ACCT 212 DEVRY ENTIRE COURSE LATEST

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

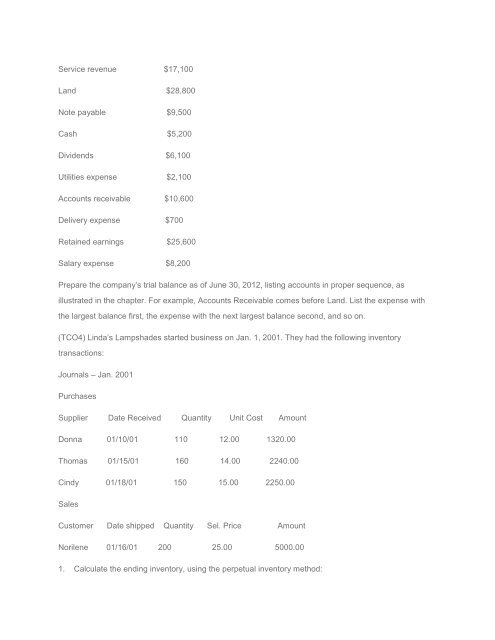

Service revenue $17,100<br />

Land $28,800<br />

Note payable $9,500<br />

Cash $5,200<br />

Dividends $6,100<br />

Utilities expense $2,100<br />

Accounts receivable $10,600<br />

Delivery expense $700<br />

Retained earnings $25,600<br />

Salary expense $8,200<br />

Prepare the company’s trial balance as of June 30, 2012, listing accounts in proper sequence, as<br />

illustrated in the chapter. For example, Accounts Receivable comes before Land. List the expense with<br />

the largest balance first, the expense with the next largest balance second, and so on.<br />

(TCO4) Linda’s Lampshades started business on Jan. 1, 2001. They had the following inventory<br />

transactions:<br />

Journals – Jan. 2001<br />

Purchases<br />

Supplier Date Received Quantity Unit Cost Amount<br />

Donna 01/10/01 110 12.00 1320.00<br />

Thomas 01/15/01 160 14.00 2240.00<br />

Cindy 01/18/01 150 15.00 2250.00<br />

Sales<br />

Customer Date shipped Quantity Sel. Price Amount<br />

Norilene 01/16/01 200 25.00 5000.00<br />

1. Calculate the ending inventory, using the perpetual inventory method: