ACCT 444 DeVry Week 1 Complete Work Latest

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

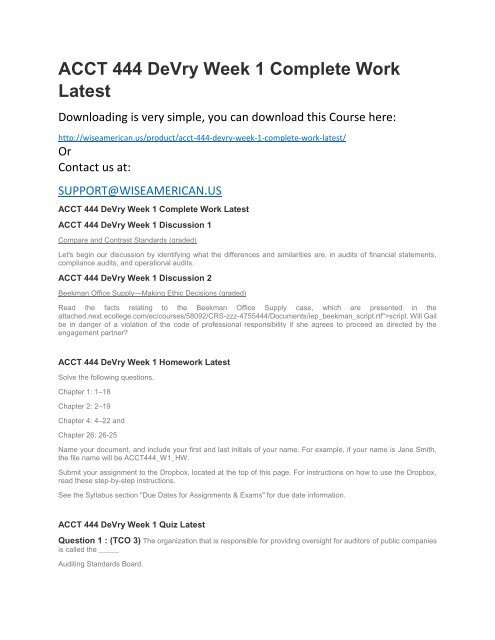

<strong>ACCT</strong> <strong>444</strong> <strong>DeVry</strong> <strong>Week</strong> 1 <strong>Complete</strong> <strong>Work</strong><br />

<strong>Latest</strong><br />

Downloading is very simple, you can download this Course here:<br />

http://wiseamerican.us/product/acct-<strong>444</strong>-devry-week-1-complete-work-latest/<br />

Or<br />

Contact us at:<br />

SUPPORT@WISEAMERICAN.US<br />

<strong>ACCT</strong> <strong>444</strong> <strong>DeVry</strong> <strong>Week</strong> 1 <strong>Complete</strong> <strong>Work</strong> <strong>Latest</strong><br />

<strong>ACCT</strong> <strong>444</strong> <strong>DeVry</strong> <strong>Week</strong> 1 Discussion 1<br />

Compare and Contrast Standards (graded)<br />

Let's begin our discussion by identifying what the differences and similarities are, in audits of financial statements,<br />

compliance audits, and operational audits.<br />

<strong>ACCT</strong> <strong>444</strong> <strong>DeVry</strong> <strong>Week</strong> 1 Discussion 2<br />

Beekman Office Supply—Making Ethic Decisions (graded)<br />

Read the facts relating to the Beekman Office Supply case, which are presented in the<br />

attached.next.ecollege.com/ec/courses/58092/CRS-zzz-4755<strong>444</strong>/Documents/iep_beekman_script.rtf">script. Will Gail<br />

be in danger of a violation of the code of professional responsibility if she agrees to proceed as directed by the<br />

engagement partner?<br />

<strong>ACCT</strong> <strong>444</strong> <strong>DeVry</strong> <strong>Week</strong> 1 Homework <strong>Latest</strong><br />

Solve the following questions.<br />

Chapter 1: 1–18<br />

Chapter 2: 2–19<br />

Chapter 4: 4–22 and<br />

Chapter 26: 26-25<br />

Name your document, and include your first and last initials of your name. For example, if your name is Jane Smith,<br />

the file name will be <strong>ACCT</strong><strong>444</strong>_W1_HW.<br />

Submit your assignment to the Dropbox, located at the top of this page. For instructions on how to use the Dropbox,<br />

read these step-by-step instructions.<br />

See the Syllabus section "Due Dates for Assignments & Exams" for due date information.<br />

<strong>ACCT</strong> <strong>444</strong> <strong>DeVry</strong> <strong>Week</strong> 1 Quiz <strong>Latest</strong><br />

Question 1 : (TCO 3) The organization that is responsible for providing oversight for auditors of public companies<br />

is called the _____<br />

Auditing Standards Board.

American Institution of Public Accountants.<br />

Accounting Oversight Board.<br />

Public Company Accounting Oversight Board.<br />

Question 2. Question: (TCO 1) Which one of the following is not a field work standard?<br />

Adequate planning and supervision<br />

Due professional care<br />

Understand the entity and its environment, including internal control<br />

Sufficient appropriate audit evidence<br />

Question 3. Question : (TCO 1) An independent auditor must have which of the following?<br />

A pre-existing and well-informed point of view with respect to the audit<br />

Technical training that is adequate to meet the requirements of a professional<br />

A background in many different disciplines<br />

Question 4. Question : (TCO 1) Any service that requires a CPA firm to issue a report about the reliability of an<br />

assertion that is made by another party is a(n) _____<br />

accounting and bookkeeping service.<br />

attestation service.<br />

assurance service.<br />

tax service.<br />

Question 5. Question : (TCO 1) Which of the following statements is incorrect regarding the SEC's partner<br />

rotation rules?<br />

All audit partners must rotate off the audit engagement after 5 years.<br />

Small firms may be exempted from the partner rotation requirement.<br />

The lead and concurring partners are subject to a 5-year time out period.<br />

Other audit partners are subject to a 2-year time out period.<br />

Question 6. Question : (TCO 3) The concept of materiality would be least important to an auditor when<br />

considering the<br />

adequacy of disclosure of a client's illegal act.<br />

discovery of weaknesses in a client's internal control.<br />

effects of a direct financial interest in the client on the CPA's independence.<br />

decision whether to use positive or negative confirmations of accounts receivable.<br />

Question 7. Question : (TCO 3) An auditor strives to achieve independence in appearance to<br />

maintain public confidence in the profession.<br />

be in a position to offer other services to the client.<br />

comply with the generally accepted accounting principles.<br />

maintain a biased mental attitude.<br />

Question 8. Question : (TCO 3) Several months after an unqualified audit report was issued, the auditor<br />

discovered the financial statements were materially misstated. The client’s CEO agrees that there are misstatements,<br />

but refuses to correct them. She claims that confidentiality prevents the CPA from informing anyone.

The CEO is correct and the auditor must maintain confidentiality.<br />

The CEO is incorrect, but because the audit report has been issued, it is too late.<br />

The CEO is correct, but to be ethically correct the auditor should violate the confidentiality rule and disclose the error.<br />

Question 9. Question : (TCO 1) Which of the following statements is correct concerning an auditor's<br />

responsibilities regarding financial statements?<br />

An auditor may not draft an entity's financial statements based on information from management's accounting system.<br />

The adoption of sound accounting policies is an implicit part of an auditor's responsibilities.<br />

An auditor's responsibilities for audited financial statements are confined to the expression of the auditor's opinion.<br />

Question 10. Question : (TCO 1) Which of the following items impairs independence under U.S. ethics standards<br />

but does not necessarily impair independence under the IFAC Code of Ethics for Professional Accountants?<br />

An immaterial direct financial interest in an audit client<br />

Employment at a client of an immediate family member of the engagement partner in a key accounting position<br />

The auditor also provides internal audit outsourcing services<br />

Contingent fee arrangements for audit engagements