5 Mistakes First Time Property Investors Should Avoid

Retirement planning is a common motive for people to invest in property. But did you know that a majority of these investors start late? A majority of these investors are making a loss because they have higher holding costs when compared to the rental income. Visit https://www.mortgagecorp.com.au to learn more.

Retirement planning is a common motive for people to invest in property. But did you know that a majority of these investors start late? A majority of these investors are making a loss because they have higher holding costs when compared to the rental income. Visit https://www.mortgagecorp.com.au to learn more.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

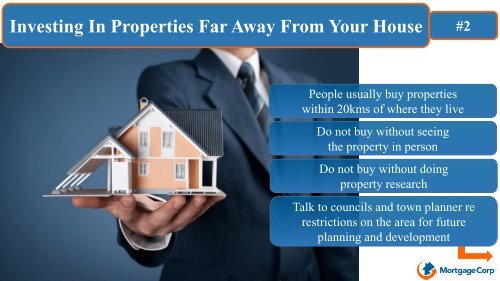

Investing In Properties Far Away From Your House #2<br />

People usually buy properties<br />

within 20kms of where they live<br />

Do not buy without seeing<br />

the property in person<br />

Do not buy without doing<br />

property research<br />

Talk to councils and town planner re<br />

restrictions on the area for future<br />

planning and development