BUSN 380 DEVRY COMPLETE PROBLEM SET PACKAGE

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

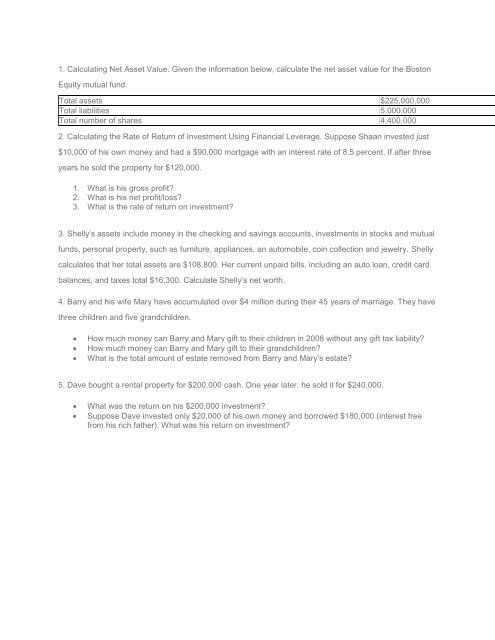

1. Calculating Net Asset Value. Given the information below, calculate the net asset value for the Boston<br />

Equity mutual fund.<br />

Total assets $225,000,000<br />

Total liabilities 5,000,000<br />

Total number of shares 4,400,000<br />

2. Calculating the Rate of Return of Investment Using Financial Leverage. Suppose Shaan invested just<br />

$10,000 of his own money and had a $90,000 mortgage with an interest rate of 8.5 percent. If after three<br />

years he sold the property for $120,000.<br />

1. What is his gross profit?<br />

2. What is his net profit/loss?<br />

3. What is the rate of return on investment?<br />

3. Shelly’s assets include money in the checking and savings accounts, investments in stocks and mutual<br />

funds, personal property, such as furniture, appliances, an automobile, coin collection and jewelry. Shelly<br />

calculates that her total assets are $108,800. Her current unpaid bills, including an auto loan, credit card<br />

balances, and taxes total $16,300. Calculate Shelly’s net worth.<br />

4. Barry and his wife Mary have accumulated over $4 million during their 45 years of marriage. They have<br />

three children and five grandchildren.<br />

<br />

<br />

<br />

How much money can Barry and Mary gift to their children in 2008 without any gift tax liability?<br />

How much money can Barry and Mary gift to their grandchildren?<br />

What is the total amount of estate removed from Barry and Mary’s estate?<br />

5. Dave bought a rental property for $200,000 cash. One year later, he sold it for $240,000.<br />

<br />

<br />

What was the return on his $200,000 investment?<br />

Suppose Dave invested only $20,000 of his own money and borrowed $180,000 (interest free<br />

from his rich father). What was his return on investment?