Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

C<br />

Capital<br />

D<br />

Policy<br />

Money <strong>for</strong> taking off is up <strong>for</strong><br />

grabs. After seed <strong>an</strong>d early<br />

stage, raising money in <strong>Belgium</strong><br />

may remain challenging.<br />

The regulator’s door is slightly<br />

open, but increasing government<br />

support is contradicted by<br />

administration <strong>an</strong>d high taxes.<br />

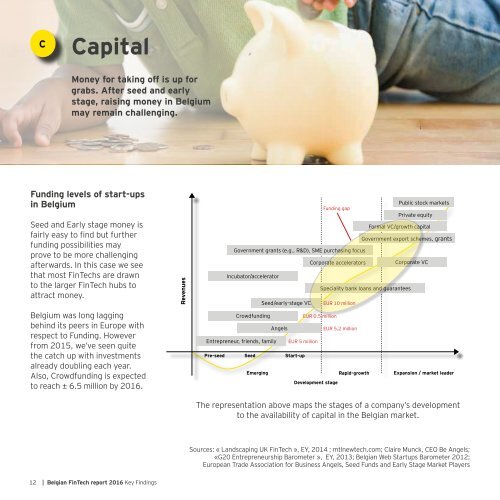

Funding levels of start-ups<br />

in <strong>Belgium</strong><br />

Seed <strong>an</strong>d Early stage money is<br />

fairly easy to find but further<br />

funding possibilities may<br />

prove to be more challenging<br />

afterwards. In this case we see<br />

that most <strong>FinTech</strong>s are drawn<br />

to the larger <strong>FinTech</strong> <strong>hub</strong>s to<br />

attract money.<br />

<strong>Belgium</strong> was long lagging<br />

behind its peers in Europe with<br />

respect to Funding. However<br />

from 2015, we’ve seen quite<br />

the catch up with investments<br />

already doubling each year.<br />

Also, Crowdfunding is expected<br />

to reach ± 6.5 million by 2016.<br />

Revenues<br />

Government gr<strong>an</strong>ts (e.g., R&D), SME purchasing focus<br />

Incubator/accelerator<br />

Crowdfunding<br />

Entrepreneur, friends, family<br />

Seed/early-stage VC<br />

Angels<br />

EUR 5 million<br />

Pre-seed Seed Start-up<br />

Funding gap<br />

Corporate accelerators<br />

EUR 0,5 million<br />

Formal VC/growth capital<br />

Government export schemes, gr<strong>an</strong>ts<br />

Speciality b<strong>an</strong>k lo<strong>an</strong>s <strong>an</strong>d guar<strong>an</strong>tees<br />

Public stock markets<br />

Private equity<br />

Corporate VC<br />

Emerging Rapid-growth Exp<strong>an</strong>sion / market leader<br />

Development stage<br />

EUR 10 million<br />

EUR 5,2 million<br />

The representation above maps the stages of a comp<strong>an</strong>y’s development<br />

to the availability of capital in the Belgi<strong>an</strong> market.<br />

Sources: « L<strong>an</strong>dscaping UK <strong>FinTech</strong> », EY, 2014 ; mtlnewtech.com; Claire Munck, CEO Be Angels;<br />

«G20 Entrepreneurship Barometer », EY, 2013; Belgi<strong>an</strong> Web Startups Barometer 2012;<br />

Europe<strong>an</strong> Trade Association <strong>for</strong> Business Angels, Seed Funds <strong>an</strong>d Early Stage Market Players<br />

Regulation as a first mover adv<strong>an</strong>tage<br />

“The regulator is open to innovative business models, yet<br />

(as a <strong>FinTech</strong>) you are not on the top of their list, which<br />

slows down the license acquisition system.”<br />

<strong>FinTech</strong> <strong>Belgium</strong><br />

In terms of regulation, Belgi<strong>an</strong> supervisors are slowly<br />

investigating this emerging trend. Moreover in June<br />

2016 the FSMA (Fin<strong>an</strong>cial Services <strong>an</strong>d Markets<br />

Authority) launched “the <strong>FinTech</strong> Portal”, which is<br />

intended to support a dialogue between the FSMA<br />

<strong>an</strong>d <strong>FinTech</strong> comp<strong>an</strong>ies. Nevertheless it remains a<br />

rather hesit<strong>an</strong>t first step, especially compared to other<br />

countries such as the UK (see Exibit) that have created<br />

environments to foster innovation. Such a “s<strong>an</strong>dbox”<br />

principle allows start-ups to explore ideas with a small<br />

subset of potential clients albeit well contained <strong>an</strong>d<br />

overlooked by the regulator.<br />

Exibit 2:<br />

• The FCA, the regulator in the UK, installed a<br />

regulatory s<strong>an</strong>dbox to which you c<strong>an</strong> apply twice<br />

a year. If the application is successful, you c<strong>an</strong> try<br />

your business model <strong>for</strong> six months without the<br />

regulatory burden <strong>an</strong>d then focus on obtaining<br />

required licenses.<br />

Support is increasing yet administration is burdening…<br />

“We do not need more subsidies, some <strong>FinTech</strong><br />

entrepreneurs spend more time obtaining subsidies th<strong>an</strong><br />

acquiring clients.”<br />

<strong>FinTech</strong>, <strong>Belgium</strong><br />

Ef<strong>for</strong>ts from the government have been made to develop<br />

the in<strong>for</strong>mation technology sector through job creation<br />

<strong>an</strong>d investment solutions <strong>for</strong> digital SMES. Yet <strong>Belgium</strong><br />

is suffering from its political structure that burdens the<br />

administration related to entrepreneurship.<br />

…just as are taxes<br />

“The Government should reduce the requirements <strong>for</strong><br />

comp<strong>an</strong>ies when hiring a first employee.”<br />

<strong>FinTech</strong>, <strong>Belgium</strong><br />

<strong>Belgium</strong> is a country in which taxation of the labour <strong>for</strong>ce<br />

is the highest in Europe, with 59.4% of the salary costs<br />

going to the government. There<strong>for</strong>e, it is challenging <strong>for</strong><br />

start-ups to af<strong>for</strong>d hiring numerous employees quickly.<br />

Yet, there are various initiatives from the government to<br />

reduce these costs, which makes it cheaper to attract the<br />

first set of employees. However it remains hindering in<br />

the growth stage.<br />

12 | Belgi<strong>an</strong> <strong>FinTech</strong> report 2016 Key Findings Belgi<strong>an</strong> <strong>FinTech</strong> report 2016 Key Findings | 13