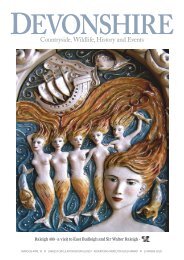

Devonshire magazine November December 2018

Devon's countryside, wildlife, history and events! Including a massive Christmas section with events and gift ideas from across the county and our Shop Local scheme.

Devon's countryside, wildlife, history and events!

Including a massive Christmas section with events and gift ideas from across the county and our Shop Local scheme.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

MANAGING your MONEY<br />

"the hardest thing in the world<br />

to understand is income tax"<br />

Albert Einstein<br />

Celebrating 26 years of<br />

providing independent<br />

financial advice in Devon<br />

Stalling longevity<br />

and its impact on the pension world<br />

Helen Mulvaney<br />

BA (Hons), Dip M, DipPFS<br />

Proprietor of<br />

RICHMOND INDEPENDENT<br />

We seem to have got very used to the ever growing life<br />

expectancy rates which have been used, particularly by<br />

government, over the last decade or so, to convince us that we need<br />

to pick up our state retirement pensions a lot later.<br />

However, over recent years, the<br />

increase in life expectancy seems<br />

to have stalled*. The reasons for<br />

this are difficult to pin-point as<br />

there seem to be multiple factors<br />

causing this slowdown. Not least,<br />

that deaths from dementia and<br />

Alzheimer** related complications<br />

are on the rise and these have<br />

off-set the gains from other<br />

serious illnesses, such as cancer<br />

and heart problems. Diabetes is<br />

also possibly going to make an<br />

increasing impact with diagnosis<br />

of this disease trebling for men<br />

and women over the last 20 years<br />

and storing up problems for the<br />

future. This is also a disease which<br />

will have a devastating impact on<br />

the NHS as its management can<br />

be very expensive. The UK is not<br />

alone in experiencing slowing life<br />

expectancy with many developed<br />

countries in the same position.<br />

Slowing life expectancy has had a<br />

number of implications especially<br />

for annuity providers and trustees<br />

and corporate sponsors of final<br />

salary schemes. Many have had<br />

to revisit their projections. For<br />

final salary schemes this has<br />

represented a bit of relief and<br />

possible reduction in anticipated<br />

costs, whilst big insurance<br />

companies with large annuity<br />

books are probably going to be<br />

Slowing life<br />

expectancy has<br />

had a number of<br />

implications<br />

more profitable and able to release<br />

some reserves. Although the effect<br />

of slowing mortality rates may take<br />

some time to filter through. For<br />

those looking at buying an annuity,<br />

the situation has improved as their<br />

retirement savings may go a little<br />

further. This is likely to continue<br />

over the next few years , unless<br />

there's a substantial pick up in life<br />

expectancy.<br />

The recent improvements in<br />

annuity rates have been due mainly<br />

to improving gilt yields, but they<br />

are probably still historically low.<br />

However, as factors such as life<br />

expectancy and interest rates<br />

develop it is possible that buying<br />

an annuity will become more<br />

attractive in the future. Those in<br />

good health have probably not<br />

benefited too much from recent<br />

annuity increases because more<br />

retirees are taking advantage<br />

of medical underwriting and<br />

therefore those who are fit and<br />

healthy will get worse rates. If<br />

you want a guaranteed income<br />

for your lifetime then here's a<br />

reminder that shopping round the<br />

market for an annuity will nearly<br />

always be beneficial (unless there<br />

is a high guaranteed annuity rate<br />

attaching to your pension policy).<br />

Therefore it's worthwhile getting<br />

some independent advice on this<br />

matter. For clients in drawdown, we<br />

regularly consider how annuities<br />

compare and how much income<br />

Helen has been advising<br />

clients in the East Devon<br />

for the past 26 years and<br />

specialises in the provision<br />

of retirement and<br />

investment advice.<br />

richmondindependent.co.uk<br />

helen@richmond-ifa.com<br />

01395 512166<br />

might be produced from an annuity<br />

at our regular reviews. This helps<br />

clients to focus on merits of taking<br />

a guaranteed income as opposed to<br />

taking income from a drawdown<br />

pension. Stockmarkets have been<br />

volatile recently and may become<br />

increasingly volatile as we head<br />

towards Brexit and it's important<br />

that retirees should also remain<br />

aware of the investment risk and<br />

sequencing risks that are part of<br />

drawdown plans.<br />

Helen Mulvaney<br />

* Source Office of National Statistics<br />

** reasons for stalling longevity FT<br />

Adviser 04/10/<strong>2018</strong><br />

Richmond Independent is a trading name of<br />

Investment & Financial Solutions Partnership<br />

LLP which is authorised and regulated by the<br />

Financial Conduct Authority<br />

The Old Vet’nary<br />

continued from page 93<br />

domesticity to the feline full.<br />

Although she will go out and enjoy<br />

her territory, she makes it clear that<br />

unless the weather is perfect, she<br />

would rather stay in with us. She<br />

is the most intelligent of the three<br />

and has developed many quirks of<br />

habit. She will only drink from a tap<br />

and lets us know when she is thirsty.<br />

At night she sleeps in the kitchen<br />

for she would otherwise give us no<br />

overnight peace. I have to announce<br />

“It’s time for Bed” and she appears<br />

for her nightly head scratch before<br />

making her way to the kitchen. She<br />

loves routine and her favourite foods<br />

are mayonnaise and mashed potato.<br />

She is full of life, but I would be less<br />

than honest if I said she was an angel.<br />

Some time in those early few weeks<br />

of life when she was like a sponge<br />

soaking up habits, good and bad,<br />

someone taught her a game which<br />

involved attacking hands or ankles.<br />

Nothing we have tried has cured her.<br />

As she can also open doors, it can<br />

get tedious.<br />

Yet of all her habits, one is the most<br />

charming. It is my old fashioned way,<br />

after a meal, to get up and give my<br />

wife a kiss. Wherever she may be<br />

in the house this cat miraculously<br />

appears on the table and as I bend<br />

down I feel a wet kiss on my cheek<br />

as she joins in the general love-in.<br />

Her name is Tigger. - Ken<br />

98<br />

Countryside, History, Walks, the Arts, Events & all things Devon at: DEVONSHIRE <strong>magazine</strong>.co.uk