ACCT 346 DeVry Entire Course

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

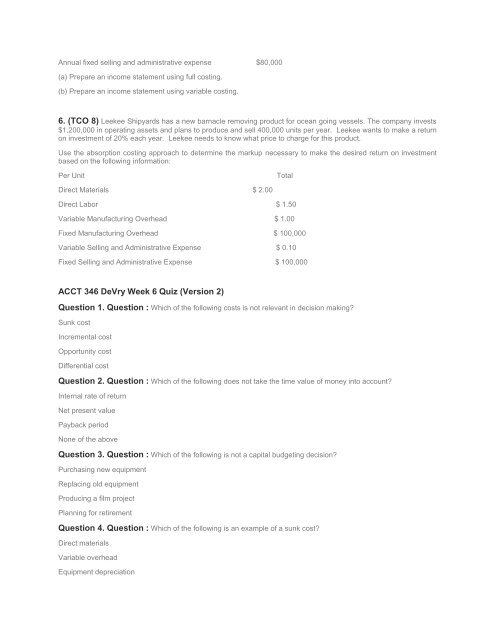

Annual fixed selling and administrative expense $80,000<br />

(a) Prepare an income statement using full costing.<br />

(b) Prepare an income statement using variable costing.<br />

6. (TCO 8) Leekee Shipyards has a new barnacle removing product for ocean going vessels. The company invests<br />

$1,200,000 in operating assets and plans to produce and sell 400,000 units per year. Leekee wants to make a return<br />

on investment of 20% each year. Leekee needs to know what price to charge for this product.<br />

Use the absorption costing approach to determine the markup necessary to make the desired return on investment<br />

based on the following information:<br />

Per Unit<br />

Total<br />

Direct Materials $ 2.00<br />

Direct Labor $ 1.50<br />

Variable Manufacturing Overhead $ 1.00<br />

Fixed Manufacturing Overhead $ 100,000<br />

Variable Selling and Administrative Expense $ 0.10<br />

Fixed Selling and Administrative Expense $ 100,000<br />

<strong>ACCT</strong> <strong>346</strong> <strong>DeVry</strong> Week 6 Quiz (Version 2)<br />

Question 1. Question : Which of the following costs is not relevant in decision making?<br />

Sunk cost<br />

Incremental cost<br />

Opportunity cost<br />

Differential cost<br />

Question 2. Question : Which of the following does not take the time value of money into account?<br />

Internal rate of return<br />

Net present value<br />

Payback period<br />

None of the above<br />

Question 3. Question : Which of the following is not a capital budgeting decision?<br />

Purchasing new equipment<br />

Replacing old equipment<br />

Producing a film project<br />

Planning for retirement<br />

Question 4. Question : Which of the following is an example of a sunk cost?<br />

Direct materials<br />

Variable overhead<br />

Equipment depreciation