2018-Report-AW-3 copy

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

16. Pensions<br />

Help the Aged Final Salary Scheme continued<br />

17. Related party transactions<br />

There are no related party’s transactions during the year.<br />

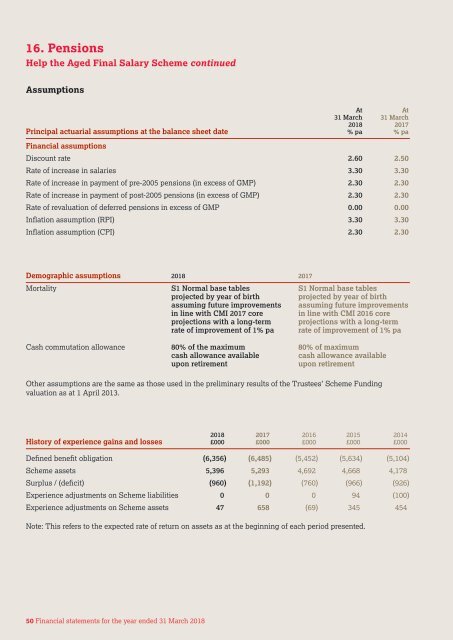

Assumptions<br />

At<br />

At<br />

31 March 31 March<br />

Principal actuarial assumptions at the balance sheet date<br />

<strong>2018</strong> 2017<br />

% pa % pa<br />

Financial assumptions<br />

Discount rate 2.60 2.50<br />

Rate of increase in salaries 3.30 3.30<br />

Rate of increase in payment of pre-2005 pensions (in excess of GMP) 2.30 2.30<br />

Rate of increase in payment of post-2005 pensions (in excess of GMP) 2.30 2.30<br />

Rate of revaluation of deferred pensions in excess of GMP 0.00 0.00<br />

Inflation assumption (RPI) 3.30 3.30<br />

Inflation assumption (CPI) 2.30 2.30<br />

18. Operating lease commitments<br />

Total future lease commitments under operating leases are as follows for each of the following periods:<br />

Property / office lease<br />

Equipment / vehicle<br />

2017/18 2016/17 2017/18 2016/17<br />

International offices £000 £000 £000 £000<br />

Less than one year 144 186 1 5<br />

One to five years 44 105 0 0<br />

Over five years 0 0 0 0<br />

188 291 1 5<br />

Demographic assumptions <strong>2018</strong> 2017<br />

Mortality S1 Normal base tables S1 Normal base tables<br />

projected by year of birth<br />

projected by year of birth<br />

assuming future improvements assuming future improvements<br />

in line with CMI 2017 core in line with CMI 2016 core<br />

projections with a long-term projections with a long-term<br />

rate of improvement of 1% pa rate of improvement of 1% pa<br />

Cash commutation allowance 80% of the maximum 80% of maximum<br />

cash allowance available<br />

cash allowance available<br />

upon retirement<br />

upon retirement<br />

Other assumptions are the same as those used in the preliminary results of the Trustees’ Scheme Funding<br />

valuation as at 1 April 2013.<br />

Property / office lease<br />

2017/18 2016/17<br />

London office £000 £000<br />

Less than one year 52 52<br />

One to five years 196 248<br />

Over five years 0 0<br />

248 300<br />

This figure relates to the UK office which is leased from Age UK at a commercial rent of £52,288 per annum.<br />

The lease expires on 15 December 2022 and can be terminated at six months’ notice.<br />

<strong>2018</strong>. 2017. 2016. 2015. 2014.<br />

History of experience gains and losses £000. £000. £000. £000. £000.<br />

Ethiopia country team outside their office in<br />

Addis Ababa. Anteneh Teshome/HelpAge International<br />

Defined benefit obligation (6,356) (6,485) (5,452) (5,634) (5,104)<br />

Scheme assets 5,396. 5,293. 4,692. 4,668. 4,178.<br />

Surplus / (deficit) (960) (1,192) (760) (966) (926)<br />

Experience adjustments on Scheme liabilities 0. 0. 0. 94. (100)<br />

Experience adjustments on Scheme assets 47. 658. (69) 345. 454.<br />

Note: This refers to the expected rate of return on assets as at the beginning of each period presented.<br />

50 Financial statements for the year ended 31 March <strong>2018</strong> 51