Global Banking & Finance Review - Business and Financial Magazine - Magazines from GBAF

Global Banking & Finance Review is a leading Online and Print Magazine, which has evolved from the growing need to have a more balanced view, for informative and independent news within the financial community. Our experienced contributors provide this quality and in-depth insight in a clear and concise way, providing leading players and key figures with up to date information within the finance sector.Experienced industry Journalists providing up to minute coverage on Banking, Foreign Exchange, Brokerage, Funds, Islamic Finance, Wealth Management, Corporate Governance, Project Finance, Merger and Acquisitions, Tax and Accounting, Inward Investment, CSR Activities; all under one Global Umbrella.

Global Banking & Finance Review is a leading Online and Print Magazine, which has evolved from the growing need to have a more balanced view, for informative and independent news within the financial community. Our experienced contributors provide this quality and in-depth insight in a clear and concise way, providing leading players and key figures with up to date information within the finance sector.Experienced industry Journalists providing up to minute coverage on Banking, Foreign Exchange, Brokerage, Funds, Islamic Finance, Wealth Management, Corporate Governance, Project Finance, Merger and Acquisitions, Tax and Accounting, Inward Investment, CSR Activities; all under one Global Umbrella.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

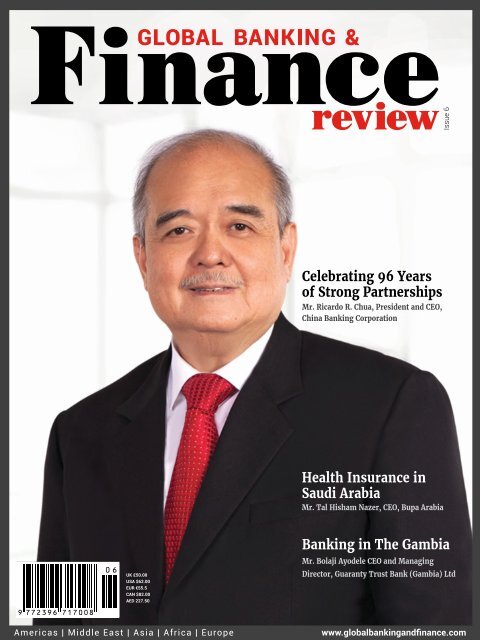

Issue 6<br />

Celebrating 96 Years<br />

of Strong Partnerships<br />

Mr. Ricardo R. Chua, President <strong>and</strong> CEO,<br />

China <strong>Banking</strong> Corporation<br />

Health Insurance in<br />

Saudi Arabia<br />

Mr. Tal Hisham Nazer, CEO, Bupa Arabia<br />

<strong>Banking</strong> in The Gambia<br />

UK £50.00<br />

USA $62.00<br />

EUR €55.5<br />

CAN $82.00<br />

AED 227.50<br />

Mr. Bolaji Ayodele CEO <strong>and</strong> Managing<br />

Director, Guaranty Trust Bank (Gambia) Ltd<br />

Americas | Middle East | Asia | Africa | Europe<br />

www.globalbanking<strong>and</strong>finance.com

Innovation is a Must.<br />

What about you?<br />

Best <strong>Banking</strong><br />

Technology<br />

Innovator<br />

2015<br />

Best Investment<br />

& Securities<br />

Outsourcing<br />

Provider - 2015<br />

Best Investment &<br />

Securities Outsourcing Provider<br />

Diversity. Change. Speed. Regulations.<br />

That’s the market.<br />

Customization. Evolution. Real Time. Solutions.<br />

That’s Inversis.<br />

It’s time to meet us. Visit inversis.com<br />

Brokerage –Clearing & Setllement- Custody<br />

Open architecture. Equities. Fix Income. Funds, ETF’s<br />

Real time technology. Mobility solutions

CEO <strong>and</strong> Publisher<br />

Varun Sash<br />

Editor<br />

W<strong>and</strong>a Rich<br />

email: wrich@gbafmag.com<br />

Editorial Coordinator<br />

Sachin MR<br />

Web Development <strong>and</strong> Maintenance<br />

An<strong>and</strong> Giri<br />

Client Service Manager<br />

Michelle Farrell<br />

Head of Distribution<br />

Subban Bellie<br />

Head of Operations<br />

Sreejith Nair<br />

Assistant Manager Operations<br />

Bala Prasad<br />

Project Managers<br />

Megan Sash, Peter Barron, Manuel<br />

Carmona,<br />

David Dineen, Oisin Kavanagh<br />

Video Production <strong>and</strong> Journalist<br />

Phil Fothergill<br />

Graphic Designer<br />

Jessica Weisman-Pitts<br />

<strong>Business</strong> Consultants<br />

Anshuma Gupta, Diksha Kumar, Leo Pereira,<br />

Roger Pinto, Sam Mathew<br />

Research Analyst<br />

Maahi Basvaraj, Chethan Govindaraj<br />

Human Resource Head<br />

Eveline Cynthiya<br />

Accounts<br />

Joy Cantlon, Quynh Quan<br />

Advertising<br />

Phone: +44 (0) 208 144 3511<br />

marketing@gbafmag.com<br />

<strong>GBAF</strong> Publications Ltd Kemp House,<br />

Unit 2, 7 Tarves Way, London, SE10 9JP.<br />

United Kingdom<br />

Fax: +44 (0) 871 2664 964<br />

Email: info@gbafmag.com<br />

<strong>Global</strong> <strong>Banking</strong> & <strong>Finance</strong> <strong>Review</strong> is the trading<br />

name of <strong>GBAF</strong> Publications LTD<br />

Company Registration Number: 7403411<br />

VAT Number: GB 112 5966 21<br />

ISSN 2396-717X. Printed in the UK by The<br />

<strong>Magazine</strong> Printing Company<br />

The information contained in this publication<br />

has been obtained <strong>from</strong> sources the publishers<br />

believe to be correct. The publisher wishes to<br />

stress that the information contained herein may<br />

be subject to varying international, federal, state<br />

<strong>and</strong>/or local laws or regulations.<br />

The purchaser or reader of this publication<br />

assumes all responsibility for the use of these<br />

materials <strong>and</strong> information. However, the<br />

publisher assumes no responsibility for errors,<br />

omissions, or contrary interpretations of the<br />

subject matter contained herein no legal liability<br />

can be accepted for any errors. No part of this<br />

publication may be reproduced without the prior<br />

consent of the publisher<br />

Image credits: @istock.com/gece33 (p8n9), @<br />

istock.com/Rawpixel(p10,11,18,19,27,45), @istock.<br />

com/ monkeybusinessimages (p12), @istock.com/<br />

BrianAJackson (p14-16),@istock.com/PytyCzech (p19),<br />

@istock.com/BraunS (p21), @istock.com/SIYAMA9 (p22-<br />

23),@istock.com/iLexx (p28),@istock.com/ Choreograph<br />

(p32-33), @istock.com/Rawpixel Ltd(34-35), @istock.<br />

com/ swisshippo (p36-37), @istock.com/4X-image<br />

(p40,41), @istock.com/Richmatts(p42), @istock.com/<br />

SolisImages(p42), istock.com/<strong>and</strong>resr(p44), @istock.<br />

com/goir (p46),@istock.com/fazon1(p62,63),@istock.<br />

com/ferrantraite(p78-81), @istock.com/KeongDaGreat<br />

(p82,83), @istock.com/Todor Tsvetkov (p84,85), @istock.<br />

com/Cylonphoto(p86,87), @istock.com/Sky1991(p88,89),<br />

@istock.com/HomoCosmicos (p96,97), @istock.<br />

com/ mathiaswilson (p99), @istock.com/ mtcurado<br />

(p100,101), @istock.com/monsitj (p102,103), @<br />

istock.com/oneinchpunch (p104,105), @istock.com/<br />

RossHelen (p108,109,111), @istock.com/Roman Babakin<br />

(p118,119), @istock.com/Szepy (p120,121), @istock.com/<br />

LDProd (p120)@istock.com/YinYang (p120), @istock.<br />

com/franckreporter (p122), @istock.com/microolga<br />

(p124,125),istock.com/danchooalex (p125), @istock.<br />

com/ spainter_vfx (p126,127),@istock.com/tupungato<br />

(p128,129), @istock.com/pixelfit (p130,131)@istock.<br />

com/ (p136), @istock.com/ railelectropower (p138,139),<br />

@istock.com/shironosov (p132-135), @istock.com/<br />

sakkmesterke 143,145), @istock.com/lolloj (p146) @<br />

istock.com/tomograf(p48,49,51,52,55,56,59-61)@istock.<br />

com/-1001- (p53,54,57)<br />

W<strong>and</strong>a Rich<br />

Editor<br />

FROM THE<br />

editor<br />

I am pleased to present to you Issue 6 of<br />

<strong>Global</strong> <strong>Banking</strong> & <strong>Finance</strong> <strong>Review</strong>. For<br />

those of you that are reading us for the<br />

first time, welcome.<br />

In this edition we are pleased to present the 2016 <strong>Global</strong> <strong>Banking</strong> & <strong>Finance</strong> <strong>Review</strong><br />

Award Winners. You will also find engaging interviews with leaders <strong>from</strong> the financial<br />

community <strong>and</strong> insightful commentary <strong>from</strong> industry experts.<br />

Featured on the front cover is Mr. Ricardo R. Chua, President <strong>and</strong> CEO of China<br />

<strong>Banking</strong> Corporation. Founded in 1920 by entrepreneurs, China <strong>Banking</strong> Corporation<br />

is celebrating 96 years of strong partnerships. We spoke with Mr. Ricardo R. Chua<br />

about the current business <strong>and</strong> banking environment in the Philippines.<br />

For over 5 years, we have enjoyed bringing the latest activity <strong>from</strong> within the global<br />

financial community to our online <strong>and</strong> now offline readership. We strive to capture<br />

the breaking news about the world’s economy, financial events, <strong>and</strong> banking game<br />

changers <strong>from</strong> prominent leaders in the industry <strong>and</strong> public viewpoints with an<br />

intention to serve a holistic outlook. We have gone that extra mile to ensure we give<br />

you the best <strong>from</strong> the world of finance.<br />

Send us your thoughts on how we can continue to improve <strong>and</strong> what you’d like to see<br />

in the future.<br />

Happy reading!<br />

Stay caught up on the latest news <strong>and</strong> trends taking place. Read us online at<br />

http://www.globalbanking<strong>and</strong>finance.com/<br />

®<br />

Issue 6 | 3

CONTENTS<br />

12<br />

76<br />

<strong>Global</strong> <strong>Business</strong><br />

with <strong>Business</strong><br />

Bank Group<br />

Three Things Banks Can Learn<br />

<strong>from</strong> Pokemon Go<br />

82<br />

84<br />

Digital <strong>Banking</strong> in Chile<br />

118<br />

Customer<br />

Engagement in<br />

Retail <strong>Banking</strong><br />

inside...<br />

BANKING<br />

14<br />

18<br />

New Decision Management<br />

Technologies Help Mid-Tier <strong>and</strong><br />

Smaller Banks Overcome Big<br />

Data Challenges<br />

Ashoke Dutt, CEO , Semantify<br />

FRTB – Why Banks Must Act Now<br />

Christopher Burke, CEO, Brickendon<br />

Consulting<br />

12<br />

25<br />

BUSINESS<br />

124<br />

128<br />

How can CFOs stop the exodus of<br />

young talent?<br />

Thack Brown, <strong>Global</strong> Head of Line of<br />

<strong>Business</strong> <strong>Finance</strong> at SAP<br />

How to ‘keep calm <strong>and</strong> carry on’<br />

during an M&A<br />

Nick Pointon, Head of M&A at SQS<br />

How to keep pace with the<br />

changing global manufacturing<br />

l<strong>and</strong>scape<br />

Stuart Hall, Sales Director for Epicor<br />

Software, UK <strong>and</strong> Irel<strong>and</strong><br />

The Subscription Economy – a new way<br />

to travel<br />

Dr Steve Cassidy, Managing Director,<br />

Viaqqio, part of ESP Group<br />

31<br />

42<br />

FINANCE<br />

104<br />

108<br />

Risk-based approach to KYC<br />

Neil Jeans, Head of Policy & Regulation –<br />

Thomson Reuters Org ID<br />

Microfinance Movement: Time for a<br />

Revolution?<br />

Steve Polsky, Founder <strong>and</strong> CEO, Juvo<br />

Lessons <strong>from</strong> retail marketing for the<br />

financial services industry<br />

Customer data attitudes <strong>and</strong><br />

postures: Breaking down siloes for a<br />

better view<br />

Chiara Pensato, Director - EMEA, Alteryx Inc.<br />

Innovation is opening the door to a<br />

real future of financial inclusion<br />

Marija Zivanovic-Smith, Vice President of<br />

Corporate Marketing, Communications <strong>and</strong><br />

Public Affairs, NCR Corporation<br />

4 | Issue 6

AMERICAS TECHNOLOGY<br />

36 Health Insurance in Saudi Arabia<br />

28<br />

Underst<strong>and</strong>ing the<br />

next generation of<br />

software robotics<br />

78 LOCATION INTELLIGENCE 64<br />

Leasing in Mexico<br />

INVESTMENT<br />

91<br />

8<br />

21<br />

Sydney Stock Exchange wins Most<br />

Innovative Exchange<br />

Sydney Stock Exchange Mr. George Wang,<br />

Deputy Chairman <strong>and</strong> Non-Executive<br />

Director, Sydney Stock Exchange CEO, Mr.<br />

Tony Sacre <strong>and</strong> APX Settlement CEO Mr.<br />

David Lawrence<br />

TECHONOLOGY<br />

Will 2017 be the year of data<br />

literacy?<br />

Dan Sommer, Senior Director, Qlik<br />

Seven logical steps to secure<br />

today’s Industrial Control Systems<br />

Sameer Dixit, Senior Director Security<br />

Consulting, Spirent Communications<br />

40<br />

44<br />

70<br />

143<br />

TECHONOLOGY<br />

Five factors behind digital<br />

transformation success<br />

Roberto Mircoli, Senior Director Enterprise<br />

Marketing – EMEA, Dell EMC<br />

The Power of Graph<br />

Wobi Plugs Into The Power Of Graph For<br />

Insurance Price Comparison<br />

Emil Eifrem, CEO, Neo Technology<br />

Denial. Resistance. Adaptation<br />

The Three Phases of SSH Key<br />

Management<br />

Matthew McKenna, Chief Strategy Officer,<br />

SSH Communications Security<br />

What’s Next for Blockchain:<br />

Disruptive Technology <strong>and</strong> New<br />

Regulations<br />

Penny S<strong>and</strong>ers, Head of <strong>Financial</strong> Services<br />

Regulation, Gowling WLG<br />

102<br />

124<br />

INSURANCE<br />

Underst<strong>and</strong>ing the value of cyber<br />

insurance<br />

Darren Anstee, Chief Security Technologist<br />

at Arbor Networks<br />

Cyber Insurance: Protecting the<br />

<strong>Financial</strong> Industry<br />

Dan Trueman, Unit Head of Cyber with<br />

Novae at Lloyd’s<br />

Issue 6 | 5

CONTENTS<br />

62<br />

CELEBRATING 96 YEARS OF STRONG<br />

PARTNERSHIPS<br />

interviews...<br />

CELEBRATING 96 YEARS OF<br />

STRONG PARTNERSHIPS 62<br />

Ricardo R. Chua, President <strong>and</strong> CEO, China <strong>Banking</strong><br />

Corporation<br />

(Founded in 1920 by entrepreneurs, China <strong>Banking</strong><br />

Corporation is celebrating 96 years of strong<br />

partnerships. <strong>Global</strong> <strong>Banking</strong> & <strong>Finance</strong> <strong>Review</strong><br />

spoke with Ricardo R. Chua, President <strong>and</strong> CEO<br />

of China <strong>Banking</strong> Corporation about the key to<br />

successful corporate governance, the current<br />

business <strong>and</strong> banking environment in the Philippines<br />

<strong>and</strong> China Bank’s future strategy.<br />

BANKING IN THE GAMBIA 96<br />

Mr. Bolaji Ayodele CEO <strong>and</strong> Managing Director,<br />

Guaranty Trust Bank (Gambia) Ltd<br />

( Mr. Bolaji Ayodele CEO <strong>and</strong> Managing Director of<br />

Guaranty Trust Bank (Gambia) Ltd spoke with <strong>Global</strong><br />

<strong>Banking</strong> & <strong>Finance</strong> <strong>Review</strong> about the banking industry<br />

in The Gambia <strong>and</strong> the role of Guaranty Trust Bank<br />

(G) Ltd.)<br />

DIGITAL BANKING IN<br />

ANGOLA 112<br />

CURRENT BANKING TRENDS<br />

IN MACEDONIA 132<br />

Mr. Vladimir Eftimoski, CEO of Stopanska banka<br />

a.d. Bitola<br />

<strong>Global</strong> <strong>Banking</strong> & <strong>Finance</strong> <strong>Review</strong> spoke with Mr.<br />

Vladimir Eftimoski, CEO of Stopanska banka a.d.<br />

Bitola to find out the current banking trends in<br />

Macedonia.<br />

Eduardo Pinto, COO of Banco Económico<br />

(Eduardo Pinto, COO of Banco Económico has<br />

been working in financial services for 23 years. He<br />

joined Banco Económico three years ago as COO,<br />

to lead its digital transformation. )<br />

6 | Issue 6

98 Redefining<br />

the ease<br />

of banking<br />

CONTENTS<br />

96<br />

DIGITAL BANKING IN<br />

BANKING IN THE GAMBIA ANGOLA 112<br />

132<br />

CURRENT BANKING TRENDS IN<br />

MACEDONIA<br />

Issue 6 | 7

Americas<br />

8 Issue 6

AMERICAS TECHNOLOGY<br />

Will 2017 be<br />

the year of data literacy?<br />

Over the past twelve months we’ve seen an<br />

explosion of data, an increase in processing it<br />

<strong>and</strong> a move towards information activism. This<br />

means the number of employees actively able<br />

to work with – <strong>and</strong> master – the huge amounts<br />

of information available, such as data scientists,<br />

application developers, <strong>and</strong> business analysts,<br />

have become a valuable entity.<br />

Unfortunately, however, there still aren’t enough<br />

people with the expertise to h<strong>and</strong>le the everincreasing,<br />

vast levels of data <strong>and</strong> computing.<br />

You would assume, with all the information<br />

currently being produced <strong>and</strong> held by businesses,<br />

that 2017 would see us in a new digital era of<br />

facts. But, without the right number of specialists<br />

to consume <strong>and</strong> analyse it, there’s a gap in<br />

resources. Data is, unfortunately, growing faster<br />

than our ability to make use of it.<br />

For many business leaders then, this means a<br />

reliance on gut instinct to make even the most<br />

important decisions. Unable to hone in on the<br />

most important insights, they’re presented<br />

with multiple – <strong>and</strong> sometimes conflicting –<br />

data points, so the most important ones seem<br />

unreliable.<br />

The situation needs to change. Yes, that will<br />

mean upskilling more data scientists in 2017,<br />

but there will be a greater focus on empowering<br />

more people more broadly. That will go beyond<br />

information activists <strong>and</strong> towards providing more<br />

people with the tools <strong>and</strong> training to increase data<br />

literacy. Just as reading <strong>and</strong> writing skills needed<br />

to move beyond scholars 100 years ago, data<br />

literacy will become one of the most important<br />

business skills for any member of staff.<br />

So, what will change to see culture-wide data<br />

literacy become a reality? Here are my predictions:<br />

1. Combinations of data – Big data will<br />

become less about size <strong>and</strong> more about<br />

combinations. With more fragmentation of<br />

data <strong>and</strong> most of it created externally in the<br />

cloud, there will be a cost impact to hoarding<br />

data without a clear purpose. That means we’ll<br />

move towards a model where businesses have<br />

to quickly combine their big data with small<br />

data so they can gain insights <strong>and</strong> context<br />

to get value <strong>from</strong> it as quickly as possible.<br />

Combining data will also shine a light on<br />

false information more easily, improving data<br />

accuracy as well as underst<strong>and</strong>ing.<br />

Issue 6 | 9

AMERICAS TECHNOLOGY<br />

2. Hybrid thinking – In 2017, hybrid cloud <strong>and</strong> multi-platform will<br />

emerge as the primary model for data analytics. Because of<br />

where data is generated, ease of getting started, <strong>and</strong> its ability<br />

to scale, we’re now seeing an accelerated move to cloud. But<br />

one cloud is not enough, because the data <strong>and</strong> workloads won’t<br />

be in one platform. In addition, data gravity also means that on<br />

premise has long staying power. Hybrid <strong>and</strong> multi-environment<br />

will emerge as the dominant model, meaning workloads <strong>and</strong><br />

publishing will happen across cloud <strong>and</strong> on-premise.<br />

3. Self-service for all – Freemium is the new normal, so 2017<br />

will be the year users have easier access to their analytics.<br />

More <strong>and</strong> more data visualization tools are available at low<br />

cost, or even for free, so some form of analytics will become<br />

accessible across the workforce. With more people beginning<br />

their analytics journey, data literacy rates will naturally increase<br />

— more people will know what they’re looking at <strong>and</strong> what it<br />

means for their organisation. That means information activism<br />

will rise too.<br />

4. Scale-up – Much a result of its own success, user-driven data<br />

discovery <strong>from</strong> two years ago has become today’s enterprisewide<br />

BI. In 2017, this will evolve to replace archaic reportingfirst<br />

platforms. As modern BI becomes the new reference<br />

architecture, it will open more self-service data analysis to<br />

more people. It also puts different requirements on the back<br />

end for scale, performance, governance, <strong>and</strong> security.<br />

5. Advancing analytics – In 2017, the focus will shift <strong>from</strong><br />

“advanced analytics” to “advancing analytics.” Advanced<br />

analytics is critical, but the creation of the models, as well as<br />

the governance <strong>and</strong> curation of them, is dependent on highlyskilled<br />

experts. However, many more should be able to benefit<br />

<strong>from</strong> those models once they are created, meaning that they<br />

can be brought into self-service tools. In addition, analytics<br />

can be advanced by increased intelligence being embedded<br />

into software, removing complexity <strong>and</strong> chaperoning insights.<br />

But the analytical journey shouldn’t be a black box or too<br />

prescriptive. There is a lot of hype around “artificial intelligence,”<br />

10 | Issue 6

AMERICAS TECHNOLOGY<br />

but it will often serve best as an augmentation rather than<br />

replacement of human analysis because it’s equally important<br />

to keep asking the right questions as it is to provide the<br />

answers.<br />

6. Visualization as a concept will move <strong>from</strong> analysis-only to the<br />

whole information supply chain – Visualization will become a<br />

strong component in unified hubs that take a visual approach<br />

to information asset management, as well as visual self-service<br />

data preparation, underpinning the actual visual analysis.<br />

Furthermore, progress will be made in having visualization as<br />

a means to communicate our findings. The net effect of this<br />

is increased numbers of users doing more in the data supply<br />

chain.<br />

7. Focus will shift to custom analytic apps <strong>and</strong> analytics in the<br />

app – Everyone won’t — <strong>and</strong> cannot be —both a producer <strong>and</strong> a<br />

consumer of apps. But they should be able to explore their own<br />

data. Data literacy will therefore benefit <strong>from</strong> analytics meeting<br />

people where they are, with applications developed to support<br />

them in their own context <strong>and</strong> situation, as well as the analytics<br />

tools we use when setting out to do some data analysis. As<br />

such, open, extensible tools that can be easily customised <strong>and</strong><br />

contextualised by application <strong>and</strong> web developers will make<br />

further headway.<br />

These trends lay the foundation for increased levels of not just<br />

information activism, but also data literacy. After all, new platforms<br />

<strong>and</strong> technologies that can catch “the other half” (i.e., less skilled<br />

information workers <strong>and</strong> operational workers on the go) will help<br />

usher us into an era where the right data becomes connected with<br />

people <strong>and</strong> their ideas — that’s going to close the chasm between<br />

the levels of data we have available <strong>and</strong> our ability to garner insights<br />

<strong>from</strong> it. Which, let’s face it, is what we need to put us on the path<br />

toward a more enlightened, information-driven, <strong>and</strong> fact-based era.<br />

Dan Sommer<br />

Senior Director<br />

Qlik<br />

Issue 6 | 11

AMERICAS BUSINESS<br />

How can CFOs Stop<br />

The Exodus of Young Talent?<br />

Many of the CFOs I meet are worried <strong>and</strong><br />

disheartened about the exodus of young<br />

millennials <strong>from</strong> the profession – <strong>and</strong><br />

for good reason. These talented young<br />

professionals have both the skills <strong>and</strong><br />

the desire to spearhead finance’s<br />

needed evolution <strong>from</strong><br />

looking at yesterday<br />

to planning for<br />

tomorrow.<br />

This outflow of talent is a lose/lose<br />

situation. Those leaving lose the opportunity<br />

to advance in a profession that holds great<br />

promise, <strong>and</strong> corporations lose both the<br />

talent <strong>and</strong> the costly investment they have<br />

made in hiring them.<br />

It’s nothing new for early-career finance<br />

talent to ab<strong>and</strong>on the profession. I speak<br />

<strong>from</strong> personal experience. My career began<br />

with 18 to 20 months of management<br />

training, rotating through international<br />

assignments throughout a Fortune 500<br />

company. It was fun <strong>and</strong> exciting. Then we<br />

newcomers settled into our actual roles:<br />

tedious transactional accounting work.<br />

Within a year, only about 10 of us<br />

were left <strong>from</strong> the original 36<br />

who started. Most migrated<br />

out of finance to other<br />

professions.<br />

12 | Issue 6

AMERICAS BUSINESS<br />

The young people I meet today are highly<br />

motivated; they want to have an impact. But<br />

they are stuck with correcting accounting<br />

problems <strong>and</strong> data gathering instead of<br />

learning the skills they’ll need to solve future<br />

problems. The churn rate is 15 to 20%.<br />

Capitalizing on youthful enthusiasm<br />

The reality is that we can eliminate that<br />

wasted, useless work through automation:<br />

business networks for procurement,<br />

machine learning, software that supports<br />

financial close, <strong>and</strong> so on. At SAP, we have<br />

seen exactly that as we have shifted that<br />

talent to doing things that can help the<br />

business change – working on new billing<br />

structures <strong>and</strong> more complex contracts, for<br />

instance.<br />

Here’s an example. When I was the SAP<br />

CFO in Latin America several years ago,<br />

we had a number of young professionals<br />

under the age of 30, <strong>and</strong> wanted to keep<br />

them engaged. We made transparent the<br />

difference between management reports<br />

<strong>and</strong> statutory reporting, <strong>and</strong> had them work<br />

on analyzing how decisions that helped the<br />

management books could actually have<br />

negative effects on statutory results <strong>and</strong><br />

cash flow.<br />

The results were incredible: tens of millions<br />

of dollars in cash flow improvement,<br />

favorable tax impacts, <strong>and</strong> balance sheet<br />

cleanups. I was so impressed: they did this<br />

on their own time, working crazy long hours<br />

<strong>and</strong> making personal sacrifices. And they<br />

were so incredibly proud that they could<br />

show business leaders how the finance<br />

team was adding value.<br />

Rethinking our own paradigm<br />

But I think CFOs are starting to better<br />

underst<strong>and</strong> the frustration of young people<br />

in the field, whose expectations are dashed<br />

as they are sentenced to years of mindnumbing<br />

work before being given a chance<br />

to make a meaningful contribution. At a<br />

recent meeting, I heard CFOs expressing<br />

the importance of changing their own<br />

mindset if they are going to stop the<br />

hemorrhaging of talent. They are beginning<br />

to underst<strong>and</strong> the need to ab<strong>and</strong>on the<br />

“rite of induction” mentality, that the way<br />

you learn is through painful, mind-numbing<br />

account reconciliation work – <strong>and</strong> whoever<br />

can take the most pain for the longest time<br />

survives. Creating opportunities for young<br />

professionals has to start early.<br />

And we need take another look at how<br />

we educate them. It’s essential to ensure<br />

that finance professsionalis develop a firm<br />

grasp of the cornerstones of the profession<br />

– accounting rules, balance sheets, cash<br />

flows, <strong>and</strong> P&L – while helping them focus<br />

their skills where they are most needed in an<br />

increasingly complex business environment.<br />

Thack Brown<br />

General Manager,<br />

<strong>Global</strong> Head of Line of <strong>Business</strong> <strong>Finance</strong><br />

SAP<br />

Issue 6 | 13

AMERICAS BANKING<br />

New Decision Management<br />

Technologies Help Mid-Tier<br />

<strong>and</strong> Smaller Banks Overcome<br />

Big Data Challenges<br />

14 | Issue 6<br />

Banks have always had to manage large<br />

amounts of critical data. Yet, in spite of the<br />

buzz around the value of “big data”, most<br />

frontline employees in mid-tier <strong>and</strong> smaller<br />

banks still lack direct access to timely <strong>and</strong><br />

relevant data insights.<br />

Traditionally, data analytics has been seen as<br />

a back-office function that utilizes expensive,<br />

complex business intelligence solutions <strong>and</strong><br />

requires a level of IT support often out of reach<br />

for smaller institutions. But not anymore.<br />

Thanks to innovative, new “decision<br />

management technologies”, smaller banks<br />

without large IT staffs can transform how their<br />

less tech-savvy employees work with data<br />

<strong>and</strong> get the same kinds of actionable insights<br />

as larger banks.<br />

As the banking industry becomes increasingly<br />

complex, these new cutting edge data<br />

technologies help mid-tier <strong>and</strong> smaller banks<br />

mitigate risk <strong>and</strong> fraudulent activity <strong>and</strong> create<br />

more compliant environments. And, they<br />

provide real time metrics to improve customer<br />

service <strong>and</strong> enhance product development all<br />

at a fraction of the cost.<br />

Struggles with Traditional Data Analytics<br />

Many mid-tier <strong>and</strong> smaller banks struggle<br />

with basic customer <strong>and</strong> business analytics<br />

because they cannot afford traditional data<br />

management platforms that are expensive,<br />

highly technical, <strong>and</strong> often incompatible with<br />

their existing infrastructure. Built for power<br />

users who routinely prep, collate, extract <strong>and</strong><br />

compile data <strong>and</strong> reports, these platforms are<br />

difficult <strong>and</strong> time consuming for nontechnical<br />

employees even after training.<br />

Unfortunately, these barriers prevent frontline<br />

employees <strong>and</strong> their managers <strong>from</strong> having<br />

direct access to information that is critical<br />

to timely business decisions <strong>and</strong> customer<br />

response. Prompt responses to regulators is<br />

also of particular importance to smaller banks<br />

since they are often subject to as much, if not<br />

more, regulatory scrutiny than larger banks.<br />

New decision management solutions take<br />

aim at all of these challenges. Most are highly<br />

“self-service” in nature, low maintenance <strong>and</strong><br />

do not require expensive technical consultants<br />

to get work done. They empower smaller<br />

players to be more nimble, competitive <strong>and</strong><br />

satisfy their employees’ growing need to<br />

access information.

Committed<br />

to bonds for<br />

over 90 years<br />

Ranked among the top 10 municipal trustees in the U.S. 1<br />

While many banks have exited this line of business, MUFG Union Bank, N.A.,<br />

has remained dedicated to bonds <strong>and</strong> the complexities of bond<br />

administration for nearly a century.<br />

Our relationship managers have an average of 18 years of in-depth<br />

experience in corporate trust, escrow, <strong>and</strong> project finance. Ongoing<br />

education to strengthen this knowledge enables our specialists to provide<br />

insights into industry trends. Whether it’s making timely interest payments<br />

to bondholders or providing comprehensive recordkeeping, you can count<br />

on our support for the life of the issue.<br />

MUFG Union Bank, N.A., was named Best Corporate Trust Bank in the U.S.<br />

for four out of the last five years. 2<br />

MUFG (Mitsubishi UFJ <strong>Financial</strong> Group) is one of the world’s leading financial<br />

groups. The global MUFG network encompasses 2,200 offices in more than<br />

40 countries. MUFG provides access to corporate banking, trust banking,<br />

securities trading services, credit cards, consumer banking <strong>and</strong> finance,<br />

asset management, <strong>and</strong> leasing.<br />

Learn more at mufgamericas.com/corporatetrust<br />

Corporate Trust Services<br />

Carl Boyd<br />

Director<br />

Southern California<br />

213-236-7150<br />

Dean Levitt<br />

Director<br />

No. California &<br />

Pacific Northwest<br />

415-705-5020<br />

Julie B. Good<br />

Director<br />

Mid-West & Texas<br />

714-336-4230<br />

Nils Dahl<br />

Director<br />

Eastern U.S.<br />

646-452-2115<br />

MUFG Union Bank, N.A.<br />

A member of MUFG, a global financial group<br />

1<br />

Thomson Reuters <strong>Financial</strong>.<br />

2<br />

2012, 2013, 2014, <strong>and</strong> 2016 <strong>Global</strong> <strong>Banking</strong> & <strong>Finance</strong> <strong>Review</strong>.<br />

©2016 Mitsubishi UFJ <strong>Financial</strong> Group, Inc. All rights reserved. The MUFG logo <strong>and</strong> name is a service mark of Mitsubishi UFJ<br />

<strong>Financial</strong> Group, Inc., <strong>and</strong> is used by MUFG Union Bank, N.A., with permission. Member FDIC.

AMERICAS BANKING<br />

How It Works: Conversations with Data<br />

Today’s decision management platforms use technologies like<br />

artificial intelligence, machine learning <strong>and</strong> cognitive search<br />

to perform simple vocabulary-based data analysis. What this<br />

means is that non-technical users can perform their own<br />

analytics by simply typing questions like “How many customers<br />

with more than one account take advantage of special perks for<br />

having multiple accounts?” into a familiar, Google-like search<br />

bar. Within seconds (not minutes!) the platform responds by<br />

generating a customized report of real time, authenticated data<br />

in easy-to-underst<strong>and</strong> formats.<br />

<strong>Business</strong> users in every corner of the organization can become<br />

their own data analyst, engaging <strong>and</strong> collaborating in real time<br />

data exploration to investigate business hunches, increase<br />

efficiencies, share insights <strong>and</strong> information, maximize returns<br />

<strong>and</strong> minimize risk exposures. Here are just a few ways teams<br />

can benefit:<br />

• Governance, Risk <strong>and</strong> Compliance can use AI, machine<br />

learning <strong>and</strong> cognitive search to automate the process<br />

of searching, underst<strong>and</strong>ing <strong>and</strong> managing changes to<br />

regulations. A simple search-like interface can be used for<br />

everything <strong>from</strong> looking for policy <strong>and</strong> procedure documents<br />

to complex analysis of transactions by searching across<br />

both structured <strong>and</strong> unstructured data.<br />

• Risk Management can use natural language querying <strong>and</strong><br />

machine learning to connect the dots between emails,<br />

phone calls, text <strong>and</strong> transactional information to spot<br />

anomalies or compliance issues. (e.g. bankers opening<br />

multiple accounts for the same customer; creating<br />

online banking accounts with bogus email addresses;<br />

customers performing fraudulent activities). Combined<br />

with predictive analysis, this functionality can help predict<br />

likely occurrences of fraud as well as detect <strong>and</strong> report of<br />

fraudulent patterns.<br />

• Sales & Marketing can easily track sales performance<br />

<strong>and</strong> other key performance indicators (KPI) using both<br />

internal <strong>and</strong> external customer data. This improves their<br />

underst<strong>and</strong>ing of customer behavior <strong>and</strong> how to refine<br />

customer segmentation.<br />

• Customer Service now has the ability to search across<br />

multiple data repositories <strong>and</strong> easily extract customer<br />

data without using multiple systems <strong>and</strong> windows. This<br />

facilitates response time <strong>and</strong> accuracy, improving customer<br />

satisfaction <strong>and</strong> outcomes.<br />

16 | Issue 6

AMERICAS BANKING<br />

Considering the latest advancements in data analytics, there is<br />

no reason why mid-tier banks still need to rely on yesterday’s<br />

expensive, complex technologies <strong>and</strong> deny their business users<br />

access to the kinds of actionable data insights that benefit<br />

larger banks.<br />

Ready to take the Plunge? Avoid the Pitfalls<br />

In order to insure your organization gets the long term value<br />

it deserves <strong>from</strong> a decision management solution, make data<br />

analytics a part of your corporate DNA. This means getting top<br />

management involved as well as line-of-business managers.<br />

Let’s take a look at some basic things to keep in mind:<br />

• Do your homework: With a growing number of solutions<br />

available, look for a platform that is adaptable, scalable <strong>and</strong><br />

customizable to your unique business needs. The solution<br />

should be truly “self-service” <strong>and</strong> require minimal employee<br />

training <strong>and</strong> vendor support to run <strong>and</strong> maintain. Take the<br />

time to properly define your business requirements upfront so<br />

potential vendors can help you make the appropriate decisions.<br />

• Get your workplace onboard: Remove corporate resistance<br />

to empowering frontline staff to access data. Executive<br />

Management should support a workplace culture free of central<br />

gate keepers who decide how, what <strong>and</strong> when information<br />

should be fed to the business.<br />

• Reduce the need for human intervention: Think twice about<br />

investing in multiple incompatible tools <strong>and</strong> building a larger<br />

IT team to manage disparate systems. This is a decision that<br />

many large banks suffer <strong>from</strong> today <strong>and</strong> smaller banks should<br />

steer clear of this strategy.<br />

• Find a technology partner that meets your needs: Consider<br />

doing a gap analysis on the needs <strong>and</strong> support required by<br />

your business teams to achieve company objectives. Ask<br />

potential technology vendors to address these gaps <strong>and</strong> do<br />

not settle for rigid prescriptive tools that only partially get the<br />

job done. The right technology vendor must be a good cultural<br />

fit for your company <strong>and</strong> underst<strong>and</strong> what your organization<br />

requires to truly meet the needs of its customers, employees,<br />

<strong>and</strong> business goals.<br />

Data has always played a critical role in day-to-day bank operations<br />

<strong>and</strong> solving business problems. Until recently, most mid-tier <strong>and</strong><br />

smaller bank employees have missed out on the benefits of direct<br />

<strong>and</strong> prompt access to big data. But now, thanks to the growing <strong>and</strong><br />

evolving world of data technologies, smaller financial institutions<br />

finally have the opportunity to level the playing field.<br />

Ashoke Dutt<br />

CEO<br />

Semantify<br />

Ashoke Dutt is the CEO of Semantify, a<br />

pioneering semantic search technology<br />

platform company based in Chicago,<br />

Illinois. His career in global financial<br />

services spans more than 30 years<br />

<strong>and</strong> includes the launch of India’s first<br />

credit card business in 1989 at Citibank.<br />

Dutt went on to assume various other<br />

leadership roles at Citibank, including<br />

EVP, International Cards. He also served<br />

at Morgan Stanley (EVP, International<br />

Retail), <strong>and</strong> Discover Card (EVP,<br />

Marketing). Today, Dutt is an active<br />

entrepreneur <strong>and</strong> investor, serving as<br />

on boards of various start-ups <strong>and</strong><br />

philanthropic organizations.<br />

Issue 6 | 17

AMERICAS BANKING<br />

FRTB – Why Banks<br />

Must Act Now<br />

The final rules for the Fundamental <strong>Review</strong><br />

of the Trading Book (FRTB) regulations were<br />

published in January <strong>and</strong> although details<br />

of how the regulators in each jurisdiction<br />

will implement them still remains ill-defined<br />

we know the changes are coming <strong>and</strong> that<br />

now is the time to prepare. FRTB, part of the<br />

Basel III rules which were finally published<br />

in January 2016, will transform the way<br />

banks manage their capital requirements<br />

in addition to how they are structured <strong>and</strong><br />

managed internally.<br />

Risk models, liquidity horizons <strong>and</strong> data for<br />

risk calculations, back testing <strong>and</strong> hedging<br />

must be changed to meet the new regulatory<br />

guidelines, with a significant component of<br />

this change impacting desk structures <strong>and</strong><br />

their oversight, management <strong>and</strong> reporting.<br />

The rules at a local level are not yet granular<br />

enough for banks to implement them with<br />

confidence. While this makes preparation<br />

difficult, the deadline of January 2020 is not<br />

far off considering the massive scale of the<br />

changes. <strong>Financial</strong> institutions need to get<br />

lean, streamline efficiencies <strong>and</strong> ultimately<br />

prepare ahead of this change. With this in<br />

mind, we propose some critical steps to help<br />

during this period of uncertainty:<br />

18 | Issue 6<br />

Step One: Underst<strong>and</strong>ing the Scale of<br />

the Changes<br />

The implementation of FRTB will be<br />

substantial <strong>and</strong> undoubtedly incur significant<br />

costs, so if you haven’t already, setting up<br />

a programme to ensure good governance<br />

<strong>and</strong> structure is critical. It is important that<br />

the FRTB team establish <strong>and</strong> maintain early<br />

communication with impacted stakeholder<br />

groups (especially Risk, <strong>Finance</strong> <strong>and</strong> Front<br />

Office) as they will be looking at potential<br />

impacts based on findings presented by<br />

the team <strong>and</strong> as well as those assessed<br />

internally. There is a degree of uncertainty<br />

around the new rules for desk definition<br />

<strong>and</strong> the need to clarify the P&L attribution.<br />

This is currently being worked through via<br />

the International Swaps <strong>and</strong> Derivatives<br />

Association (ISDA) panel <strong>and</strong> examples<br />

include repos for funding <strong>and</strong> liquidity<br />

purposes that should be in the banking<br />

book, but are in fact currently managed on a<br />

trading desk.<br />

Another complication is the difference<br />

between the Volcker <strong>and</strong> FRTB desk<br />

definitions, giving rise to speculation about<br />

virtual, or “reporting desks”, versus physical<br />

desks. Such an arrangement might be<br />

acceptable under Volcker but is unlikely to be<br />

valid under FRTB where desk management,<br />

P&L attribution, strategy <strong>and</strong> remuneration<br />

– all physical things – need to be clearly <strong>and</strong><br />

singularly associated with a desk.<br />

Step Two: Get Lean Quick<br />

The estimated costs of implementing FRTB<br />

will double or quadruple the cost of doing<br />

business across a bank. To stay competitive<br />

<strong>and</strong> ensure you have the right mix of desks<br />

to operate your business, it is important<br />

to reduce costs <strong>and</strong> align procedures <strong>and</strong><br />

systems. Streamlining <strong>and</strong> rationalising<br />

business <strong>and</strong> IT processes, implementing<br />

automation in areas such as back testing,<br />

consolidating systems <strong>and</strong> reducing your<br />

costs per trade are all critical activities. Some<br />

desks may no longer be viable businesses<br />

once the changes have been made, but if you<br />

know your structure, at least you will be in a<br />

better position to decide which desks should<br />

or shouldn’t remain.<br />

Step three: Organise Your Data<br />

One of the main concerns the various<br />

regulatory programmes have raised for<br />

banks relates to the completeness <strong>and</strong><br />

consistency of their data sourced <strong>from</strong><br />

multiple systems. Additionally, business

AMERICAS BANKING<br />

desks will potentially need to produce up to<br />

60 times more data than current levels for<br />

certain desks. The subsequent increased<br />

workload for regulators will be enormous. In<br />

preparation, allocating more resources <strong>and</strong><br />

processes to interpret the data is essential.<br />

Just like the ‘multiple trading system issue’<br />

encountered in various trade repowrting<br />

programmes, banks are about to have a<br />

‘multiple risk system issue’. This is not<br />

because those systems are deficient but<br />

because, as with the trading systems, they<br />

are generally single-purpose, operate in<br />

relative isolation, <strong>and</strong> as a result do not<br />

share a common data dictionary. This is<br />

exacerbated by the current granularity<br />

of the data versus the required degree of<br />

granularity (i.e. risk measured at portfolio vs<br />

transaction level) under the new regulations.<br />

What is certain is that risk data will need<br />

to be much more granular to provide<br />

the correct inputs to calculations with<br />

new categorisations for reporting to the<br />

regulators. With banks juggling multiple<br />

risk systems across asset classes <strong>and</strong><br />

geographies, there will be a requirement to<br />

consolidate risk data in a central repository<br />

<strong>from</strong> which calculations <strong>and</strong> reporting can<br />

be derived. Firms that have already taken<br />

steps to create central data repositories –<br />

even for non-risk data, such as trade or client<br />

data – will be in a much better position than<br />

those who have not.<br />

There will also need to be a much tighter<br />

integration of data between the front<br />

office <strong>and</strong> risk <strong>and</strong> finance functions to<br />

ensure consistency of P&L attribution<br />

calculations. If these fail three times in any<br />

12-month period, the approved internal<br />

model used by the desk will be withdrawn<br />

by the regulator, immediately increasing<br />

the desk’s capital charge.<br />

There are many other topics to watch out<br />

for within FRTB, such as multijurisdictional<br />

implementation challenges, hypothetical<br />

versus risk theoretical P&L, the move <strong>from</strong><br />

VaR to Expected Shortfall (ES), the treatment<br />

of Non Modellable Risk Factors (NMRF), <strong>and</strong><br />

the uncertainty around CVA calculations.<br />

Intertwined within these are the ‘softer side’<br />

HR impacts of the new guidelines. The<br />

rearrangement of the trading desks <strong>and</strong><br />

more stringent requirements for staff job<br />

descriptions aligned to those desks <strong>and</strong><br />

their strategies <strong>and</strong> business cases will<br />

have a significant impact on a company’s<br />

organisational structure. Anything that so<br />

fundamentally impacts a person’s role, their<br />

responsibilities <strong>and</strong> authority levels, <strong>and</strong><br />

directly links them to a reportable, regulatorapproved<br />

business case <strong>and</strong> strategy is<br />

likely to significantly affect where <strong>and</strong> how<br />

businesses are run post-FRTB.<br />

This has been a brief look at only some of<br />

the critical topics within FRTB. What’s known<br />

is that it is coming – what’s not known is<br />

how the banking world will look once all the<br />

yet-to-be confirmed regulations are finalised<br />

by local regulators.<br />

Christopher Burke<br />

CEO<br />

Brickendon Consulting<br />

Issue 6 | 19

AMERICAS TECHNOLOGY<br />

7 logical steps to secure today’s Industrial<br />

Control Systems<br />

Critical infrastructure is evolving fast. No longer residing<br />

in splendid isolation, many control systems are joining the<br />

great migration to the Internet – with all its advantages<br />

of ubiquitous coverage, easy access <strong>and</strong> potential<br />

integration with other services <strong>and</strong> systems. There is a<br />

real need for security testing, auditing <strong>and</strong> monitoring<br />

– as well as physical <strong>and</strong> logical security training says<br />

Sameer Dixit, Senior Director Security Consulting, Spirent<br />

Communications<br />

Industrial Control Systems (ICS) are taking industries’<br />

control mechanisms online, allowing management to<br />

monitor <strong>and</strong> control critical infrastructure remotely over<br />

the Internet. This brings many management benefits,<br />

providing a distributed workforce with real time monitoring<br />

<strong>and</strong> control. As a result, individual companies <strong>and</strong> public<br />

services are growing more efficient. They are reducing<br />

overheads while gaining in agility <strong>and</strong> responsiveness – but<br />

they also face new risks.<br />

Welcome to cyberspace<br />

Traditional security challenges include loss or theft of<br />

employee <strong>and</strong> consumer data, <strong>and</strong> corporate secrets such<br />

as intellectual property, future project designs <strong>and</strong> business<br />

strategy plans getting leaked via breach in physical security,<br />

network compromise, social engineering attacks or other<br />

zero-day system vulnerabilities. Enterprise <strong>and</strong> financial<br />

systems have grown up with these challenges <strong>and</strong> an entire<br />

industry has developed around secure coding practices,<br />

safeguarding databases <strong>and</strong> hardening networks with<br />

firewalls, intrusion detection systems <strong>and</strong> deep packet<br />

inspection devices to examine all the traffic on a network<br />

<strong>and</strong> look for anomalies <strong>and</strong> cyber threats.<br />

Critical control systems, however, were often developed as<br />

st<strong>and</strong>-alone solutions, designed to fulfil a specific function<br />

of replacing widespread manual operations with central<br />

control. So they were not designed with cyber-security in<br />

mind. When security became an issue, defence measures<br />

were often layered on in a piecemeal fashion after the<br />

networks become operational<br />

– with a bias towards keeping out intruders or unauthorized<br />

access, rather than the more devious <strong>and</strong> malign threats<br />

that infect the Internet. Because of a strong incentive to get<br />

the process operational, rather than imagining how it might<br />

perform under attack, network routers were often installed<br />

with default factory settings <strong>and</strong> an “administrator”<br />

password that worked just fine, but left the system<br />

vulnerable to attack.<br />

Issue 6 | 21

AMERICAS TECHNOLOGY<br />

22 | Issue 6

AMERICAS TECHNOLOGY<br />

Critical control systems, many of them designed <strong>and</strong> built<br />

long before the Internet became the backbone of our world<br />

economy, are now increasingly being connected online,<br />

<strong>and</strong> remote control of industrial processes brings new<br />

risks of remote tampering. Manufacturing industries that<br />

have already learned the vital necessity of cyber-security<br />

to protect office networks now face a new threat that goes<br />

beyond information or financial loss because it can result in<br />

direct physical damage, wastage or breakdown. Increasing<br />

automation also means that a lot more harm could happen<br />

in a shorter time before management is alerted.<br />

New Security Challenges<br />

The expansion of integrated technology in the industrial<br />

sector has created a surge in dem<strong>and</strong> for process<br />

automation, <strong>and</strong> an increase in self-driven heavy<br />

machinery. These improvements in manufacturing are<br />

creating a new cyber security challenge for industries<br />

where cyber- attacks could destroy machinery <strong>and</strong> threaten<br />

workers’ lives.<br />

The Stuxnet worm is a famous example of what can<br />

happen to physical systems – in January 2010 it reputedly<br />

damaged up to a thous<strong>and</strong> centrifuges across Iran<br />

by deliberately pushing them beyond recommended<br />

operational rotation speeds. So the potential threat to ICS is<br />

proven, <strong>and</strong> the risk to critical infrastructure has prompted<br />

the US Department of Homel<strong>and</strong> Security to create a task<br />

force ICS-CERT – “The Industrial Control Systems Cyber<br />

Emergency Response Team”.<br />

ICS-CERT aims to reduce risks within <strong>and</strong> across all critical<br />

infrastructure sectors by partnering with law enforcement<br />

agencies <strong>and</strong> the intelligence community <strong>and</strong> coordinating<br />

efforts among Federal, state, local, <strong>and</strong> tribal governments<br />

<strong>and</strong> control systems owners, operators, <strong>and</strong> vendors. ICS-<br />

CERT also collaborates with international <strong>and</strong> private sector<br />

Computer Emergency Response Teams (CERTs) to share<br />

control systems-related security incidents <strong>and</strong> mitigation<br />

measures.<br />

Seven key steps for hardening critical systems<br />

1 Defence-in-depth strategies<br />

• Establish network segmentation, firewalls, <strong>and</strong> “de-militarised<br />

zones”<br />

• Deploy firewalls on SCADA <strong>and</strong> process control networks<br />

2 Harden ICS remote access<br />

• Authentication, authorization, <strong>and</strong> access control for direct <strong>and</strong><br />

remote connection<br />

• Use virtual private networks <strong>and</strong> encryption for secure<br />

communications<br />

• Secure all wireless connections<br />

• Deploy intruder detection <strong>and</strong> prevention systems<br />

3 Manage patching for control systems<br />

• Patch <strong>and</strong> vulnerability management<br />

• Enterprise password management<br />

• Computer security <strong>and</strong> privacy controls<br />

• Secure control system modems<br />

4 Establish a secure topology <strong>and</strong> architecture<br />

• Apply <strong>and</strong> comply with security st<strong>and</strong>ards<br />

• Always re-examine security when modernizing <strong>and</strong> upgrading<br />

• Establish an industrial automation <strong>and</strong> control systems security<br />

program<br />

• Establish specifications for control system security procurement<br />

5 Assess assets, vulnerabilities, <strong>and</strong> risks<br />

• Underst<strong>and</strong> <strong>and</strong> analyze critical infrastructure interdependencies<br />

• Look for common vulnerabilities in critical infrastructure control<br />

systems<br />

• Conduct penetration testing of ICSs<br />

6 Security <strong>and</strong> response training<br />

• Initiate cyber-security training for control system engineers,<br />

technicians, administrators <strong>and</strong> operators<br />

7 Cyber-forensics planning for control systems<br />

• Develop an ICS incident response plan<br />

An extensive list of recommended best practices to<br />

safeguard Industrial Control Systems can be found<br />

on the ICS-CERT website at: https://ics-cert.us-cert.<br />

gov/Recommended-Practices. Not surprisingly, the<br />

recommendations follow similar lines to typical enterprise<br />

network <strong>and</strong> perimeter security best practices.<br />

Knowing where to start is often the biggest initial challenge.<br />

Of course we do need more in- depth detail once we start<br />

putting security into place, but it is better to begin with a<br />

palatable summary. So, to save you reading hundreds of<br />

documents, I will summarise the key requirements below<br />

into seven common sense steps.<br />

Sameer Dixit<br />

Senior Director Security Consulting<br />

Spirent Communications<br />

Issue 6 | 23

“Strategic Alliances to support<br />

SME Institutions making a<br />

more effective impact<br />

in financial inclusion<br />

of the majority<br />

population in<br />

Mexico”<br />

Financiamiento Progresemos, S.A. de C.V., SOFOM, E.N.R.<br />

http://www.progresemos.com.mx/

AMERICAS BUSINESS<br />

How to ‘keep calm <strong>and</strong><br />

carry on’ during an M&A<br />

In June 2015, U.S security regulators<br />

investigated a group of hackers, known as<br />

FIN4. The group were suspected of breaking<br />

into corporate email accounts of 100<br />

listed companies <strong>and</strong> stealing information<br />

in relation to mergers 1 for financial gain.<br />

Hackers are always on the lookout for<br />

opportunities to exploit vulnerable IT<br />

systems during mergers or acquisitions.<br />

Starwood Group, an American hotel <strong>and</strong><br />

leisure company, was the victim of a data<br />

breach in 2015 caused by malware infected<br />

point-of-sale terminals, shortly after the<br />

acquisition by Marriott Corporation had<br />

been announced. As a result of the breach,<br />

hackers gained access to customer names,<br />

payment card numbers, security codes, <strong>and</strong><br />

expiration dates. It was later questioned<br />

whether IT systems were appropriately<br />

assessed before the acquisition was made<br />

public knowledge.<br />

There is so much going on in the process of<br />

an acquisition or a business merger that IT<br />

systems are often neglected. This creates<br />

vulnerabilities, potentially exposing sensitive<br />

information which cyber criminals can<br />

exploit. IT teams must focus their attention<br />

on ensuring the security of existing<br />

systems before a company even considers<br />

undergoing an acquisition or merger.<br />

Pre-acquisition technical due diligence<br />

Technical due diligence refers to the<br />

period during which IT systems are<br />

inspected, reviewed <strong>and</strong> assessed for<br />

areas of vulnerability that need to be<br />

addressed. Organisations looking to be<br />

acquired or merge, should begin a process<br />

of technical due diligence internally before<br />

seeking interested parties. By carrying out<br />

such an internal technical due diligence, the<br />

company being acquired can be satisfied<br />

its systems are robust, secure <strong>and</strong> fit for<br />

purpose, <strong>and</strong> the acquirer’s due diligence<br />

will not expose any issues that may<br />

jeopardise the deal.<br />

In addition to the security vulnerabilities,<br />

many organisations carry open-source<br />

licensing risks. Open-source modules<br />

or snippets of code are commonly<br />

incorporated by developers into software to<br />

aid rapid development. Although this opensource<br />

code is freely downloadable, it is<br />

normally subject to an open-source licence,<br />

<strong>and</strong> this licence places restrictions <strong>and</strong><br />

obligations on what can be done with this<br />

code. Companies often have no idea what<br />

open-source code is used in their systems<br />

<strong>and</strong> any breach of licensing restrictions can<br />

be costly to fix <strong>and</strong> endanger the deal. So<br />

the internal technical due diligence should<br />

include an assessment of open-source<br />

licensing risk, allowing the company to<br />

resolve any problems in advance.<br />

By conducting thorough technical due<br />

diligence before embarking on the process<br />

of an acquisition, organisations will have<br />

a greater appeal to interested parties <strong>and</strong><br />

can ensure the deal will proceed smoothly.<br />

Those looking to acquire will have a clearer<br />

underst<strong>and</strong>ing of the technical assets for sale,<br />

with the added reassurance there won’t be<br />

any unpleasant surprises.<br />

Yahoo recently felt the ramifications of<br />

neglecting IT systems in anticipation of the<br />

Verizon acquisition, after it was revealed earlier<br />

this year that 500 million customer email<br />

accounts were hacked. This now has the<br />

potential to affect the final deal - Verizon have<br />

issued a statement stating that the company<br />

is looking to alter the terms of the deal, as it felt<br />

Yahoo wasn’t completely transparent about the<br />

breach. This is a prime example of technical<br />

due diligence that hasn’t been thoroughly<br />

conducted <strong>and</strong> proves issues unearthed during<br />

the closing stages of an acquisition have the<br />

potential to affect the final sale price.<br />

Pre-implementation hurdles<br />

Once an acquisition has been agreed in<br />

principle, senior stakeholders must then<br />

address which systems are being continued<br />

<strong>and</strong> which should be decommissioned. A<br />

skilled project manager must be chosen to<br />

manage <strong>and</strong> monitor the implementation of<br />

the systems; ensuring decisions impacting<br />

the seamless integration of the acquisition are<br />

made on time.<br />

Issue 6 | 25

We are the bridge<br />

that connects you<br />

with world markets<br />

We offer the most advanced solutions<br />

to operate in real time worldwide<br />

0810 666 4717<br />

www.puentenet.com<br />

<strong>Financial</strong> solutions since 1915<br />

PUENTE HNOS. S.A. IS AN INTEGRAL AND SETTLEMENT AGENT AND A BARGAINING AGENT (ALYC INTEGRAL) REGISTRED AT THE CNV (ACRONYM WHICH STANDS FOR "COMISION NACIONAL DE<br />

VALORES", "NATIONAL SECURITIES EXCHANGE COMMISSSION" IN ENGLISH) UNDER NUMBER 28, AND REGISTRED AT THE PUBLIC REGISTRY OF COMMERCE UNDER NUMBER 11481, BOOK 6, VOLUME<br />

- OF "CORPORATIONS". REPÚBLICA BUILDING, 1st TUCUMAN ST, 14th FLOOR (C1049AAA), BUENOS AIRES, ARGENTINA. PHONE 0810-666-4717 / CUIT 30-70102707-4 / WWW.PUENTENET.COM

AMERICAS BUSINESS<br />

Companies often underestimate the amount<br />

of work that goes into managing the<br />

process of an acquisition. This can result<br />

in the appointment of a project manager<br />

without the necessary skills needed to<br />

efficiently run the entire process. All too<br />

often it is assumed acquisitions only affect<br />

the financial <strong>and</strong> legal teams, when in reality<br />

it affects every department. An individual<br />

is needed with the skills to communicate<br />

across all departments <strong>and</strong> at all levels.<br />

Post-acquisition finishing touches<br />

The sale is agreed <strong>and</strong> personnel have<br />

merged, but it doesn’t stop there. Postacquisition<br />

integration is a separate<br />

project in its own right <strong>and</strong> requires close<br />

engagement <strong>from</strong> senior stakeholders.<br />

Merging IT systems across companies<br />

can affect the smooth running of daily<br />

operations, exposing flaws in acquired<br />

systems likely to cause system downtime.<br />

By bringing third-party experts on-board,<br />

companies facing both pre- <strong>and</strong> postacquisition<br />

challenges can be kept safe<br />

in the knowledge that IT systems are<br />

maintained <strong>and</strong> sensitive data is kept safe.<br />

No matter how big or small the company<br />

or the number of employees, acquisitions<br />

are always a major upheaval. In order<br />

to allow the organisation to continue to<br />

operate efficiently both during <strong>and</strong> after<br />

the deal, it is vital the entire integration is<br />

properly planned <strong>and</strong> effectively executed.<br />

This planning starts during due diligence<br />

by carrying out a thorough assessment<br />

of the technology <strong>and</strong> systems. And the<br />

process continues with the execution of the<br />

integration project, which requires a skilled<br />

project manager supported by engaged<br />

stakeholders <strong>and</strong> effective communication<br />

at all levels in the new organisation.<br />

Nick Pointon<br />

Head of M&A<br />

SQS<br />

1<br />

http://www.reuters.com/article/us-hackers-insidertradinidU<br />

SKBN0P31M720150623<br />

Issue 6 | 27

AMERICAS TECHNOLOGY<br />

Underst<strong>and</strong>ing the<br />

Next Generation of<br />

Software Robotics<br />

28 | Issue 6

AMERICAS TECHNOLOGY<br />

Neil Kinson, chief of staff, Redwood<br />

Software discusses why we must move<br />

away <strong>from</strong> the idea that robots simply<br />

replace humans if the industry is to thrive in<br />

the new year.<br />

The Robotised Enterprise, where an<br />

organisation has realised the ideal of having<br />

all back-office operations fully robotised<br />

so human involvement is only required<br />

for judgement <strong>and</strong> analysis, is seldom<br />

understood <strong>from</strong> a business perspective.<br />

The shared services sector in particular<br />

is split on the capability of robotics when<br />

performing critical business processes.<br />

According to recent Redwood Software<br />

research carried out with Shared Services<br />

Link, 97% of people in shared services agree<br />

that robotics have the ability to automate<br />

manual data entry tasks, yet only 52%<br />

are in agreement that they underst<strong>and</strong><br />

basic financial processes. Only 51% of<br />

respondents were confident in their ability<br />

to replace human activity across the entire<br />

spectrum, which is surprising considering<br />

that 67% of shared service professionals<br />

plan on using RPA within the next 12<br />

months. 72% of these organisations plan<br />

on leveraging existing investment in ERP<br />

to drive further automation in the next year.<br />

Process robotics can therefore play an<br />

integral role in how processes are managed<br />

<strong>and</strong> transformed in shared services.<br />

So, what do these statistics mean <strong>and</strong> how<br />

can shared services <strong>and</strong> finance professionals<br />

better underst<strong>and</strong> Robotic Process<br />

Automation in order to fully reap the benefits?<br />

Underst<strong>and</strong>ing robotics<br />

Everyone is talking about robotics but no<br />

one is agreeing on a uniform definition.<br />

Everyone thinks that they know, but no one<br />

is looking at it holistically.<br />

We need to make some clear distinctions<br />

between the different forms of process<br />

robotics on the market.<br />

According to the Institute for Robotic<br />

Process Automation (IRPA), enterprise<br />

process robotics is the application of<br />

technology that enables employees to<br />

configure computer software or a ‘robot’ to<br />

capture <strong>and</strong> analyse existing applications for<br />

manipulating data, processing a transaction<br />

or triggering responses <strong>and</strong> communicating<br />

with other digital systems.<br />

But that is not the extent of robotics’<br />

capability. The rise of process robotics<br />

presents a real chance to reimagine<br />

processes <strong>from</strong> the ground up. Companies<br />

should look at how they can positively<br />

transform core processes by looking at<br />

opportunities with a ‘robotic lens’ <strong>and</strong> not<br />

a ‘human one’. For example, to ensure<br />

enterprise grade scalability, security <strong>and</strong><br />

resilience, organisations should deploy<br />

robots to interact with business <strong>and</strong> core<br />

ERP systems through APIs <strong>and</strong> other<br />

st<strong>and</strong>ard integration methods.<br />

In light of this, organisations should<br />

thoroughly consider how robotics can<br />

be used to achieve significant process<br />

improvement, part of which requires a<br />

strong commitment to not doing things in<br />

the way they have always been done, but<br />

rather the way they’ve always imagined<br />

processes could be done.<br />

What many finance <strong>and</strong> shared services<br />

professionals are worried about however, is<br />

that if you remove humans <strong>from</strong> the process<br />

entirely, control will diminish. That is not the<br />

case. Indeed, it is the opposite. Automating<br />

processes end-to-end removes the siloed<br />

approach <strong>and</strong> enhances overall control.<br />

Robotics isn’t too good to be true<br />

Now we have defined robotics, it is important<br />

to underst<strong>and</strong> the benefits it can bring to<br />

a company. In a financial context, process<br />

robotics brings tremendous potential to<br />

improve core financial processes <strong>and</strong><br />

efficiencies, <strong>and</strong> more importantly, the<br />

st<strong>and</strong>ardisation thereof. For example, reports<br />

can be automatically generated allowing<br />

for reliable <strong>and</strong> trusted data thanks to the<br />

accompanying documentation <strong>and</strong> 100%<br />

accurate audit trails that are present at every<br />

part of the process. Moreover, built in business<br />

rules eliminate the need to micro manage <strong>and</strong><br />

allows users to trigger actions <strong>and</strong> monitor<br />

processes, whether at a desk or on the move.<br />

Recent Redwood research into the rise of<br />

‘Robo<strong>Finance</strong>®’ revealed that investment<br />

into robotics doesn’t just meet, but can<br />

in fact exceed a company’s expectations.<br />

At Royal DSM – a global science, health<br />

<strong>and</strong> nutrition company – it was reported<br />

that by deploying over 60 software<br />

“process robots” across nine business<br />

groups allowed the organisation to<br />

automate a staggering 89 percent of the<br />

485,000 manual tasks associated with its<br />

global financial close process, shrank its<br />

financial close process <strong>from</strong> 15 to 3 days,<br />

<strong>and</strong> freed up 45 Full Time Equivalents<br />

(FTEs) for more valuable work. The limits<br />

of what enterprise process robotics can<br />

achieve for core business processes are<br />

seemingly limitless.<br />

2017 as the ‘new dawn’ for robotics<br />

The days of throwing more timeconsuming<br />

manual effort at critical<br />

business processes to make them run<br />

more efficiently are behind us. Process<br />

robotics, without the need for unnecessary<br />

manual intervention, offers the consistency,<br />

speed <strong>and</strong> accuracy that businesses need<br />

to stay afloat in today’s competitive global<br />

marketplace. Those organisations that<br />