Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

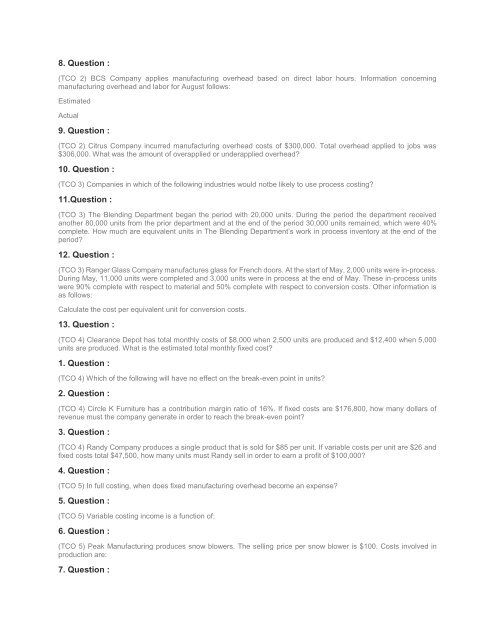

8. Question :<br />

(TCO 2) BCS Company applies manufacturing overhead based on direct labor hours. Information concerning<br />

manufacturing overhead and labor for August follows:<br />

Estimated<br />

Actual<br />

9. Question :<br />

(TCO 2) Citrus Company incurred manufacturing overhead costs of $300,000. Total overhead applied to jobs was<br />

$306,000. What was the amount of overapplied or underapplied overhead?<br />

10. Question :<br />

(TCO 3) Companies in which of the following industries would notbe likely to use process costing?<br />

11.Question :<br />

(TCO 3) The Blending Department began the period with 20,000 units. During the period the department received<br />

another 80,000 units from the prior department and at the end of the period 30,000 units remained, which were 40%<br />

complete. How much are equivalent units in The Blending Department’s work in process inventory at the end of the<br />

period?<br />

12. Question :<br />

(TCO 3) Ranger Glass Company manufactures glass for French doors. At the start of May, 2,000 units were in-process.<br />

During May, 11,000 units were completed and 3,000 units were in process at the end of May. These in-process units<br />

were 90% complete with respect to material and 50% complete with respect to conversion costs. Other information is<br />

as follows:<br />

Calculate the cost per equivalent unit for conversion costs.<br />

13. Question :<br />

(TCO 4) Clearance Depot has total monthly costs of $8,000 when 2,500 units are produced and $12,400 when 5,000<br />

units are produced. What is the estimated total monthly fixed cost?<br />

1. Question :<br />

(TCO 4) Which of the following will have no effect on the break-even point in units?<br />

2. Question :<br />

(TCO 4) Circle K Furniture has a contribution margin ratio of 16%. If fixed costs are $176,800, how many dollars of<br />

revenue must the company generate in order to reach the break-even point?<br />

3. Question :<br />

(TCO 4) Randy Company produces a single product that is sold for $85 per unit. If variable costs per unit are $26 and<br />

fixed costs total $47,500, how many units must Randy sell in order to earn a profit of $100,000?<br />

4. Question :<br />

(TCO 5) In full costing, when does fixed manufacturing overhead become an expense?<br />

5. Question :<br />

(TCO 5) Variable costing income is a function of:<br />

6. Question :<br />

(TCO 5) Peak Manufacturing produces snow blowers. The selling price per snow blower is $100. Costs involved in<br />

production are:<br />

7. Question :