ACCT 444 DeVry Complete Quiz Package

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

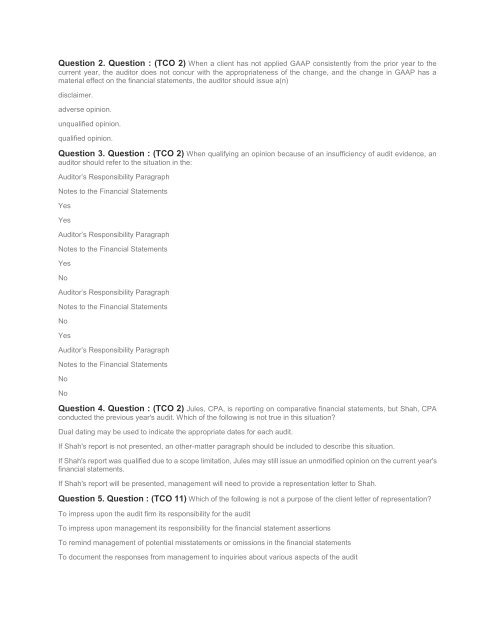

Question 2. Question : (TCO 2) When a client has not applied GAAP consistently from the prior year to the<br />

current year, the auditor does not concur with the appropriateness of the change, and the change in GAAP has a<br />

material effect on the financial statements, the auditor should issue a(n)<br />

disclaimer.<br />

adverse opinion.<br />

unqualified opinion.<br />

qualified opinion.<br />

Question 3. Question : (TCO 2) When qualifying an opinion because of an insufficiency of audit evidence, an<br />

auditor should refer to the situation in the:<br />

Auditor’s Responsibility Paragraph<br />

Notes to the Financial Statements<br />

Yes<br />

Yes<br />

Auditor’s Responsibility Paragraph<br />

Notes to the Financial Statements<br />

Yes<br />

No<br />

Auditor’s Responsibility Paragraph<br />

Notes to the Financial Statements<br />

No<br />

Yes<br />

Auditor’s Responsibility Paragraph<br />

Notes to the Financial Statements<br />

No<br />

No<br />

Question 4. Question : (TCO 2) Jules, CPA, is reporting on comparative financial statements, but Shah, CPA<br />

conducted the previous year's audit. Which of the following is not true in this situation?<br />

Dual dating may be used to indicate the appropriate dates for each audit.<br />

If Shah's report is not presented, an other-matter paragraph should be included to describe this situation.<br />

If Shah's report was qualified due to a scope limitation, Jules may still issue an unmodified opinion on the current year's<br />

financial statements.<br />

If Shah's report will be presented, management will need to provide a representation letter to Shah.<br />

Question 5. Question : (TCO 11) Which of the following is not a purpose of the client letter of representation?<br />

To impress upon the audit firm its responsibility for the audit<br />

To impress upon management its responsibility for the financial statement assertions<br />

To remind management of potential misstatements or omissions in the financial statements<br />

To document the responses from management to inquiries about various aspects of the audit