J14

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

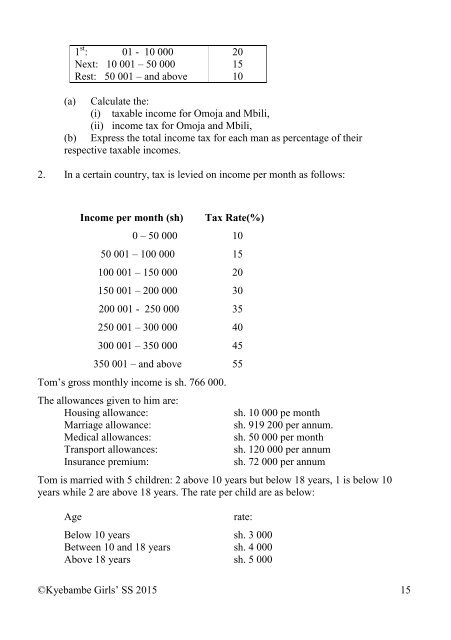

1 st : 01 - 10 000 20<br />

Next: 10 001 – 50 000 15<br />

Rest: 50 001 – and above 10<br />

(a) Calculate the:<br />

(i) taxable income for Omoja and Mbili,<br />

(ii) income tax for Omoja and Mbili,<br />

(b) Express the total income tax for each man as percentage of their<br />

respective taxable incomes.<br />

2. In a certain country, tax is levied on income per month as follows:<br />

Income per month (sh)<br />

Tax Rate(%)<br />

0 – 50 000 10<br />

50 001 – 100 000 15<br />

100 001 – 150 000 20<br />

150 001 – 200 000 30<br />

200 001 - 250 000 35<br />

250 001 – 300 000 40<br />

300 001 – 350 000 45<br />

350 001 – and above 55<br />

Tom’s gross monthly income is sh. 766 000.<br />

The allowances given to him are:<br />

Housing allowance:<br />

Marriage allowance:<br />

Medical allowances:<br />

Transport allowances:<br />

Insurance premium:<br />

sh. 10 000 pe month<br />

sh. 919 200 per annum.<br />

sh. 50 000 per month<br />

sh. 120 000 per annum<br />

sh. 72 000 per annum<br />

Tom is married with 5 children: 2 above 10 years but below 18 years, 1 is below 10<br />

years while 2 are above 18 years. The rate per child are as below:<br />

Age<br />

rate:<br />

Below 10 years sh. 3 000<br />

Between 10 and 18 years sh. 4 000<br />

Above 18 years sh. 5 000<br />

©Kyebambe Girls’ SS 2015 15