Financial Plan With A Reverse Mortgage

Should you incorporate a reverse mortgage into your financial plan? Here are some things to consider. Visit: http://roseburgreverse.com/

Should you incorporate a reverse mortgage into your financial plan? Here are some things to consider. Visit: http://roseburgreverse.com/

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

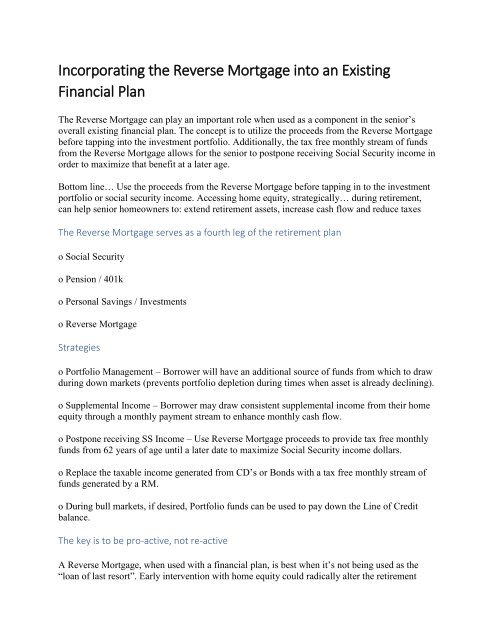

Incorporating the <strong>Reverse</strong> <strong>Mortgage</strong> into an Existing<br />

<strong>Financial</strong> <strong>Plan</strong><br />

The <strong>Reverse</strong> <strong>Mortgage</strong> can play an important role when used as a component in the senior’s<br />

overall existing financial plan. The concept is to utilize the proceeds from the <strong>Reverse</strong> <strong>Mortgage</strong><br />

before tapping into the investment portfolio. Additionally, the tax free monthly stream of funds<br />

from the <strong>Reverse</strong> <strong>Mortgage</strong> allows for the senior to postpone receiving Social Security income in<br />

order to maximize that benefit at a later age.<br />

Bottom line… Use the proceeds from the <strong>Reverse</strong> <strong>Mortgage</strong> before tapping in to the investment<br />

portfolio or social security income. Accessing home equity, strategically… during retirement,<br />

can help senior homeowners to: extend retirement assets, increase cash flow and reduce taxes<br />

The <strong>Reverse</strong> <strong>Mortgage</strong> serves as a fourth leg of the retirement plan<br />

o Social Security<br />

o Pension / 401k<br />

o Personal Savings / Investments<br />

o <strong>Reverse</strong> <strong>Mortgage</strong><br />

Strategies<br />

o Portfolio Management – Borrower will have an additional source of funds from which to draw<br />

during down markets (prevents portfolio depletion during times when asset is already declining).<br />

o Supplemental Income – Borrower may draw consistent supplemental income from their home<br />

equity through a monthly payment stream to enhance monthly cash flow.<br />

o Postpone receiving SS Income – Use <strong>Reverse</strong> <strong>Mortgage</strong> proceeds to provide tax free monthly<br />

funds from 62 years of age until a later date to maximize Social Security income dollars.<br />

o Replace the taxable income generated from CD’s or Bonds with a tax free monthly stream of<br />

funds generated by a RM.<br />

o During bull markets, if desired, Portfolio funds can be used to pay down the Line of Credit<br />

balance.<br />

The key is to be pro-active, not re-active<br />

A <strong>Reverse</strong> <strong>Mortgage</strong>, when used with a financial plan, is best when it’s not being used as the<br />

“loan of last resort”. Early intervention with home equity could radically alter the retirement

outcome. Draws from the portfolio in a bear market can be devastating to cash flow survival.<br />

Especially in the early retirement years. By relying on home equity in coordination with portfolio<br />

withdrawals, many retirees might be able to justify a more robust withdrawal rate and for some,<br />

simply a way to stay on track. More money helps stabilize the plan to create a more stimulating<br />

retirement.<br />

http://roseburgreverse.com