FIN 575 Final Exam 2016 Pdf Download at Studentehelp

Start preparation for FIN 575 Final Exam through studentehelp and get highest ranking in the university of phoenix by having proper guideline in UOP FIN 575 Final Exam, FIN 575 Final Exam Question and Answers, FIN 575 Final Exam Answers. Download PDF of FIN 575 Final Exam for 100% marks. http://www.studentehelp.com/University-of-phoenix/FIN-575-Final-Exam.html

Start preparation for FIN 575 Final Exam through studentehelp and get highest ranking in the university of phoenix by having proper guideline in UOP FIN 575 Final Exam, FIN 575 Final Exam Question and Answers, FIN 575 Final Exam Answers. Download PDF of FIN 575 Final Exam for 100% marks.

http://www.studentehelp.com/University-of-phoenix/FIN-575-Final-Exam.html

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

http://www.studentehelp.com/<br />

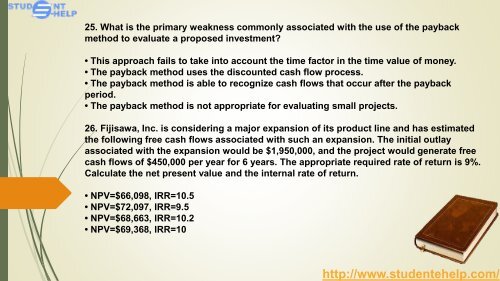

25. Wh<strong>at</strong> is the primary weakness commonly associ<strong>at</strong>ed with the use of the payback<br />

method to evalu<strong>at</strong>e a proposed investment?<br />

• This approach fails to take into account the time factor in the time value of money.<br />

• The payback method uses the discounted cash flow process.<br />

• The payback method is able to recognize cash flows th<strong>at</strong> occur after the payback<br />

period.<br />

• The payback method is not appropri<strong>at</strong>e for evalu<strong>at</strong>ing small projects.<br />

26. Fijisawa, Inc. is considering a major expansion of its product line and has estim<strong>at</strong>ed<br />

the following free cash flows associ<strong>at</strong>ed with such an expansion. The initial outlay<br />

associ<strong>at</strong>ed with the expansion would be $1,950,000, and the project would gener<strong>at</strong>e free<br />

cash flows of $450,000 per year for 6 years. The appropri<strong>at</strong>e required r<strong>at</strong>e of return is 9%.<br />

Calcul<strong>at</strong>e the net present value and the internal r<strong>at</strong>e of return.<br />

• NPV=$66,098, IRR=10.5<br />

• NPV=$72,097, IRR=9.5<br />

• NPV=$68,663, IRR=10.2<br />

• NPV=$69,368, IRR=10