Iran-IFRS-Profile

Iran-IFRS-Profile

Iran-IFRS-Profile

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

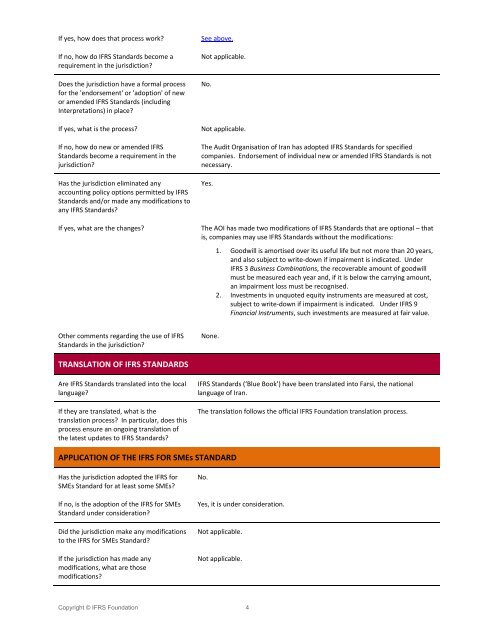

If yes, how does that process work?<br />

If no, how do <strong>IFRS</strong> Standards become a<br />

requirement in the jurisdiction?<br />

Does the jurisdiction have a formal process<br />

for the 'endorsement' or 'adoption' of new<br />

or amended <strong>IFRS</strong> Standards (including<br />

Interpretations) in place?<br />

If yes, what is the process?<br />

If no, how do new or amended <strong>IFRS</strong><br />

Standards become a requirement in the<br />

jurisdiction?<br />

Has the jurisdiction eliminated any<br />

accounting policy options permitted by <strong>IFRS</strong><br />

Standards and/or made any modifications to<br />

any <strong>IFRS</strong> Standards?<br />

If yes, what are the changes?<br />

See above.<br />

Not applicable.<br />

No.<br />

Not applicable.<br />

The Audit Organisation of <strong>Iran</strong> has adopted <strong>IFRS</strong> Standards for specified<br />

companies. Endorsement of individual new or amended <strong>IFRS</strong> Standards is not<br />

necessary.<br />

Yes.<br />

The AOI has made two modifications of <strong>IFRS</strong> Standards that are optional – that<br />

is, companies may use <strong>IFRS</strong> Standards without the modifications:<br />

1. Goodwill is amortised over its useful life but not more than 20 years,<br />

and also subject to write-down if impairment is indicated. Under<br />

<strong>IFRS</strong> 3 Business Combinations, the recoverable amount of goodwill<br />

must be measured each year and, if it is below the carrying amount,<br />

an impairment loss must be recognised.<br />

2. Investments in unquoted equity instruments are measured at cost,<br />

subject to write-down if impairment is indicated. Under <strong>IFRS</strong> 9<br />

Financial Instruments, such investments are measured at fair value.<br />

Other comments regarding the use of <strong>IFRS</strong><br />

Standards in the jurisdiction?<br />

None.<br />

TRANSLATION OF <strong>IFRS</strong> STANDARDS<br />

Are <strong>IFRS</strong> Standards translated into the local<br />

language?<br />

If they are translated, what is the<br />

translation process? In particular, does this<br />

process ensure an ongoing translation of<br />

the latest updates to <strong>IFRS</strong> Standards?<br />

<strong>IFRS</strong> Standards (‘Blue Book’) have been translated into Farsi, the national<br />

language of <strong>Iran</strong>.<br />

The translation follows the official <strong>IFRS</strong> Foundation translation process.<br />

APPLICATION OF THE <strong>IFRS</strong> FOR SMEs STANDARD<br />

Has the jurisdiction adopted the <strong>IFRS</strong> for<br />

SMEs Standard for at least some SMEs?<br />

If no, is the adoption of the <strong>IFRS</strong> for SMEs<br />

Standard under consideration?<br />

Did the jurisdiction make any modifications<br />

to the <strong>IFRS</strong> for SMEs Standard?<br />

If the jurisdiction has made any<br />

modifications, what are those<br />

modifications?<br />

No.<br />

Yes, it is under consideration.<br />

Not applicable.<br />

Not applicable.<br />

Copyright © <strong>IFRS</strong> Foundation 4