WHATGIVES Summer 2018

CCF\'s Newsletter, What Gives? - Summer 2018 Edition

CCF\'s Newsletter, What Gives? - Summer 2018 Edition

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Brian Hussain, CCF’s Longtime<br />

Financial Steward<br />

After 23 years of leading the Foundation’s explosive growth in assets, Vice<br />

President of Finance and Chief Investment Officer Brian Hussain retired in<br />

May. When he started with CCF in 1995, Anita Zucker was the Board Chair, Ruth<br />

Heffron was the Executive Director and the Foundation had just reached $10<br />

million in assets and was sustaining $1 million in annual grantmaking. Fast<br />

forward two decades and CCF has surpassed $250 million in assets and $18<br />

million in annual grantmaking. (We mapped just a handful of other significant<br />

Foundation milestones under Brian’s leadership, to the right.)<br />

MILESTONES UNDER BRIAN’S LEADERSHIP<br />

1996 The Jewish Endowment Fund, Inc. (JEF) is begun as a partnership<br />

with the Charleston Jewish Federation with several<br />

endowments created by local families.<br />

1998 The Beaufort Fund is created with an anonymous<br />

multi-million-dollar gift from a Beaufort family for charitable<br />

work in Beaufort, Colleton, Hampton and Jasper<br />

counties. Total lifetime grantmaking will exceed $1.6<br />

million this year, and more than 100 nonprofits have<br />

benefited over the past six years.<br />

The Saul Alexander Foundation, one of the region’s oldest<br />

and most generous private foundations (since 1952)<br />

becomes an affiliate of CCF.<br />

Greatest one-year leap in managed assets – from $17.9 to<br />

$36.7 million.<br />

2000 Tony and Linda Bakker give $6.5 million (second largest gift<br />

in CCF history) to create the Bakker Family Fund.<br />

2003 $33 million bequest creates CCF affiliate, the Frances<br />

P. Bunnelle Foundation, to support nonprofit groups in<br />

Georgetown County.<br />

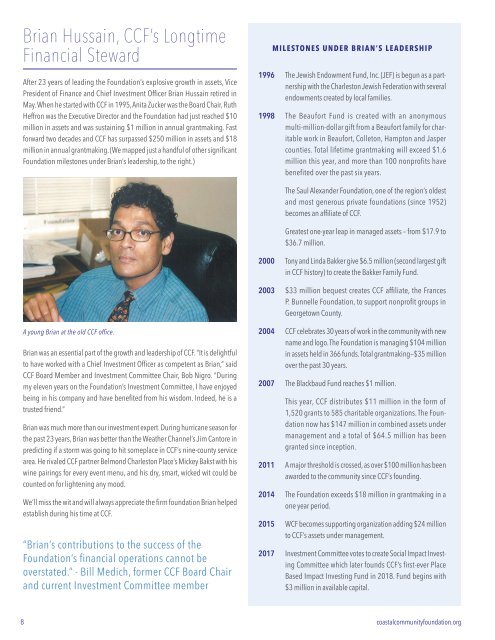

A young Brian at the old CCF office.<br />

Brian was an essential part of the growth and leadership of CCF. “It is delightful<br />

to have worked with a Chief Investment Officer as competent as Brian,” said<br />

CCF Board Member and Investment Committee Chair, Bob Nigro. “During<br />

my eleven years on the Foundation’s Investment Committee, I have enjoyed<br />

being in his company and have benefited from his wisdom. Indeed, he is a<br />

trusted friend.”<br />

Brian was much more than our investment expert. During hurricane season for<br />

the past 23 years, Brian was better than the Weather Channel’s Jim Cantore in<br />

predicting if a storm was going to hit someplace in CCF’s nine-county service<br />

area. He rivaled CCF partner Belmond Charleston Place’s Mickey Bakst with his<br />

wine pairings for every event menu, and his dry, smart, wicked wit could be<br />

counted on for lightening any mood.<br />

We’ll miss the wit and will always appreciate the firm foundation Brian helped<br />

establish during his time at CCF.<br />

“Brian’s contributions to the success of the<br />

Foundation’s financial operations cannot be<br />

overstated.” - Bill Medich, former CCF Board Chair<br />

and current Investment Committee member<br />

2004 CCF celebrates 30 years of work in the community with new<br />

name and logo. The Foundation is managing $104 million<br />

in assets held in 366 funds. Total grantmaking—$35 million<br />

over the past 30 years.<br />

2007 The Blackbaud Fund reaches $1 million.<br />

This year, CCF distributes $11 million in the form of<br />

1,520 grants to 585 charitable organizations. The Foundation<br />

now has $147 million in combined assets under<br />

management and a total of $64.5 million has been<br />

granted since inception.<br />

2011 A major threshold is crossed, as over $100 million has been<br />

awarded to the community since CCF’s founding.<br />

2014 The Foundation exceeds $18 million in grantmaking in a<br />

one year period.<br />

2015 WCF becomes supporting organization adding $24 million<br />

to CCF’s assets under management.<br />

2017 Investment Committee votes to create Social Impact Investing<br />

Committee which later founds CCF’s first-ever Place<br />

Based Impact Investing Fund in <strong>2018</strong>. Fund begins with<br />

$3 million in available capital.<br />

8 coastalcommunityfoundation.org