Brazoria County Appraisal District

95Ju4f

95Ju4f

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

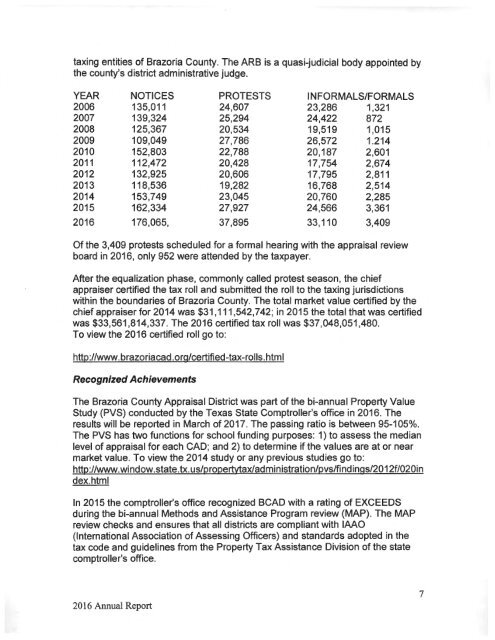

taxing entities of <strong>Brazoria</strong> <strong>County</strong>. The ARB is a quasi-judicial body appointed by<br />

the county's district administrative judge.<br />

YEAR<br />

2006<br />

2007<br />

2008<br />

2009<br />

2010<br />

2011<br />

2012<br />

2013<br />

2014<br />

2015<br />

2016<br />

NOTICES<br />

135,011<br />

139,324<br />

125,367<br />

109,049<br />

152,803<br />

112,472<br />

132,925<br />

118,536<br />

153,749<br />

162,334<br />

176,065,<br />

PROTESTS<br />

24,607<br />

25,294<br />

20 ,534<br />

27,786<br />

22 ,788<br />

20,428<br />

20,606<br />

19,282<br />

23,045<br />

27,927<br />

37 ,895<br />

IN FORMALS/FORMALS<br />

23,286 1,321<br />

24,422 872<br />

19,519 1,015<br />

26,572 1.214<br />

20,187 2,601<br />

17,754 2,674<br />

17,795 2,811<br />

16,768 2,514<br />

20,760 2,285<br />

24,566 3,361<br />

33,110 3,409<br />

Of the 3,409 protests scheduled for a formal hearing with the appraisal review<br />

board in 2016, only 952 were attended by the taxpayer.<br />

After the equalization phase, commonly called protest season, the chief<br />

appraiser certified the tax roll and submitted the roll to the taxing jurisdictions<br />

within the boundaries of <strong>Brazoria</strong> <strong>County</strong>. The total market value certified by the<br />

chief appraiser for 2014 was $31 ,111 ,542 ,742; in 2015 the total that was certified<br />

was $33,561 ,814,337. The 2016 certified tax roll was $37,048,051 ,480.<br />

To view the 2016 certified roll go to:<br />

http://www.brazoriacad .org/certified-tax-rolls.html<br />

Recognized Achievements<br />

The <strong>Brazoria</strong> <strong>County</strong> <strong>Appraisal</strong> <strong>District</strong> was part of the bi-annual Property Value<br />

Study (PVS) conducted by the Texas State Comptroller's office in 2016. The<br />

results will be reported in March of 2017. The passing ratio is between 95-105%.<br />

The PVS has two functions for school funding purposes: 1) to assess the median<br />

level of appraisal for each CAD; and 2) to determine if the values are at or near<br />

market value. To view the 2014 study or any previous studies go to:<br />

http://www.window.state.tx.us/propertytax/administration/pvs/findings/2012f/020in<br />

dex.html<br />

In 2015 the comptroller's office recognized BCAD with a rating of EXCEEDS<br />

during the bi-annual Methods and Assistance Program review (MAP). The MAP<br />

review checks and ensures that all districts are compliant with IMO<br />

(International Association of Assessing Officers) and standards adopted in the<br />

tax code and guidelines from the Property Tax Assistance Division of the state<br />

comptroller's office.<br />

2016 Annual Report<br />

7