ACCT 344 DeVry Entire Course

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

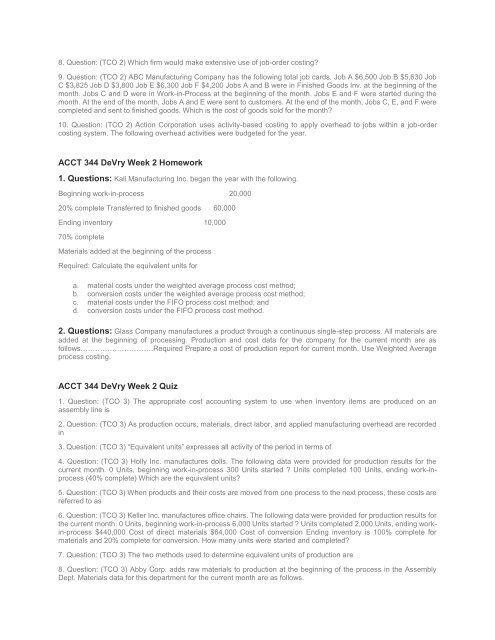

8. Question: (TCO 2) Which firm would make extensive use of job-order costing?<br />

9. Question: (TCO 2) ABC Manufacturing Company has the following total job cards. Job A $6,500 Job B $5,630 Job<br />

C $3,825 Job D $3,800 Job E $6,300 Job F $4,200 Jobs A and B were in Finished Goods Inv. at the beginning of the<br />

month. Jobs C and D were in Work-in-Process at the beginning of the month. Jobs E and F were started during the<br />

month. At the end of the month, Jobs A and E were sent to customers. At the end of the month, Jobs C, E, and F were<br />

completed and sent to finished goods. Which is the cost of goods sold for the month?<br />

10. Question: (TCO 2) Action Corporation uses activity-based costing to apply overhead to jobs within a job-order<br />

costing system. The following overhead activities were budgeted for the year.<br />

<strong>ACCT</strong> <strong>344</strong> <strong>DeVry</strong> Week 2 Homework<br />

1. Questions: Kali Manufacturing Inc. began the year with the following.<br />

Beginning work-in-process 20,000<br />

20% complete Transferred to finished goods 60,000<br />

Ending inventory 10,000<br />

70% complete<br />

Materials added at the beginning of the process<br />

Required: Calculate the equivalent units for<br />

a. material costs under the weighted average process cost method;<br />

b. conversion costs under the weighted average process cost method;<br />

c. material costs under the FIFO process cost method; and<br />

d. conversion costs under the FIFO process cost method.<br />

2. Questions: Glass Company manufactures a product through a continuous single-step process. All materials are<br />

added at the beginning of processing. Production and cost data for the company for the current month are as<br />

follows…………………………Required Prepare a cost of production report for current month. Use Weighted Average<br />

process costing.<br />

<strong>ACCT</strong> <strong>344</strong> <strong>DeVry</strong> Week 2 Quiz<br />

1. Question: (TCO 3) The appropriate cost accounting system to use when inventory items are produced on an<br />

assembly line is<br />

2. Question: (TCO 3) As production occurs, materials, direct labor, and applied manufacturing overhead are recorded<br />

in<br />

3. Question: (TCO 3) “Equivalent units” expresses all activity of the period in terms of<br />

4. Question: (TCO 3) Holly Inc. manufactures dolls. The following data were provided for production results for the<br />

current month. 0 Units, beginning work-in-process 300 Units started ? Units completed 100 Units, ending work-inprocess<br />

(40% complete) Which are the equivalent units?<br />

5. Question: (TCO 3) When products and their costs are moved from one process to the next process, these costs are<br />

referred to as<br />

6. Question: (TCO 3) Keller Inc. manufactures office chairs. The following data were provided for production results for<br />

the current month. 0 Units, beginning work-in-process 6,000 Units started ? Units completed 2,000 Units, ending workin-process<br />

$440,000 Cost of direct materials $64,000 Cost of conversion Ending inventory is 100% complete for<br />

materials and 20% complete for conversion. How many units were started and completed?<br />

7. Question: (TCO 3) The two methods used to determine equivalent units of production are<br />

8. Question: (TCO 3) Abby Corp. adds raw materials to production at the beginning of the process in the Assembly<br />

Dept. Materials data for this department for the current month are as follows.