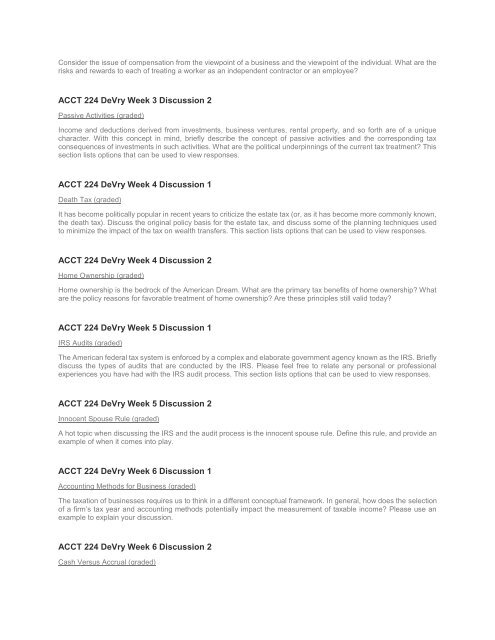

ACCT 224 DeVry Complete Week Discussions Package

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Consider the issue of compensation from the viewpoint of a business and the viewpoint of the individual. What are the<br />

risks and rewards to each of treating a worker as an independent contractor or an employee?<br />

<strong>ACCT</strong> <strong>224</strong> <strong>DeVry</strong> <strong>Week</strong> 3 Discussion 2<br />

Passive Activities (graded)<br />

Income and deductions derived from investments, business ventures, rental property, and so forth are of a unique<br />

character. With this concept in mind, briefly describe the concept of passive activities and the corresponding tax<br />

consequences of investments in such activities. What are the political underpinnings of the current tax treatment? This<br />

section lists options that can be used to view responses.<br />

<strong>ACCT</strong> <strong>224</strong> <strong>DeVry</strong> <strong>Week</strong> 4 Discussion 1<br />

Death Tax (graded)<br />

It has become politically popular in recent years to criticize the estate tax (or, as it has become more commonly known,<br />

the death tax). Discuss the original policy basis for the estate tax, and discuss some of the planning techniques used<br />

to minimize the impact of the tax on wealth transfers. This section lists options that can be used to view responses.<br />

<strong>ACCT</strong> <strong>224</strong> <strong>DeVry</strong> <strong>Week</strong> 4 Discussion 2<br />

Home Ownership (graded)<br />

Home ownership is the bedrock of the American Dream. What are the primary tax benefits of home ownership? What<br />

are the policy reasons for favorable treatment of home ownership? Are these principles still valid today?<br />

<strong>ACCT</strong> <strong>224</strong> <strong>DeVry</strong> <strong>Week</strong> 5 Discussion 1<br />

IRS Audits (graded)<br />

The American federal tax system is enforced by a complex and elaborate government agency known as the IRS. Briefly<br />

discuss the types of audits that are conducted by the IRS. Please feel free to relate any personal or professional<br />

experiences you have had with the IRS audit process. This section lists options that can be used to view responses.<br />

<strong>ACCT</strong> <strong>224</strong> <strong>DeVry</strong> <strong>Week</strong> 5 Discussion 2<br />

Innocent Spouse Rule (graded)<br />

A hot topic when discussing the IRS and the audit process is the innocent spouse rule. Define this rule, and provide an<br />

example of when it comes into play.<br />

<strong>ACCT</strong> <strong>224</strong> <strong>DeVry</strong> <strong>Week</strong> 6 Discussion 1<br />

Accounting Methods for Business (graded)<br />

The taxation of businesses requires us to think in a different conceptual framework. In general, how does the selection<br />

of a firm’s tax year and accounting methods potentially impact the measurement of taxable income? Please use an<br />

example to explain your discussion.<br />

<strong>ACCT</strong> <strong>224</strong> <strong>DeVry</strong> <strong>Week</strong> 6 Discussion 2<br />

Cash Versus Accrual (graded)