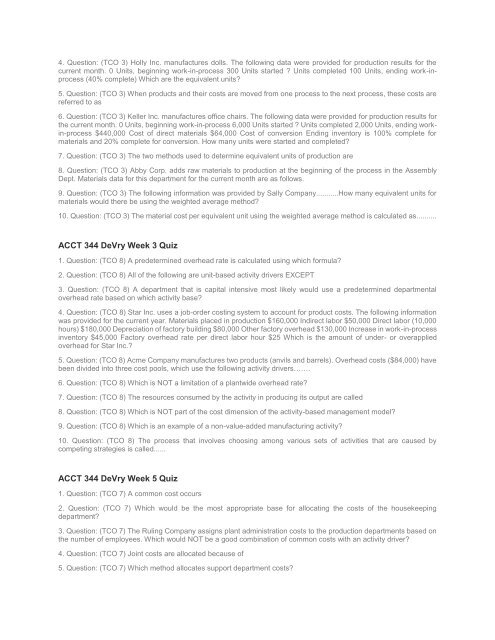

ACCT 344 DeVry Complete Quiz Package

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

4. Question: (TCO 3) Holly Inc. manufactures dolls. The following data were provided for production results for the<br />

current month. 0 Units, beginning work-in-process 300 Units started ? Units completed 100 Units, ending work-inprocess<br />

(40% complete) Which are the equivalent units?<br />

5. Question: (TCO 3) When products and their costs are moved from one process to the next process, these costs are<br />

referred to as<br />

6. Question: (TCO 3) Keller Inc. manufactures office chairs. The following data were provided for production results for<br />

the current month. 0 Units, beginning work-in-process 6,000 Units started ? Units completed 2,000 Units, ending workin-process<br />

$440,000 Cost of direct materials $64,000 Cost of conversion Ending inventory is 100% complete for<br />

materials and 20% complete for conversion. How many units were started and completed?<br />

7. Question: (TCO 3) The two methods used to determine equivalent units of production are<br />

8. Question: (TCO 3) Abby Corp. adds raw materials to production at the beginning of the process in the Assembly<br />

Dept. Materials data for this department for the current month are as follows.<br />

9. Question: (TCO 3) The following information was provided by Sally Company...........How many equivalent units for<br />

materials would there be using the weighted average method?<br />

10. Question: (TCO 3) The material cost per equivalent unit using the weighted average method is calculated as..........<br />

<strong>ACCT</strong> <strong>344</strong> <strong>DeVry</strong> Week 3 <strong>Quiz</strong><br />

1. Question: (TCO 8) A predetermined overhead rate is calculated using which formula?<br />

2. Question: (TCO 8) All of the following are unit-based activity drivers EXCEPT<br />

3. Question: (TCO 8) A department that is capital intensive most likely would use a predetermined departmental<br />

overhead rate based on which activity base?<br />

4. Question: (TCO 8) Star Inc. uses a job-order costing system to account for product costs. The following information<br />

was provided for the current year. Materials placed in production $160,000 Indirect labor $50,000 Direct labor (10,000<br />

hours) $180,000 Depreciation of factory building $80,000 Other factory overhead $130,000 Increase in work-in-process<br />

inventory $45,000 Factory overhead rate per direct labor hour $25 Which is the amount of under- or overapplied<br />

overhead for Star Inc.?<br />

5. Question: (TCO 8) Acme Company manufactures two products (anvils and barrels). Overhead costs ($84,000) have<br />

been divided into three cost pools, which use the following activity drivers…….<br />

6. Question: (TCO 8) Which is NOT a limitation of a plantwide overhead rate?<br />

7. Question: (TCO 8) The resources consumed by the activity in producing its output are called<br />

8. Question: (TCO 8) Which is NOT part of the cost dimension of the activity-based management model?<br />

9. Question: (TCO 8) Which is an example of a non-value-added manufacturing activity?<br />

10. Question: (TCO 8) The process that involves choosing among various sets of activities that are caused by<br />

competing strategies is called......<br />

<strong>ACCT</strong> <strong>344</strong> <strong>DeVry</strong> Week 5 <strong>Quiz</strong><br />

1. Question: (TCO 7) A common cost occurs<br />

2. Question: (TCO 7) Which would be the most appropriate base for allocating the costs of the housekeeping<br />

department?<br />

3. Question: (TCO 7) The Ruling Company assigns plant administration costs to the production departments based on<br />

the number of employees. Which would NOT be a good combination of common costs with an activity driver?<br />

4. Question: (TCO 7) Joint costs are allocated because of<br />

5. Question: (TCO 7) Which method allocates support department costs?