Under construction House How to Claim Tax Deduction on Home Loan Interest Payments (2)

Most of us know that a home loan borrower can enjoy tax benefits on the principal and interest amount that is paid towards loan. But not everyone is aware of the advantage available to those who have taken home loan for construction purpose. Yes, even if your property is still under construction, you can still enjoy the benefits of Indian tax deductions by smart moves. Blog: https://financebuddha.com/blog/how-to-claim-tax-deduction-on-home-loan-interest-payments-for-under-construction-house Apply for Loan: https://financebuddha.com/home-loan

Most of us know that a home loan borrower can enjoy tax benefits on the principal and interest amount that is paid towards loan. But not everyone is aware of the advantage available to those who have taken home loan for construction purpose. Yes, even if your property is still under construction, you can still enjoy the benefits of Indian tax deductions by smart moves.

Blog: https://financebuddha.com/blog/how-to-claim-tax-deduction-on-home-loan-interest-payments-for-under-construction-house

Apply for Loan: https://financebuddha.com/home-loan

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

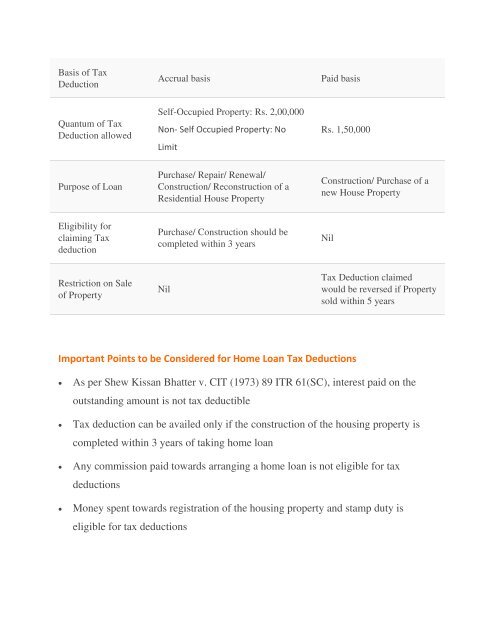

Basis of <str<strong>on</strong>g>Tax</str<strong>on</strong>g><br />

<str<strong>on</strong>g>Deducti<strong>on</strong></str<strong>on</strong>g><br />

Accrual basis<br />

Paid basis<br />

Quantum of <str<strong>on</strong>g>Tax</str<strong>on</strong>g><br />

<str<strong>on</strong>g>Deducti<strong>on</strong></str<strong>on</strong>g> allowed<br />

Self-Occupied Property: Rs. 2,00,000<br />

N<strong>on</strong>- Self Occupied Property: No<br />

Limit<br />

Rs. 1,50,000<br />

Purpose of <strong>Loan</strong><br />

Purchase/ Repair/ Renewal/<br />

C<strong>on</strong>structi<strong>on</strong>/ Re<str<strong>on</strong>g>c<strong>on</strong>structi<strong>on</strong></str<strong>on</strong>g> of a<br />

Residential <str<strong>on</strong>g>House</str<strong>on</strong>g> Property<br />

C<strong>on</strong>structi<strong>on</strong>/ Purchase of a<br />

new <str<strong>on</strong>g>House</str<strong>on</strong>g> Property<br />

Eligibility for<br />

claiming <str<strong>on</strong>g>Tax</str<strong>on</strong>g><br />

deducti<strong>on</strong><br />

Purchase/ C<strong>on</strong>structi<strong>on</strong> should be<br />

completed within 3 years<br />

Nil<br />

Restricti<strong>on</strong> <strong>on</strong> Sale<br />

of Property<br />

Nil<br />

<str<strong>on</strong>g>Tax</str<strong>on</strong>g> <str<strong>on</strong>g>Deducti<strong>on</strong></str<strong>on</strong>g> claimed<br />

would be reversed if Property<br />

sold within 5 years<br />

Important Points <str<strong>on</strong>g>to</str<strong>on</strong>g> be C<strong>on</strong>sidered for <strong>Home</strong> <strong>Loan</strong> <str<strong>on</strong>g>Tax</str<strong>on</strong>g> <str<strong>on</strong>g>Deducti<strong>on</strong></str<strong>on</strong>g>s<br />

<br />

<br />

<br />

<br />

As per Shew Kissan Bhatter v. CIT (1973) 89 ITR 61(SC), interest paid <strong>on</strong> the<br />

outstanding amount is not tax deductible<br />

<str<strong>on</strong>g>Tax</str<strong>on</strong>g> deducti<strong>on</strong> can be availed <strong>on</strong>ly if the <str<strong>on</strong>g>c<strong>on</strong>structi<strong>on</strong></str<strong>on</strong>g> of the housing property is<br />

completed within 3 years of taking home loan<br />

Any commissi<strong>on</strong> paid <str<strong>on</strong>g>to</str<strong>on</strong>g>wards arranging a home loan is not eligible for tax<br />

deducti<strong>on</strong>s<br />

M<strong>on</strong>ey spent <str<strong>on</strong>g>to</str<strong>on</strong>g>wards registrati<strong>on</strong> of the housing property and stamp duty is<br />

eligible for tax deducti<strong>on</strong>s