FIN 451 All Weeks Problem Set

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

y the active portfolio? What is the M 2 ?<br />

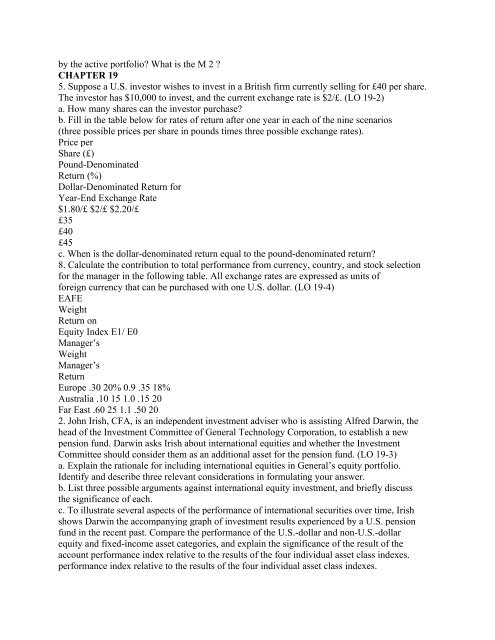

CHAPTER 19<br />

5. Suppose a U.S. investor wishes to invest in a British firm currently selling for £40 per share.<br />

The investor has $10,000 to invest, and the current exchange rate is $2/£. (LO 19-2)<br />

a. How many shares can the investor purchase?<br />

b. Fill in the table below for rates of return after one year in each of the nine scenarios<br />

(three possible prices per share in pounds times three possible exchange rates).<br />

Price per<br />

Share (£)<br />

Pound-Denominated<br />

Return (%)<br />

Dollar-Denominated Return for<br />

Year-End Exchange Rate<br />

$1.80/£ $2/£ $2.20/£<br />

£35<br />

£40<br />

£45<br />

c. When is the dollar-denominated return equal to the pound-denominated return?<br />

8. Calculate the contribution to total performance from currency, country, and stock selection<br />

for the manager in the following table. <strong>All</strong> exchange rates are expressed as units of<br />

foreign currency that can be purchased with one U.S. dollar. (LO 19-4)<br />

EAFE<br />

Weight<br />

Return on<br />

Equity Index E1/ E0<br />

Manager’s<br />

Weight<br />

Manager’s<br />

Return<br />

Europe .30 20% 0.9 .35 18%<br />

Australia .10 15 1.0 .15 20<br />

Far East .60 25 1.1 .50 20<br />

2. John Irish, CFA, is an independent investment adviser who is assisting Alfred Darwin, the<br />

head of the Investment Committee of General Technology Corporation, to establish a new<br />

pension fund. Darwin asks Irish about international equities and whether the Investment<br />

Committee should consider them as an additional asset for the pension fund. (LO 19-3)<br />

a. Explain the rationale for including international equities in General’s equity portfolio.<br />

Identify and describe three relevant considerations in formulating your answer.<br />

b. List three possible arguments against international equity investment, and briefly discuss<br />

the significance of each.<br />

c. To illustrate several aspects of the performance of international securities over time, Irish<br />

shows Darwin the accompanying graph of investment results experienced by a U.S. pension<br />

fund in the recent past. Compare the performance of the U.S.-dollar and non-U.S.-dollar<br />

equity and fixed-income asset categories, and explain the significance of the result of the<br />

account performance index relative to the results of the four individual asset class indexes.<br />

performance index relative to the results of the four individual asset class indexes.