Financial Development in Sub-Saharan Africa

dtxT305L5O2

dtxT305L5O2

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Muslim populations currently underserviced by conventional f<strong>in</strong>ance—only 24 percent of<br />

Muslims have a bank account compared with 44 percent for non-Muslims (Demirguc-Kunt,<br />

Klapper, and Randall 2013).<br />

Recent empirical work <strong>in</strong>dicates that<br />

Islamic bank<strong>in</strong>g is conducive to economic<br />

growth and f<strong>in</strong>ancial <strong>in</strong>clusion <strong>in</strong> low- and<br />

middle-<strong>in</strong>come countries, <strong>in</strong>clud<strong>in</strong>g <strong>in</strong><br />

sub-<strong>Saharan</strong> <strong>Africa</strong> (Imam and Kpodar<br />

2015; Kammer and others 2015). The<br />

Islamic f<strong>in</strong>ance pr<strong>in</strong>ciples of risk-shar<strong>in</strong>g<br />

and asset-based f<strong>in</strong>anc<strong>in</strong>g (that is, the<br />

strong l<strong>in</strong>k of credit to collateral) are<br />

considered to help promot<strong>in</strong>g<br />

macroeconomic and f<strong>in</strong>ancial stability<br />

through better risk management by both<br />

f<strong>in</strong>ancial <strong>in</strong>stitutions and their customers.<br />

Particularly, Sukuks, the Islamic bonds that<br />

are structurally similar to asset-backed<br />

securities, are considered to be well-suited<br />

for <strong>in</strong>frastructure f<strong>in</strong>anc<strong>in</strong>g, thereby<br />

support<strong>in</strong>g long-term growth and<br />

economic development. 14 Islamic f<strong>in</strong>ance<br />

pr<strong>in</strong>ciples are also considered to serve<br />

SME f<strong>in</strong>anc<strong>in</strong>g well, thereby promot<strong>in</strong>g<br />

<strong>in</strong>clusive growth.<br />

Nonetheless, Islamic f<strong>in</strong>ance poses<br />

particular challenges <strong>in</strong> terms of<br />

regulation, supervision, and monetary<br />

policy ow<strong>in</strong>g to the specific feature of its<br />

transactions. For example, the regulation<br />

and supervision frameworks should take<br />

<strong>in</strong>to consideration Islamic f<strong>in</strong>ance<br />

specificities such as profit-shar<strong>in</strong>g<br />

<strong>in</strong>vestment accounts and Shari’ah<br />

governance.<br />

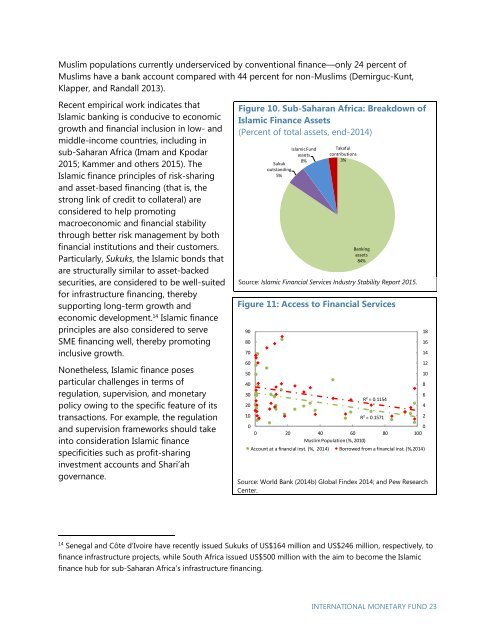

Figure 10. <strong>Sub</strong>-<strong>Saharan</strong> <strong>Africa</strong>: Breakdown of<br />

Islamic F<strong>in</strong>ance Assets<br />

(Percent of total assets, end-2014)<br />

Source: Islamic <strong>F<strong>in</strong>ancial</strong> Services Industry Stability Report 2015.<br />

Figure 11: Access to <strong>F<strong>in</strong>ancial</strong> Services<br />

90<br />

80<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

Islamic Fund<br />

assets<br />

8%<br />

Sukuk<br />

outstand<strong>in</strong>g<br />

5%<br />

Takaful<br />

contributions<br />

3%<br />

Bank<strong>in</strong>g<br />

assets<br />

84%<br />

R² = 0.1154<br />

R² = 0.1571<br />

0 20 40 60 80 100<br />

Muslim Population (%, 2010)<br />

Account at a f<strong>in</strong>ancial <strong>in</strong>st. (%, 2014) Borrowed from a f<strong>in</strong>ancial <strong>in</strong>st. (%,2014)<br />

Source: World Bank (2014b) Global F<strong>in</strong>dex 2014; and Pew Research<br />

Center.<br />

18<br />

16<br />

14<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

14<br />

Senegal and Côte d’Ivoire have recently issued Sukuks of US$164 million and US$246 million, respectively, to<br />

f<strong>in</strong>ance <strong>in</strong>frastructure projects, while South <strong>Africa</strong> issued US$500 million with the aim to become the Islamic<br />

f<strong>in</strong>ance hub for sub-<strong>Saharan</strong> <strong>Africa</strong>’s <strong>in</strong>frastructure f<strong>in</strong>anc<strong>in</strong>g.<br />

INTERNATIONAL MONETARY FUND 23