You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

4<br />

EMERGING MARKETS:<br />

RIDING THE POST SELL-OFF RECOVERY<br />

History Suggests Outsized Emerging Market<br />

Rewards After Heavy Falls<br />

Investors tracking recent market headlines and poring over<br />

data releases from around the globe are more than likely to be<br />

considering their portfolio’s exposure to emerging markets (EM)<br />

at the moment.<br />

EM equities and currencies took a battering last year amid a<br />

commodities rout, oil price falls, a strengthening USD and the<br />

increasing inevitability of a US rate rise.<br />

On top of this, very grave fears over the state of the Chinese<br />

economy and what a slowing growth outlook might mean for<br />

other developing economies added to increasingly gloomy<br />

sentiment on the prospects for EMs. The MSCI EM Index (USD)*<br />

was just under 15% down for 2015.<br />

And the start of this year has done little to improve this<br />

sentiment. Chinese stocks plunged in January as the extent<br />

of the Chinese economic slowdown became clearer and signs<br />

the global economy is continuing to struggle have led to lower<br />

growth predictions for emerging economies and warnings from<br />

global financial institutions such as the<br />

IMF that <strong>2016</strong> will be a “challenging”<br />

year for EMs.<br />

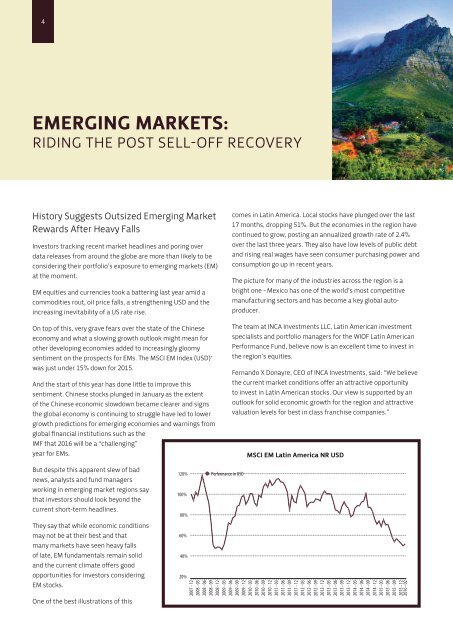

comes in Latin America. Local stocks have plunged over the last<br />

17 months, dropping 51%. But the economies in the region have<br />

continued to grow, posting an annualized growth rate of 2.4%<br />

over the last three years. They also have low levels of public debt<br />

and rising real wages have seen consumer purchasing power and<br />

consumption go up in recent years.<br />

The picture for many of the industries across the region is a<br />

bright one - Mexico has one of the world’s most competitive<br />

manufacturing sectors and has become a key global autoproducer.<br />

The team at INCA Investments LLC, Latin American investment<br />

specialists and portfolio managers for the WIOF Latin American<br />

Performance Fund, believe now is an excellent time to invest in<br />

the region’s equities.<br />

Fernando X Donayre, CEO of INCA Investments, said: “We believe<br />

the current market conditions offer an attractive opportunity<br />

to invest in Latin American stocks. Our view is supported by an<br />

outlook for solid economic growth for the region and attractive<br />

valuation levels for best in class franchise companies.”<br />

MSCI EM Latin America NR USD<br />

But despite this apparent slew of bad<br />

news, analysts and fund managers<br />

working in emerging market regions say<br />

that investors should look beyond the<br />

current short-term headlines.<br />

They say that while economic conditions<br />

may not be at their best and that<br />

many markets have seen heavy falls<br />

of late, EM fundamentals remain solid<br />

and the current climate offers good<br />

opportunities for investors considering<br />

EM stocks.<br />

One of the best illustrations of this<br />

120%<br />

100%<br />

80%<br />

60%<br />

40%<br />

20%<br />

Performance in USD<br />

2007 - 12<br />

2008 - 03<br />

2008 - 06<br />

2008 - 09<br />

2008 - 12<br />

2009 - 03<br />

2009 - 06<br />

2009 - 09<br />

2009 - 12<br />

2010 - 03<br />

2010 - 06<br />

2010 - 09<br />

2010 - 12<br />

2011 - 03<br />

2011 - 06<br />

2011 - 09<br />

2011 - 12<br />

2012 - 03<br />

2012 - 06<br />

2012 - 09<br />

2012 - 12<br />

2013 - 03<br />

2013 - 06<br />

2013 - 09<br />

2013 - 12<br />

2014 - 03<br />

2014 - 06<br />

2014 - 09<br />

2014 - 12<br />

2015 - 03<br />

2015 - 06<br />

2015 - 09<br />

2015 - 12<br />

<strong>2016</strong> - 02