Benefits Attached To 1031 Exchange in Real Estate Investing

http://www.solidrockproperty.com/

http://www.solidrockproperty.com/

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

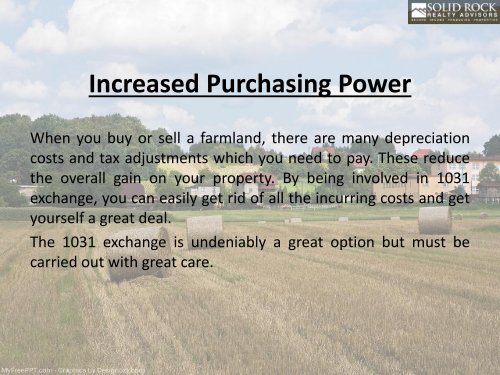

Increased Purchas<strong>in</strong>g Power<br />

When you buy or sell a farmland, there are many depreciation<br />

costs and tax adjustments which you need to pay. These reduce<br />

the overall ga<strong>in</strong> on your property. By be<strong>in</strong>g <strong>in</strong>volved <strong>in</strong> <strong>1031</strong><br />

exchange, you can easily get rid of all the <strong>in</strong>curr<strong>in</strong>g costs and get<br />

yourself a great deal.<br />

The <strong>1031</strong> exchange is undeniably a great option but must be<br />

carried out with great care.