FIN 515 Week 4 Midterm Exam _Version 2_

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

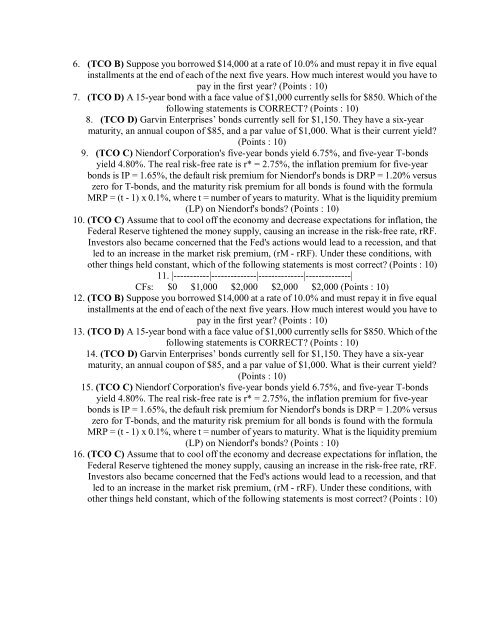

6. (TCO B) Suppose you borrowed $14,000 at a rate of 10.0% and must repay it in five equal<br />

installments at the end of each of the next five years. How much interest would you have to<br />

pay in the first year? (Points : 10)<br />

7. (TCO D) A 15-year bond with a face value of $1,000 currently sells for $850. Which of the<br />

following statements is CORRECT? (Points : 10)<br />

8. (TCO D) Garvin Enterprises’ bonds currently sell for $1,150. They have a six-year<br />

maturity, an annual coupon of $85, and a par value of $1,000. What is their current yield?<br />

(Points : 10)<br />

9. (TCO C) Niendorf Corporation's five-year bonds yield 6.75%, and five-year T-bonds<br />

yield 4.80%. The real risk-free rate is r* = 2.75%, the inflation premium for five-year<br />

bonds is IP = 1.65%, the default risk premium for Niendorf's bonds is DRP = 1.20% versus<br />

zero for T-bonds, and the maturity risk premium for all bonds is found with the formula<br />

MRP = (t - 1) x 0.1%, where t = number of years to maturity. What is the liquidity premium<br />

(LP) on Niendorf's bonds? (Points : 10)<br />

10. (TCO C) Assume that to cool off the economy and decrease expectations for inflation, the<br />

Federal Reserve tightened the money supply, causing an increase in the risk-free rate, rRF.<br />

Investors also became concerned that the Fed's actions would lead to a recession, and that<br />

led to an increase in the market risk premium, (rM - rRF). Under these conditions, with<br />

other things held constant, which of the following statements is most correct? (Points : 10)<br />

11. |-----------|--------------|--------------|--------------|<br />

CFs: $0 $1,000 $2,000 $2,000 $2,000 (Points : 10)<br />

12. (TCO B) Suppose you borrowed $14,000 at a rate of 10.0% and must repay it in five equal<br />

installments at the end of each of the next five years. How much interest would you have to<br />

pay in the first year? (Points : 10)<br />

13. (TCO D) A 15-year bond with a face value of $1,000 currently sells for $850. Which of the<br />

following statements is CORRECT? (Points : 10)<br />

14. (TCO D) Garvin Enterprises’ bonds currently sell for $1,150. They have a six-year<br />

maturity, an annual coupon of $85, and a par value of $1,000. What is their current yield?<br />

(Points : 10)<br />

15. (TCO C) Niendorf Corporation's five-year bonds yield 6.75%, and five-year T-bonds<br />

yield 4.80%. The real risk-free rate is r* = 2.75%, the inflation premium for five-year<br />

bonds is IP = 1.65%, the default risk premium for Niendorf's bonds is DRP = 1.20% versus<br />

zero for T-bonds, and the maturity risk premium for all bonds is found with the formula<br />

MRP = (t - 1) x 0.1%, where t = number of years to maturity. What is the liquidity premium<br />

(LP) on Niendorf's bonds? (Points : 10)<br />

16. (TCO C) Assume that to cool off the economy and decrease expectations for inflation, the<br />

Federal Reserve tightened the money supply, causing an increase in the risk-free rate, rRF.<br />

Investors also became concerned that the Fed's actions would lead to a recession, and that<br />

led to an increase in the market risk premium, (rM - rRF). Under these conditions, with<br />

other things held constant, which of the following statements is most correct? (Points : 10)