare<br />

_____ 1: A calculation done by the auditor independent of the client<br />

_____ 2: Addition of a column of numbers to determine if the total is the same as the<br />

client’s<br />

_____ 3: A comparison of information in two different locations<br />

_____ 4: A use of the senses to assess certain activities<br />

_____ 5: Following details of transactions from original documents to journals<br />

_____ 6: A less detailed examination of a document or record to determine if there is<br />

something unusual warranting further investigation<br />

_____ 7: Obtaining information from the client in response to specific questions<br />

_____ 8: A determination of assets on hand at a given time<br />

_____ 9: An examination of written information to determine facts pertinent to the<br />

audit<br />

8. (TCO G) Discuss the essential activities involved in the initial planning of an<br />

audit.