ACCT 304 DeVry Week 3 Complete Work Latest

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

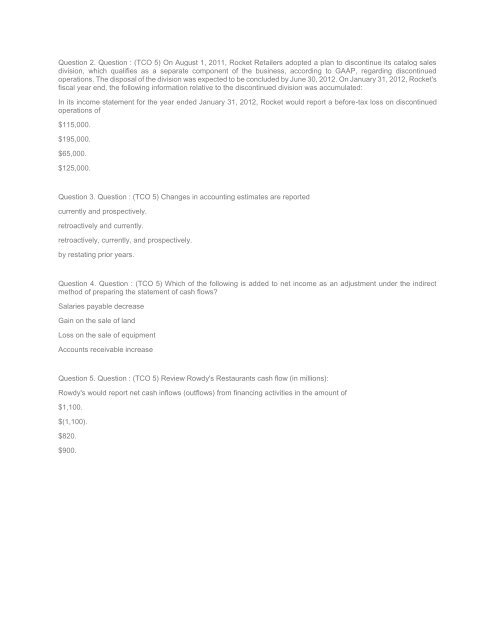

Question 2. Question : (TCO 5) On August 1, 2011, Rocket Retailers adopted a plan to discontinue its catalog sales<br />

division, which qualifies as a separate component of the business, according to GAAP, regarding discontinued<br />

operations. The disposal of the division was expected to be concluded by June 30, 2012. On January 31, 2012, Rocket's<br />

fiscal year end, the following information relative to the discontinued division was accumulated:<br />

In its income statement for the year ended January 31, 2012, Rocket would report a before-tax loss on discontinued<br />

operations of<br />

$115,000.<br />

$195,000.<br />

$65,000.<br />

$125,000.<br />

Question 3. Question : (TCO 5) Changes in accounting estimates are reported<br />

currently and prospectively.<br />

retroactively and currently.<br />

retroactively, currently, and prospectively.<br />

by restating prior years.<br />

Question 4. Question : (TCO 5) Which of the following is added to net income as an adjustment under the indirect<br />

method of preparing the statement of cash flows?<br />

Salaries payable decrease<br />

Gain on the sale of land<br />

Loss on the sale of equipment<br />

Accounts receivable increase<br />

Question 5. Question : (TCO 5) Review Rowdy's Restaurants cash flow (in millions):<br />

Rowdy's would report net cash inflows (outflows) from financing activities in the amount of<br />

$1,100.<br />

$(1,100).<br />

$820.<br />

$900.