The Ultimate Guide to Secured and Unsecured Personal Loans

These loans are taken for a specific use such as buying a home or car or using in business. There is another kind of loan which is a multipurpose loan and can be availed for any kind of use of the borrower. Such loans are known as Personal Loans. Blog: https://financebuddha.com/blog/the-ultimate-guide-to-secured-and-unsecured-personal-loans

These loans are taken for a specific use such as buying a home or car or using in business. There is another kind of loan which is a multipurpose loan and can be availed for any kind of use of the borrower. Such loans are known as Personal Loans.

Blog: https://financebuddha.com/blog/the-ultimate-guide-to-secured-and-unsecured-personal-loans

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

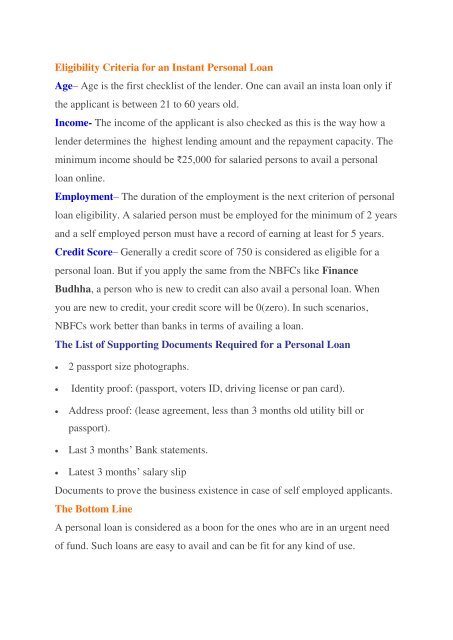

Eligibility Criteria for an Instant <strong>Personal</strong> Loan<br />

Age– Age is the first checklist of the lender. One can avail an insta loan only if<br />

the applicant is between 21 <strong>to</strong> 60 years old.<br />

Income- <strong>The</strong> income of the applicant is also checked as this is the way how a<br />

lender determines the highest lending amount <strong>and</strong> the repayment capacity. <strong>The</strong><br />

minimum income should be ₹25,000 for salaried persons <strong>to</strong> avail a personal<br />

loan online.<br />

Employment– <strong>The</strong> duration of the employment is the next criterion of personal<br />

loan eligibility. A salaried person must be employed for the minimum of 2 years<br />

<strong>and</strong> a self employed person must have a record of earning at least for 5 years.<br />

Credit Score– Generally a credit score of 750 is considered as eligible for a<br />

personal loan. But if you apply the same from the NBFCs like Finance<br />

Budhha, a person who is new <strong>to</strong> credit can also avail a personal loan. When<br />

you are new <strong>to</strong> credit, your credit score will be 0(zero). In such scenarios,<br />

NBFCs work better than banks in terms of availing a loan.<br />

<strong>The</strong> List of Supporting Documents Required for a <strong>Personal</strong> Loan<br />

<br />

<br />

<br />

<br />

2 passport size pho<strong>to</strong>graphs.<br />

Identity proof: (passport, voters ID, driving license or pan card).<br />

Address proof: (lease agreement, less than 3 months old utility bill or<br />

passport).<br />

Last 3 months’ Bank statements.<br />

<br />

Latest 3 months’ salary slip<br />

Documents <strong>to</strong> prove the business existence in case of self employed applicants.<br />

<strong>The</strong> Bot<strong>to</strong>m Line<br />

A personal loan is considered as a boon for the ones who are in an urgent need<br />

of fund. Such loans are easy <strong>to</strong> avail <strong>and</strong> can be fit for any kind of use.