Tavistock Institute of Human Relations Annual Report, 1st October 2016 - 30th September 2017.

This is the latest Tavistock Institute of Human Relations Annual Report! Covering from the 1st of October 2016, up to the 30th of September 2017.

This is the latest Tavistock Institute of Human Relations Annual Report! Covering from the 1st of October 2016, up to the 30th of September 2017.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

STRUCTURE AND FINANCE<br />

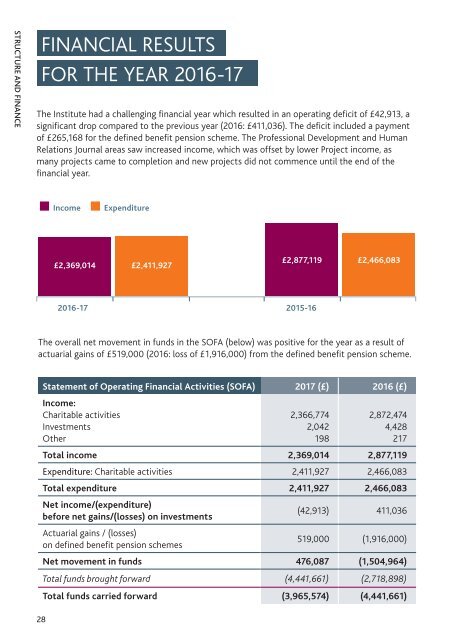

FINANCIAL RESULTS<br />

FOR THE YEAR <strong>2016</strong>-17<br />

The <strong>Institute</strong> had a challenging financial year which resulted in an operating deficit <strong>of</strong> £42,913, a<br />

significant drop compared to the previous year (<strong>2016</strong>: £411,036). The deficit included a payment<br />

<strong>of</strong> £265,168 for the defined benefit pension scheme. The Pr<strong>of</strong>essional Development and <strong>Human</strong><br />

<strong>Relations</strong> Journal areas saw increased income, which was <strong>of</strong>fset by lower Project income, as<br />

many projects came to completion and new projects did not commence until the end <strong>of</strong> the<br />

financial year.<br />

The <strong>Institute</strong>’s Balance Sheet as at <strong>30th</strong> <strong>September</strong> 2017 showed a decrease in net assets to<br />

£722,426 (<strong>2016</strong>: £906,339) before any pension liability. This was mainly due to a decrease in<br />

cash held in the bank by the <strong>Institute</strong>.<br />

Statement <strong>of</strong> Operating Financial Activities (SOFA) 2017 (£) <strong>2016</strong> (£)<br />

Fixed Assets 27,689 41,348<br />

STRUCTURE AND FINANCE<br />

Income<br />

Expenditure<br />

Current Assets 1,618,418 1,909,527<br />

Liabilities 923,681 1,044,536<br />

Net Assets (excluding pension liability) 722,426 906,339<br />

£2,369,014 £2,411,927<br />

£2,877,119 £2,466,083<br />

Defined Benefit Pension Scheme Liability (4,688,000) (5,348,000)<br />

Total Net Asset (3,965,574) (4,441,661)<br />

Total Charity funds (3,965,574) (4,441,661)<br />

<strong>2016</strong>-17 2015-16<br />

The overall net movement in funds in the SOFA (below) was positive for the year as a result <strong>of</strong><br />

actuarial gains <strong>of</strong> £519,000 (<strong>2016</strong>: loss <strong>of</strong> £1,916,000) from the defined benefit pension scheme.<br />

Statement <strong>of</strong> Operating Financial Activities (SOFA) 2017 (£) <strong>2016</strong> (£)<br />

Income:<br />

Charitable activities<br />

Investments<br />

Other<br />

2,366,774<br />

2,042<br />

198<br />

2,872,474<br />

4,428<br />

217<br />

During the year the <strong>Institute</strong> agreed a revised pension recovery plan with the pension trustees<br />

(approved by the pensions regulator), whereby the deficit will be paid within 15 years. The<br />

<strong>Institute</strong> paid £265,168 in accordance with this plan in March <strong>2017.</strong><br />

The actuarial valuation <strong>of</strong> the <strong>Tavistock</strong> <strong>Institute</strong> <strong>of</strong> <strong>Human</strong> <strong>Relations</strong> Retirements Benefit<br />

Scheme as at 30 <strong>September</strong> 2017, for the purposes <strong>of</strong> FRS102 showed a funding deficit <strong>of</strong><br />

£4,688,000 (<strong>2016</strong>: £5,348,000). This improvement to the pension balance sheet was driven<br />

principally by a more favourable discount rate (driven by higher corporate bond yields) and the<br />

updating <strong>of</strong> the longevity assumptions, in line with the changes the trustees adopted for the<br />

<strong>2016</strong> actuarial valuation.<br />

Total income 2,369,014 2,877,119<br />

Expenditure: Charitable activities 2,411,927 2,466,083<br />

Total expenditure 2,411,927 2,466,083<br />

Net income/(expenditure)<br />

before net gains/(losses) on investments<br />

(42,913) 411,036<br />

Actuarial gains / (losses)<br />

on defined benefit pension schemes<br />

519,000 (1,916,000)<br />

Net movement in funds 476,087 (1,504,964)<br />

Total funds brought forward (4,441,661) (2,718,898)<br />

Total funds carried forward (3,965,574) (4,441,661)<br />

28<br />

29