ACCT 224 DeVry All Week Homework and You Decide

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

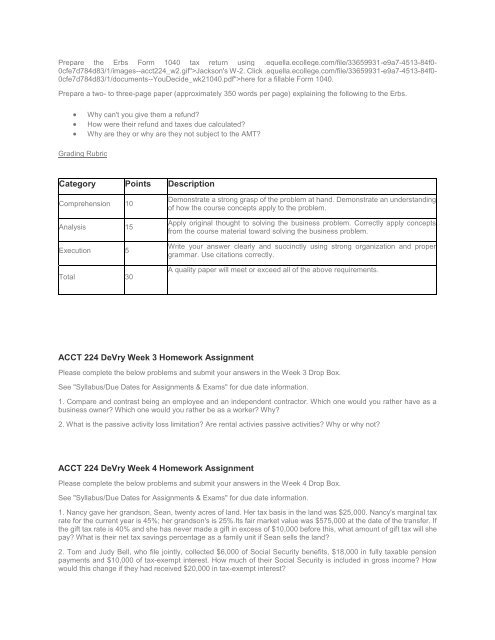

Prepare the Erbs Form 1040 tax return using .equella.ecollege.com/file/33659931-e9a7-4513-84f0-<br />

0cfe7d784d83/1/images--acct<strong>224</strong>_w2.gif">Jackson's W-2. Click .equella.ecollege.com/file/33659931-e9a7-4513-84f0-<br />

0cfe7d784d83/1/documents--<strong>You</strong><strong>Decide</strong>_wk21040.pdf">here for a fillable Form 1040.<br />

Prepare a two- to three-page paper (approximately 350 words per page) explaining the following to the Erbs.<br />

<br />

<br />

<br />

Why can't you give them a refund?<br />

How were their refund <strong>and</strong> taxes due calculated?<br />

Why are they or why are they not subject to the AMT?<br />

Grading Rubric<br />

Category Points Description<br />

Comprehension 10<br />

Analysis 15<br />

Execution 5<br />

Total 30<br />

Demonstrate a strong grasp of the problem at h<strong>and</strong>. Demonstrate an underst<strong>and</strong>ing<br />

of how the course concepts apply to the problem.<br />

Apply original thought to solving the business problem. Correctly apply concepts<br />

from the course material toward solving the business problem.<br />

Write your answer clearly <strong>and</strong> succinctly using strong organization <strong>and</strong> proper<br />

grammar. Use citations correctly.<br />

A quality paper will meet or exceed all of the above requirements.<br />

<strong>ACCT</strong> <strong>224</strong> <strong>DeVry</strong> <strong>Week</strong> 3 <strong>Homework</strong> Assignment<br />

Please complete the below problems <strong>and</strong> submit your answers in the <strong>Week</strong> 3 Drop Box.<br />

See "Syllabus/Due Dates for Assignments & Exams" for due date information.<br />

1. Compare <strong>and</strong> contrast being an employee <strong>and</strong> an independent contractor. Which one would you rather have as a<br />

business owner? Which one would you rather be as a worker? Why?<br />

2. What is the passive activity loss limitation? Are rental activies passive activities? Why or why not?<br />

<strong>ACCT</strong> <strong>224</strong> <strong>DeVry</strong> <strong>Week</strong> 4 <strong>Homework</strong> Assignment<br />

Please complete the below problems <strong>and</strong> submit your answers in the <strong>Week</strong> 4 Drop Box.<br />

See "Syllabus/Due Dates for Assignments & Exams" for due date information.<br />

1. Nancy gave her gr<strong>and</strong>son, Sean, twenty acres of l<strong>and</strong>. Her tax basis in the l<strong>and</strong> was $25,000. Nancy's marginal tax<br />

rate for the current year is 45%; her gr<strong>and</strong>son's is 25%.Its fair market value was $575,000 at the date of the transfer. If<br />

the gift tax rate is 40% <strong>and</strong> she has never made a gift in excess of $10,000 before this, what amount of gift tax will she<br />

pay? What is their net tax savings percentage as a family unit if Sean sells the l<strong>and</strong>?<br />

2. Tom <strong>and</strong> Judy Bell, who file jointly, collected $6,000 of Social Security benefits, $18,000 in fully taxable pension<br />

payments <strong>and</strong> $10,000 of tax-exempt interest. How much of their Social Security is included in gross income? How<br />

would this change if they had received $20,000 in tax-exempt interest?