LEO TECH SERVICES

Insurtech_White_Paper.compressed

Insurtech_White_Paper.compressed

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The bigger implication of this is that interest in the insurance technology space is<br />

generated by both “need for innovation” (corporate VCs) and “need for higher<br />

returns” (traditional VCs).<br />

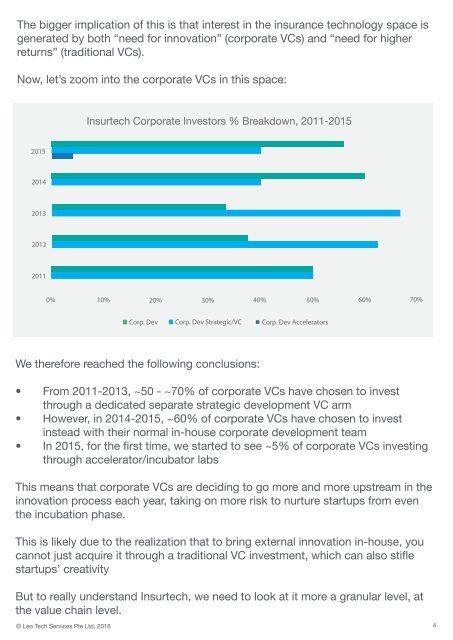

Now, let’s zoom into the corporate VCs in this space:<br />

Insurtech Corporate Investors % Breakdown, 2011-2015<br />

2015<br />

2014<br />

2013<br />

2012<br />

2011<br />

0% 10% 20% 30% 40% 50% 60% 70%<br />

Corp. Dev Corp. Dev Strategic/VC Corp. Dev Accelerators<br />

We therefore reached the following conclusions:<br />

• From 2011-2013, ~50 - ~70% of corporate VCs have chosen to invest<br />

through a dedicated separate strategic development VC arm<br />

• However, in 2014-2015, ~60% of corporate VCs have chosen to invest<br />

instead with their normal in-house corporate development team<br />

• In 2015, for the first time, we started to see ~5% of corporate VCs investing<br />

through accelerator/incubator labs<br />

This means that corporate VCs are deciding to go more and more upstream in the<br />

innovation process each year, taking on more risk to nurture startups from even<br />

the incubation phase.<br />

This is likely due to the realization that to bring external innovation in-house, you<br />

cannot just acquire it through a traditional VC investment, which can also stifle<br />

startups’ creativity<br />

But to really understand Insurtech, we need to look at it more a granular level, at<br />

the value chain level.<br />

© Leo Tech Services Pte Ltd, 2016 4