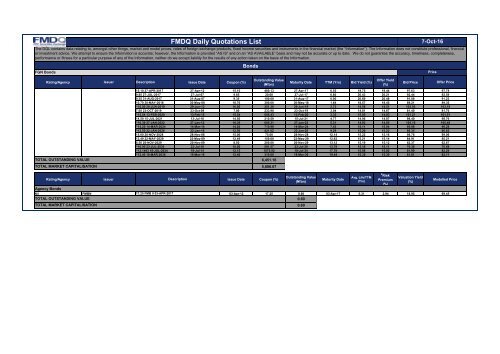

FMDQ Daily Quotations List

FMDQ-DQL_-Oct-7-2016

FMDQ-DQL_-Oct-7-2016

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

FGN Bonds<br />

Rating/Agency Issuer Description Issue Date Coupon (%)<br />

TOTAL OUTSTANDING VALUE<br />

TOTAL MARKET CAPITALISATION<br />

Outstanding Value<br />

(₦’bn)<br />

Maturity Date TTM (Yrs) Bid Yield (%)<br />

Offer Yield<br />

(%)<br />

15.10 27-APR-2017 27-Apr-12 15.10 480.13 27-Apr-17 0.55 19.75 19.44 97.63 97.78<br />

9.85 27-JUL-2017 27-Jul-07 9.85 20.00 27-Jul-17 0.80 20.43 20.21 92.44 92.59<br />

9.35 31-AUG-2017 31-Aug-07 9.35 100.00 31-Aug-17 0.90 20.69 20.48 91.08 91.23<br />

10.70 30-MAY-2018 30-May-08 10.70 300.00 30-May-18 1.64 18.57 18.45 89.21 89.36<br />

^16.00 29-JUN-2019 29-Jun-12 16.00 351.30 29-Jun-19 2.72 14.58 14.51 103.03 103.18<br />

7.00 23-OCT-2019 23-Oct-09 7.00 233.90 23-Oct-19 3.04 14.81 14.67 81.40 81.70<br />

^15.54 13-FEB-2020 13-Feb-15 15.54 606.43 13-Feb-20 3.35 15.05 14.93 101.21 101.51<br />

14.50 15-JUL-2021 13-Jul-16 14.50 210.59 15-Jul-21 4.77 14.96 14.87 98.40 98.70<br />

^16.39 27-JAN-2022 27-Jan-12 16.39 605.31 27-Jan-22 5.31 14.93 14.85 105.16 105.46<br />

^14.20 14-MAR-2024 14-Mar-14 14.20 719.99 14-Mar-24 7.43 15.11 15.04 95.98 96.28<br />

^12.50 22-JAN-2026 22-Jan-16 12.50 421.02 22-Jan-26 9.29 15.29 15.22 86.35 86.65<br />

15.00 28-NOV-2028 28-Nov-08 15.00 75.00 28-Nov-28 12.14 15.22 15.16 98.76 99.06<br />

12.49 22-MAY-2029 22-May-09 12.49 150.00 22-May-29 12.62 15.21 15.14 84.91 85.21<br />

8.50 20-NOV-2029 20-Nov-09 8.50 200.00 20-Nov-29 13.12 15.19 15.12 62.37 62.67<br />

^10.00 23-JUL-2030 23-Jul-10 10.00 591.57 23-Jul-30 13.79 15.18 15.11 70.38 70.68<br />

^12.1493 18-JUL-2034 18-Jul-14 12.15 1075.92 18-Jul-34 17.78 15.08 15.02 81.99 82.29<br />

^12.40 18-MAR-2036 18-Mar-16 12.40 310.00 18-Mar-36 19.44 15.36 15.30 81.81 82.11<br />

6,451.16<br />

5,806.07<br />

Rating/Agency Issuer Description<br />

Issue Date Coupon (%)<br />

Outstanding Value<br />

(₦’bn)<br />

Maturity Date<br />

Avg. Life/TTM<br />

(Yrs)<br />

# Risk<br />

Premium<br />

(%)<br />

Bid Price<br />

Valuation Yield<br />

(%)<br />

Agency Bonds<br />

Nil FMBN 17.25 FMB II 03-APR-2017<br />

03-Apr-12 17.25 0.60 03-Apr-17 0.31 2.94 18.95 99.45<br />

TOTAL OUTSTANDING VALUE<br />

0.60<br />

TOTAL MARKET CAPITALISATION<br />

<strong>FMDQ</strong> <strong>Daily</strong> <strong>Quotations</strong> <strong>List</strong><br />

The DQL contains data relating to, amongst other things, market and model prices, rates of foreign exchange products, fixed income securities and instruments in the financial market (the “Information”). The Information does not constitute professional, financial<br />

or investment advice. We attempt to ensure the Information is accurate; however, the Information is provided “AS IS” and on an “AS AVAILABLE” basis and may not be accurate or up to date. We do not guarantee the accuracy, timeliness, completeness,<br />

performance or fitness for a particular purpose of any of the Information, neither do we accept liability for the results of any action taken on the basis of the Information.<br />

Bonds<br />

0.60<br />

7-Oct-16<br />

Price<br />

Offer Price<br />

Modelled Price

Rating/Agency Issuer Description<br />

Issue Date Coupon (%)<br />

Sub-National Bonds<br />

Outstanding Value<br />

(₦’bn)<br />

Maturity Date<br />

Avg. Life/TTM<br />

(Yrs)<br />

# Risk<br />

Premium<br />

(%)<br />

Valuation Yield<br />

(%)<br />

A+/Agusto; A+/GCR LAGOS 10.00 LAGOS 19-APR-2017<br />

19-Apr-10 10.00 57.00 19-Apr-17 0.53 1.00 20.69 94.84<br />

A-/Agusto *BAYELSA 13.75 BAYELSA 30-JUN-2017<br />

30-Jun-10 13.75 11.33 30-Jun-17 0.49 5.71 25.10 95.03<br />

A-/Agusto EDO 14.00 EDO 31-DEC-2017<br />

31-Dec-10 14.00 25.00 31-Dec-17 1.23 2.39 22.49 91.20<br />

A/Agusto; A+/GCR *DELTA 14.00 DELTA 30-SEP-2018<br />

30-Sep-11 14.00 19.37 30-Sep-18 1.27 1.00 20.95 92.71<br />

A-/Agusto; A-/GCR *NIGER 14.00 NIGER II 4-OCT-2018<br />

04-Oct-11 14.00 3.49 04-Oct-18 1.28 1.00 20.91 92.70<br />

A/Agusto‡ ; A-/GCR† *EKITI 14.50 EKITI 09-DEC-2018<br />

09-Dec-11 14.50 9.45 09-Dec-18 1.24 3.82 23.89 90.68<br />

A-/Agusto *NIGER 14.00 NIGER III 12-DEC-2018<br />

12-Dec-13 14.00 7.01 12-Dec-18 1.25 3.56 23.61 90.41<br />

A-/Agusto; A-/GCR *ONDO 15.50 ONDO 14-FEB-2019<br />

14-Feb-12 15.50 18.70 14-Feb-19 1.43 3.82 23.20 91.28<br />

BBB+/Agusto; A-/GCR *GOMBE 15.50 GOMBE 02-OCT-2019<br />

02-Oct-12 15.50 11.14 02-Oct-19 1.84 2.02 19.86 93.73<br />

Aa-/Agusto; AA-/GCR LAGOS 14.50 LAGOS 22-NOV-2019<br />

22-Nov-12 14.50 80.00 22-Nov-19 3.12 2.01 16.86 94.39<br />

BBB-/Agusto; BBB+/GCR† *OSUN 14.75 OSUN 12-DEC-2019<br />

12-Dec-12 14.75 19.40 12-Dec-19 1.81 1.00 18.97 93.88<br />

Aa-/Agusto; AA-/GCR LAGOS 13.50 LAGOS 27-NOV-2020<br />

27-Nov-13 13.50 87.50 27-Nov-20 4.14 1.30 16.30 91.75<br />

Bbb+/Agusto; BBB+/DataPro KOGI 15.00 KOGI 31-DEC-2020<br />

31-Dec-13 15.00 5.00 31-Dec-20 4.23 3.76 18.75 89.28<br />

A/Agusto‡ *EKITI 14.50 EKITI II 31-DEC-2020<br />

31-Dec-13 14.50 3.74 31-Dec-20 2.46 2.53 18.08 93.38<br />

A-/GCR *NASARAWA 15.00 NASARAWA 06-JAN-2021<br />

06-Jan-14 15.00 3.76 06-Jan-21 2.49 1.00 16.46 97.16<br />

A-/Agusto *BAUCHI 15.50 BAUCHI 9-DEC-2021<br />

09-Dec-14 15.50 14.37 09-Dec-21 3.04 1.52 16.33 98.10<br />

A-/Agusto *OYO 16.50 OYO 16-FEB-2022<br />

17-Feb-15 16.50 4.17 16-Feb-22 3.25 4.01 18.92 94.52<br />

Bbb-/Agusto *BENUE 16.50 BENUE 27-FEB-2022<br />

27-Feb-15 16.50 4.30 27-Feb-22 3.28 1.00 15.93 101.30<br />

Bbb+/Agusto *PLATEAU 17.50 PLATEAU 30-MAR-2022<br />

30-Mar-15 17.50 27.10 30-Mar-22 3.39 2.52 17.50 99.98<br />

Bbb+/Agusto KOGI 17.00 KOGI II 31-MAR-2022<br />

01-Apr-15 17.00 3.00 31-Mar-22 6.46 1.79 16.73 100.92<br />

A-/GCR *CROSS RIVER 17.00 CROSS RIVER 27-MAY-2022<br />

27-May-15 17.00 7.34 27-May-22 3.37 3.04 18.01 97.59<br />

TOTAL OUTSTANDING VALUE<br />

TOTAL MARKET CAPITALISATION<br />

422.14<br />

396.51<br />

Corporate Bonds<br />

A-/Agusto; A-/GCR FSDH 14.25 FSDH 25-OCT-2016<br />

25-Oct-13 14.25 5.53 25-Oct-16 0.05 1.34 19.59 99.68<br />

Nil 0.00/16.00 LCRM 08-DEC-2016<br />

09-Dec-11 0.00/16.00 112.22 08-Dec-16 0.17 1.00 17.18 99.66<br />

Nil ***LCRM<br />

0.00/16.50 LCRM II 19-APR-2017<br />

20-Apr-12 0.00/16.50 116.70 19-Apr-17 0.53 3.55 23.24 96.77<br />

Nil 0.00/16.50 LCRM III 06-JUL-2017<br />

06-Jul-12 0.00/16.50 66.49 06-Jul-17 0.75 5.25 25.52 94.07<br />

A/GCR UBA 13.00 UBA 30-SEP-2017<br />

30-Sep-10 13.00 20.00 30-Sep-17 0.98 1.88 22.79 91.79<br />

BBB-/GCR *C & I LEASING 18.00 C&I LEASING 30-NOV-2017 30-Nov-12 18.00 0.36 30-Nov-17 0.66 1.88 21.91 98.46<br />

Nil *DANA #{r} MPR+7.00 DANA 9-APR-2018<br />

09-Apr-11 16.00 3.60 09-Apr-18 0.76 3.15 23.44 95.30<br />

A-/DataPro†; CCC/GCR *TOWER # MPR+7.00 TOWER 9-SEP-2018<br />

09-Sep-11 18.00 1.45 09-Sep-18 1.17 6.35 26.69 91.94<br />

AAA/DataPro†; B/GCR *TOWER # MPR+5.25 TOWER 9-SEP-2018<br />

09-Sep-11 16.00 0.40 09-Sep-18 1.17 1.00 21.34 94.83<br />

A+/Agusto; A/GCR UBA 14.00 UBA II 30-SEP-2018<br />

30-Sep-11 14.00 35.00 30-Sep-18 1.98 1.17 18.50 92.79<br />

Bbb+/Agusto†; BBB+/GCR† *LA CASERA 15.75 LA CASERA 18-OCT-2018<br />

18-Oct-13 15.75 1.50 18-Oct-18 1.03 4.42 25.27 92.18<br />

BBB-/DataPro†; BB/GCR *CHELLARAMS # MPR+5.00 CHELLARAMS II 17-FEB-2019<br />

17-Feb-12 18.00 0.23 17-Feb-19 1.36 6.11 25.72 91.73<br />

Nil *DANA #{r} 16.00 DANA II 1-APR-2019<br />

01-Apr-14 16.00 3.75 01-Apr-19 1.48 3.28 22.45 92.44<br />

A-/GCR FCMB 15.00 FCMB 6-NOV-2020<br />

06-Nov-15 15.00 23.19 06-Nov-20 4.08 4.47 19.47 87.75<br />

A+/Agusto; A-/GCR NAHCO 15.75 NAHCO II 14-NOV-2020<br />

14-Nov-13 15.75 2.05 14-Nov-20 4.10 1.00 16.00 99.22<br />

Bbb/Agusto; A-/GCR *TRANSCORP HOTELS PLC 15.50 TRANSCORP 4-DEC-2020<br />

04-Dec-15 15.50 9.76 04-Dec-20 2.60 3.55 18.83 93.54<br />

BBB/GCR *FCMB 14.25 FCMB I 20-NOV-2021<br />

20-Nov-14 14.25 26.00 20-Nov-21 5.12 2.51 17.46 89.37<br />

A/GCR UBA 16.45 UBA I 30-DEC-2021<br />

30-Dec-14 16.45 30.50 30-Dec-21 5.23 1.00 15.95 101.67<br />

BBB/GCR FIDELITY 16.48 FIDELITY 13-MAY-2022<br />

13-May-15 16.48 30.00 13-May-22 5.60 1.00 15.95 101.85<br />

Bbb/Agusto; A-/GCR *TRANSCORP HOTELS PLC 16.00 TRANSCORP 26-OCT-2022<br />

26-Oct-15 16.00 10.00 26-Oct-22 3.77 2.77 17.79 95.43<br />

A/GCR STANBIC IBTC 182D T.bills+1.20 STANBIC IA 30-SEP-2024<br />

30-Sep-14 16.29 0.10 30-Sep-24 7.98 1.00 16.16 100.54<br />

A/GCR STANBIC IBTC 13.25 STANBIC IB 30-SEP-2024<br />

30-Sep-14 13.25 15.44 30-Sep-24 7.98 1.00 16.16 87.18<br />

AAA/GCR *NMRC<br />

14.90 NMRC 29-JUL-2030<br />

29-Jul-15 14.90 7.82 29-Jul-30 9.20 1.00 16.27 93.93<br />

TOTAL OUTSTANDING VALUE<br />

TOTAL MARKET CAPITALISATION<br />

522.09<br />

500.98<br />

Modelled Price

Sukuk<br />

BBB-/Agusto *OSUN 14.75 OSUN II 10-OCT-2020<br />

10-Oct-13 14.75 9.02 10-Oct-20 2.22 3.37 19.80 91.55<br />

TOTAL OUTSTANDING VALUE<br />

TOTAL MARKET CAPITALISATION<br />

9.02<br />

8.26<br />

Rating/Agency Issuer Description<br />

Issue Date Coupon (%)<br />

Outstanding Value<br />

(₦’bn)<br />

Maturity Date<br />

Avg. Life/TTM<br />

(Yrs)<br />

# Risk<br />

Premium<br />

(%)<br />

Valuation Yield<br />

(%)<br />

Supranational Bond<br />

AAA/S&P IFC 10.20 IFC 11-FEB-2018<br />

11-Feb-13 10.20 12.00 11-Feb-18 1.35 1.00 17.88 91.12<br />

Aaa/Moody's; AAA/S&P *AfDB 11.25 AFDB 1-FEB-2021<br />

10-Jul-14 11.25 12.95 01-Feb-21 2.57 1.00 14.15 94.03<br />

TOTAL OUTSTANDING VALUE<br />

TOTAL MARKET CAPITALISATION<br />

24.95<br />

23.11<br />

Modelled Price<br />

Rating/Agency Issuer Description<br />

Issue Date Coupon (%)<br />

FGN Eurobonds<br />

Outstanding Value<br />

($’mm)<br />

Maturity Date Bid Yield (%) Offer Yield (%) Bid Price Offer Price<br />

Prices & Yields<br />

BB-/Fitch; B+/S&P 6.75 JAN 28, 2021<br />

07-Oct-11 6.75 500.00 28-Jan-21 6.68 6.45 100.23 101.09<br />

BB-/Fitch;<br />

BB-/S&P<br />

BB-/Fitch;<br />

BB-/S&P<br />

TOTAL OUTSTANDING VALUE<br />

TOTAL MARKET CAPITALISATION<br />

FGN<br />

5.13 JUL 12, 2018<br />

6.38 JUL 12, 2023<br />

12-Jul-13 5.13 500.00 12-Jul-18 4.87 4.42 100.42 101.17<br />

12-Jul-13 6.38 500.00 12-Jul-23 6.83 6.67 97.54 98.40<br />

1,500.00<br />

1,490.92<br />

Corporate Eurobonds<br />

B+/S&P ACCESS BANK PLC 7.25 JUL 25, 2017<br />

25-Jul-12 7.25 350.00 25-Jul-17 8.41 8.41 99.12 99.12<br />

B/Fitch; B/S&P FIDELITY BANK PLC 6.88 MAY 09, 2018<br />

09-May-13 6.88 300.00 02-May-18 23.03 20.87 79.63 82.00<br />

B+/Fitch; B+/S&P GTBANK PLC 6.00 NOV 08, 2018<br />

08-Nov-13 6.00 400.00 08-Nov-18 6.47 6.47 99.10 99.10<br />

B+/Fitch; BB-/S&P ZENITH BANK PLC 6.25 APR 22, 2019<br />

22-Apr-14 6.25 500.00 22-Apr-19 7.26 7.26 97.70 97.70<br />

B/Fitch; B/S&P DIAMOND BANK PLC 8.75 May 21, 2019<br />

21-May-14 8.75 200.00 21-May-19 22.35 22.35 74.13 74.13<br />

B-/Fitch; B/S&P FIRST BANK PLC 8.25 AUG 07, 2020<br />

07-Aug-13 8.25 300.00 07-Aug-20 13.23 12.67 85.01 86.51<br />

B-/Fitch; B/S&P ACCESS BANK PLC II 9.25/6M USD LIBOR+7.677 JUN 24, 2021<br />

24-Jun-14 9.25 400.00 24-Jun-21 11.94 11.62 90.16 91.20<br />

B-/Fitch; B/S&P FIRST BANK LTD 8.00/2Y USD SWAP+6.488 JUL 23 2021<br />

23-Jul-14 8.00 450.00 23-Jul-21 14.36 14.36 78.00 78.00<br />

B-/S&P ECOBANK NIG. LTD 8.75 AUG 14, 2021<br />

14-Aug-14 8.75 250.00 14-Aug-21 12.23 11.76 84.88 86.63<br />

TOTAL OUTSTANDING VALUE<br />

TOTAL MARKET CAPITALISATION<br />

3,150.00<br />

2,797.77

Rating/Agency Issuer Description<br />

Issue Date Yield @ Issue (%)<br />

Commercial Papers<br />

Outstanding Value<br />

(₦’bn)<br />

Maturity Date<br />

DTM<br />

# Risk<br />

Premium<br />

(%)<br />

Valuation Yield<br />

(%)<br />

Discount Rate (%)<br />

A-/Agusto<br />

TOTAL OUTSTANDING VALUE<br />

UACN PROPERTY DEVELOPMENT<br />

COMPANY PLC<br />

UPDC CP 18-OCT-16<br />

18-Apr-16 11.00 16.80 18-Oct-16 11 2.03 20.61 20.49<br />

16.80<br />

**TREASURY BILLS^<br />

Money Market<br />

DTM Maturity Bid Discount (%) Offer Discount (%) Bid Yield (%)<br />

Tenor Rate (%)<br />

Foreign Exchange (Spot & Forwards)<br />

13 20-Oct-16 14.23 13.98 14.31<br />

20 27-Oct-16 16.33 16.08 16.48<br />

OBB 15.67 Tenor Closing Rate ($/N)<br />

27 3-Nov-16 17.01 16.76 17.23 Spot<br />

306.75<br />

O/N 16.17<br />

41 17-Nov-16 15.99 15.74 16.29 7D<br />

324.74<br />

55 1-Dec-16 16.31 16.06 16.72 REPO 14D<br />

325.98<br />

62 8-Dec-16 14.89 14.64 15.28 Tenor Rate (%) 1M<br />

328.82<br />

69 15-Dec-16 15.36 15.11 15.81 Call 16.33 2M<br />

334.14<br />

83 29-Dec-16 15.36 15.11 15.92 1M 17.00 3M<br />

339.45<br />

90 5-Jan-17 13.91 13.66 14.41 3M 17.67 6M<br />

355.41<br />

104 19-Jan-17 14.40 14.15 15.02 6M 18.67 1Y<br />

388.20<br />

118 2-Feb-17 17.98 17.73 19.09<br />

132 16-Feb-17 17.29 17.04 18.44<br />

139 23-Feb-17 17.57 17.32 18.83<br />

NOTE:<br />

146 2-Mar-17 17.99 17.74 19.39 :Benchmarks NA :Not Applicable<br />

153 9-Mar-17 17.63 17.38 19.04 * :Amortising Bond ^ : Market Prices<br />

160 16-Mar-17 17.27 17.02 18.68 µ :Convertible Bond # : Floating Rate Bond<br />

167 23-Mar-17 17.46 17.21 18.98 AMCON: Asset Management Corporation of Nigeria ***: Deferred coupon bonds<br />

174 30-Mar-17 17.65 17.40 19.28 FGN: Federal Government of Nigeria DTM: Days-To-Maturity<br />

181 6-Apr-17 17.85 17.60 19.58 FMBN: Federal Mortgage Bank of Nigeria TTM: Term-To-Maturity<br />

188 13-Apr-17 16.49 16.24 18.02 IFC: International Finance Corporation ‡ : Bond rating under review<br />

195 20-Apr-17 15.99 15.74 17.48 LCRM: Local Contractors Receivables Management †: Bond rating expired<br />

209 4-May-17 18.08 17.83 20.17 NAHCO: Nigerian Aviation Handling Company N/A :Not Available<br />

216 11-May-17 16.58 16.33 18.38 O/N: Overnight {r} :Issuer in receivership<br />

230 25-May-17 17.68 17.43 19.89 UPDC: UAC Property Development Company NGC: Nigeria-German Company<br />

237 1-Jun-17 18.00 17.75 20.38 WAPCO:West Africa Portland Cement Company UBA: United Bank for Africa<br />

251 15-Jun-17 17.91 17.66 20.43<br />

265 29-Jun-17 17.83 17.58 20.47<br />

272 6-Jul-17 18.37 18.12 21.28<br />

279 13-Jul-17 17.17 16.92 19.76<br />

286 20-Jul-17 17.62 17.37 20.44<br />

293 27-Jul-17 17.01 16.76 19.71<br />

300 3-Aug-17 18.23 17.98 21.44<br />

307 10-Aug-17 18.27 18.02 21.58<br />

314 17-Aug-17 18.31 18.06 21.73<br />

321 24-Aug-17 18.23 17.98 21.71<br />

328 31-Aug-17 18.19 17.94 21.74<br />

342 14-Sep-17 18.23 17.98 21.99<br />

349 21-Sep-17 18.27 18.02 22.14<br />

*for the Amortising bonds, the average life is calculated and not the TTM<br />

# Risk Premium is a combination of credit risk and liquidity risk premiums<br />

**Exclusive of non-trading t.bills<br />

<strong>FMDQ</strong> FGN BOND INDEX<br />

Modified Duration Buckets<br />

Porfolio Market Value<br />

(₦’bn)<br />

Total Outstanding Volume<br />

(₦’bn)<br />

Weighting by<br />

Outstanding Volume<br />

Weighting by Mkt<br />

Value<br />

Bucket Weighting<br />

% Exposure_<br />

Mod_Duration<br />

Implied Yield<br />

Implied<br />

Portfolio Price<br />