FIN 650 GC WEEK 8 EXAM 3 LATEST

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

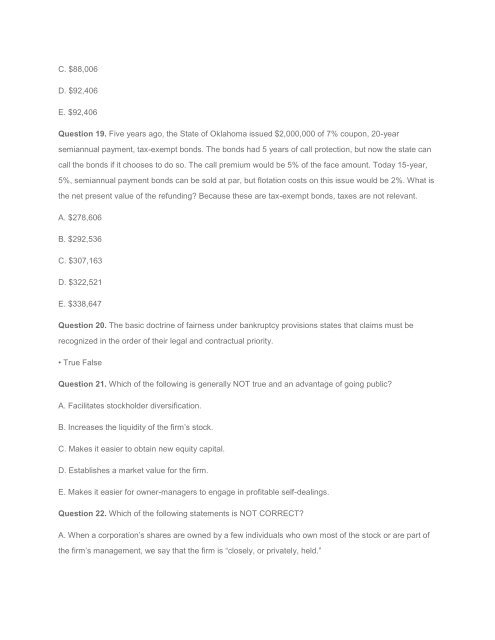

C. $88,006<br />

D. $92,406<br />

E. $92,406<br />

Question 19. Five years ago, the State of Oklahoma issued $2,000,000 of 7% coupon, 20-year<br />

semiannual payment, tax-exempt bonds. The bonds had 5 years of call protection, but now the state can<br />

call the bonds if it chooses to do so. The call premium would be 5% of the face amount. Today 15-year,<br />

5%, semiannual payment bonds can be sold at par, but flotation costs on this issue would be 2%. What is<br />

the net present value of the refunding? Because these are tax-exempt bonds, taxes are not relevant.<br />

A. $278,606<br />

B. $292,536<br />

C. $307,163<br />

D. $322,521<br />

E. $338,647<br />

Question 20. The basic doctrine of fairness under bankruptcy provisions states that claims must be<br />

recognized in the order of their legal and contractual priority.<br />

• True False<br />

Question 21. Which of the following is generally NOT true and an advantage of going public?<br />

A. Facilitates stockholder diversification.<br />

B. Increases the liquidity of the firm’s stock.<br />

C. Makes it easier to obtain new equity capital.<br />

D. Establishes a market value for the firm.<br />

E. Makes it easier for owner-managers to engage in profitable self-dealings.<br />

Question 22. Which of the following statements is NOT CORRECT?<br />

A. When a corporation’s shares are owned by a few individuals who own most of the stock or are part of<br />

the firm’s management, we say that the firm is “closely, or privately, held.”