ACCT 550 DeVry Final Exam

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

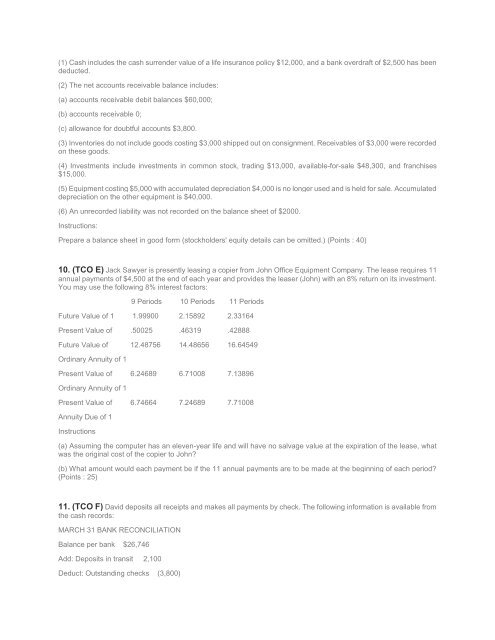

(1) Cash includes the cash surrender value of a life insurance policy $12,000, and a bank overdraft of $2,500 has been<br />

deducted.<br />

(2) The net accounts receivable balance includes:<br />

(a) accounts receivable debit balances $60,000;<br />

(b) accounts receivable 0;<br />

(c) allowance for doubtful accounts $3,800.<br />

(3) Inventories do not include goods costing $3,000 shipped out on consignment. Receivables of $3,000 were recorded<br />

on these goods.<br />

(4) Investments include investments in common stock, trading $13,000, available-for-sale $48,300, and franchises<br />

$15,000.<br />

(5) Equipment costing $5,000 with accumulated depreciation $4,000 is no longer used and is held for sale. Accumulated<br />

depreciation on the other equipment is $40,000.<br />

(6) An unrecorded liability was not recorded on the balance sheet of $2000.<br />

Instructions:<br />

Prepare a balance sheet in good form (stockholders' equity details can be omitted.) (Points : 40)<br />

10. (TCO E) Jack Sawyer is presently leasing a copier from John Office Equipment Company. The lease requires 11<br />

annual payments of $4,500 at the end of each year and provides the leaser (John) with an 8% return on its investment.<br />

You may use the following 8% interest factors:<br />

9 Periods 10 Periods 11 Periods<br />

Future Value of 1 1.99900 2.15892 2.33164<br />

Present Value of .50025 .46319 .42888<br />

Future Value of 12.48756 14.48656 16.64549<br />

Ordinary Annuity of 1<br />

Present Value of 6.24689 6.71008 7.13896<br />

Ordinary Annuity of 1<br />

Present Value of 6.74664 7.24689 7.71008<br />

Annuity Due of 1<br />

Instructions<br />

(a) Assuming the computer has an eleven-year life and will have no salvage value at the expiration of the lease, what<br />

was the original cost of the copier to John?<br />

(b) What amount would each payment be if the 11 annual payments are to be made at the beginning of each period?<br />

(Points : 25)<br />

11. (TCO F) David deposits all receipts and makes all payments by check. The following information is available from<br />

the cash records:<br />

MARCH 31 BANK RECONCILIATION<br />

Balance per bank $26,746<br />

Add: Deposits in transit 2,100<br />

Deduct: Outstanding checks (3,800)