FIN 650 GC Module 3 Exam Latest

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

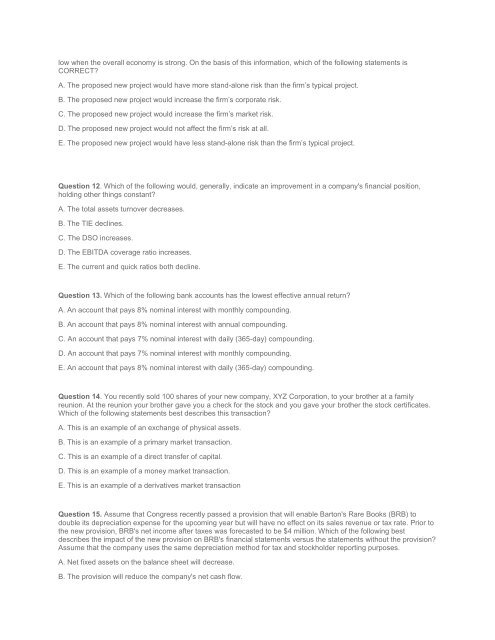

low when the overall economy is strong. On the basis of this information, which of the following statements is<br />

CORRECT?<br />

A. The proposed new project would have more stand-alone risk than the firm’s typical project.<br />

B. The proposed new project would increase the firm’s corporate risk.<br />

C. The proposed new project would increase the firm’s market risk.<br />

D. The proposed new project would not affect the firm’s risk at all.<br />

E. The proposed new project would have less stand-alone risk than the firm’s typical project.<br />

Question 12. Which of the following would, generally, indicate an improvement in a company's financial position,<br />

holding other things constant?<br />

A. The total assets turnover decreases.<br />

B. The TIE declines.<br />

C. The DSO increases.<br />

D. The EBITDA coverage ratio increases.<br />

E. The current and quick ratios both decline.<br />

Question 13. Which of the following bank accounts has the lowest effective annual return?<br />

A. An account that pays 8% nominal interest with monthly compounding.<br />

B. An account that pays 8% nominal interest with annual compounding.<br />

C. An account that pays 7% nominal interest with daily (365-day) compounding.<br />

D. An account that pays 7% nominal interest with monthly compounding.<br />

E. An account that pays 8% nominal interest with daily (365-day) compounding.<br />

Question 14. You recently sold 100 shares of your new company, XYZ Corporation, to your brother at a family<br />

reunion. At the reunion your brother gave you a check for the stock and you gave your brother the stock certificates.<br />

Which of the following statements best describes this transaction?<br />

A. This is an example of an exchange of physical assets.<br />

B. This is an example of a primary market transaction.<br />

C. This is an example of a direct transfer of capital.<br />

D. This is an example of a money market transaction.<br />

E. This is an example of a derivatives market transaction<br />

Question 15. Assume that Congress recently passed a provision that will enable Barton's Rare Books (BRB) to<br />

double its depreciation expense for the upcoming year but will have no effect on its sales revenue or tax rate. Prior to<br />

the new provision, BRB's net income after taxes was forecasted to be $4 million. Which of the following best<br />

describes the impact of the new provision on BRB's financial statements versus the statements without the provision?<br />

Assume that the company uses the same depreciation method for tax and stockholder reporting purposes.<br />

A. Net fixed assets on the balance sheet will decrease.<br />

B. The provision will reduce the company's net cash flow.