ACCT 591 DeVry Week 3 Quiz Latest

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

o<br />

o<br />

o<br />

o<br />

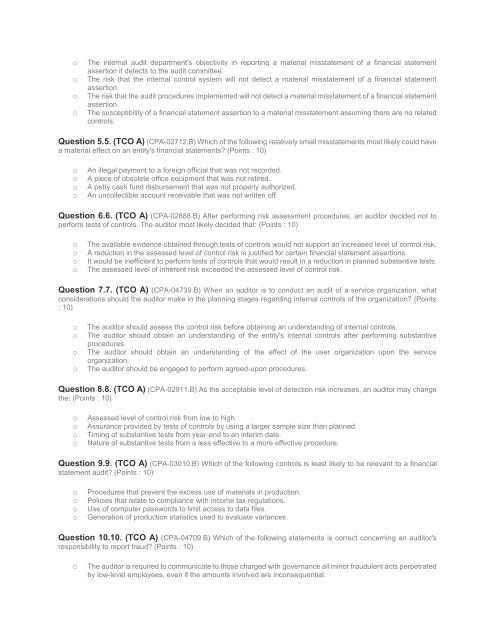

The internal audit department's objectivity in reporting a material misstatement of a financial statement<br />

assertion it detects to the audit committee.<br />

The risk that the internal control system will not detect a material misstatement of a financial statement<br />

assertion.<br />

The risk that the audit procedures implemented will not detect a material misstatement of a financial statement<br />

assertion.<br />

The susceptibility of a financial statement assertion to a material misstatement assuming there are no related<br />

controls.<br />

Question 5.5. (TCO A) (CPA-02712.B) Which of the following relatively small misstatements most likely could have<br />

a material effect on an entity's financial statements? (Points : 10)<br />

o<br />

o<br />

o<br />

o<br />

An illegal payment to a foreign official that was not recorded.<br />

A piece of obsolete office equipment that was not retired.<br />

A petty cash fund disbursement that was not properly authorized.<br />

An uncollectible account receivable that was not written off.<br />

Question 6.6. (TCO A) (CPA-02888.B) After performing risk assessment procedures, an auditor decided not to<br />

perform tests of controls. The auditor most likely decided that: (Points : 10)<br />

o<br />

o<br />

o<br />

o<br />

The available evidence obtained through tests of controls would not support an increased level of control risk.<br />

A reduction in the assessed level of control risk is justified for certain financial statement assertions.<br />

It would be inefficient to perform tests of controls that would result in a reduction in planned substantive tests.<br />

The assessed level of inherent risk exceeded the assessed level of control risk.<br />

Question 7.7. (TCO A) (CPA-04739.B) When an auditor is to conduct an audit of a service organization, what<br />

considerations should the auditor make in the planning stages regarding internal controls of the organization? (Points<br />

: 10)<br />

o<br />

o<br />

o<br />

o<br />

The auditor should assess the control risk before obtaining an understanding of internal controls.<br />

The auditor should obtain an understanding of the entity's internal controls after performing substantive<br />

procedures.<br />

The auditor should obtain an understanding of the effect of the user organization upon the service<br />

organization.<br />

The auditor should be engaged to perform agreed-upon procedures.<br />

Question 8.8. (TCO A) (CPA-02911.B) As the acceptable level of detection risk increases, an auditor may change<br />

the: (Points : 10)<br />

o<br />

o<br />

o<br />

o<br />

Assessed level of control risk from low to high.<br />

Assurance provided by tests of controls by using a larger sample size than planned.<br />

Timing of substantive tests from year-end to an interim date.<br />

Nature of substantive tests from a less effective to a more effective procedure.<br />

Question 9.9. (TCO A) (CPA-03010.B) Which of the following controls is least likely to be relevant to a financial<br />

statement audit? (Points : 10)<br />

o<br />

o<br />

o<br />

o<br />

Procedures that prevent the excess use of materials in production.<br />

Policies that relate to compliance with income tax regulations.<br />

Use of computer passwords to limit access to data files.<br />

Generation of production statistics used to evaluate variances.<br />

Question 10.10. (TCO A) (CPA-04709.B) Which of the following statements is correct concerning an auditor's<br />

responsibility to report fraud? (Points : 10)<br />

o<br />

The auditor is required to communicate to those charged with governance all minor fraudulent acts perpetrated<br />

by low-level employees, even if the amounts involved are inconsequential.