statistics

2g0RSM6

2g0RSM6

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

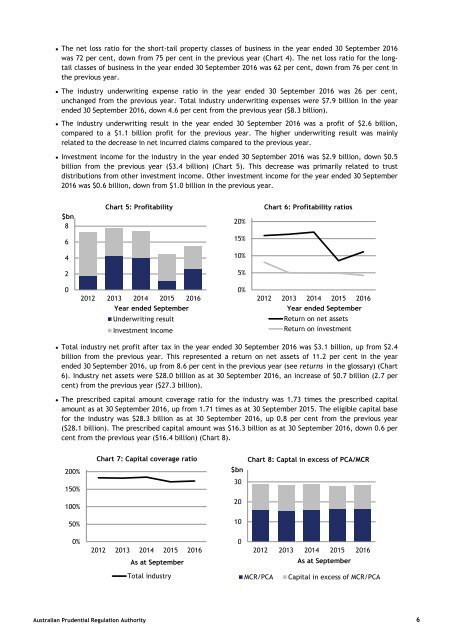

• The net loss ratio for the short-tail property classes of business in the year ended 30 September 2016<br />

was 72 per cent, down from 75 per cent in the previous year (Chart 4). The net loss ratio for the longtail<br />

classes of business in the year ended 30 September 2016 was 62 per cent, down from 76 per cent in<br />

the previous year.<br />

• The industry underwriting expense ratio in the year ended 30 September 2016 was 26 per cent,<br />

unchanged from the previous year. Total industry underwriting expenses were $7.9 billion in the year<br />

ended 30 September 2016, down 4.6 per cent from the previous year ($8.3 billion).<br />

• The industry underwriting result in the year ended 30 September 2016 was a profit of $2.6 billion,<br />

compared to a $1.1 billion profit for the previous year. The higher underwriting result was mainly<br />

related to the decrease in net incurred claims compared to the previous year.<br />

• Investment income for the industry in the year ended 30 September 2016 was $2.9 billion, down $0.5<br />

billion from the previous year ($3.4 billion) (Chart 5). This decrease was primarily related to trust<br />

distributions from other investment income. Other investment income for the year ended 30 September<br />

2016 was $0.6 billion, down from $1.0 billion in the previous year.<br />

$bn<br />

8<br />

Chart 5: Profitability<br />

20%<br />

Chart 6: Profitability ratios<br />

6<br />

15%<br />

4<br />

10%<br />

2<br />

5%<br />

0<br />

2012 2013 2014 2015 2016<br />

Year ended September<br />

Underwriting result<br />

Investment income<br />

0%<br />

2012 2013 2014 2015 2016<br />

Year ended September<br />

Return on net assets<br />

Return on investment<br />

• Total industry net profit after tax in the year ended 30 September 2016 was $3.1 billion, up from $2.4<br />

billion from the previous year. This represented a return on net assets of 11.2 per cent in the year<br />

ended 30 September 2016, up from 8.6 per cent in the previous year (see returns in the glossary) (Chart<br />

6). Industry net assets were $28.0 billion as at 30 September 2016, an increase of $0.7 billion (2.7 per<br />

cent) from the previous year ($27.3 billion).<br />

• The prescribed capital amount coverage ratio for the industry was 1.73 times the prescribed capital<br />

amount as at 30 September 2016, up from 1.71 times as at 30 September 2015. The eligible capital base<br />

for the industry was $28.3 billion as at 30 September 2016, up 0.8 per cent from the previous year<br />

($28.1 billion). The prescribed capital amount was $16.3 billion as at 30 September 2016, down 0.6 per<br />

cent from the previous year ($16.4 billion) (Chart 8).<br />

200%<br />

150%<br />

Chart 7: Capital coverage ratio<br />

$bn<br />

30<br />

Chart 8: Captal in excess of PCA/MCR<br />

100%<br />

20<br />

50%<br />

10<br />

0%<br />

2012 2013 2014 2015 2016<br />

As at September<br />

0<br />

2012 2013 2014 2015 2016<br />

As at September<br />

Total industry<br />

MCR/PCA<br />

Capital in excess of MCR/PCA<br />

Australian Prudential Regulation Authority 6