Why 1031 Exchange Investments Colorado is the best deal for property owners

Do you know why 1031 Exchange Investment Colorado is the best opportunity to maximize their profits for property owners? It is indeed the best deal but if you need convincing, we created this power slide deck for you. Check out why you should invest in 1031 exchange investment in Colorado!

Do you know why 1031 Exchange Investment Colorado is the best opportunity to maximize their profits for property owners? It is indeed the best deal but if you need convincing, we created this power slide deck for you. Check out why you should invest in 1031 exchange investment in Colorado!

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

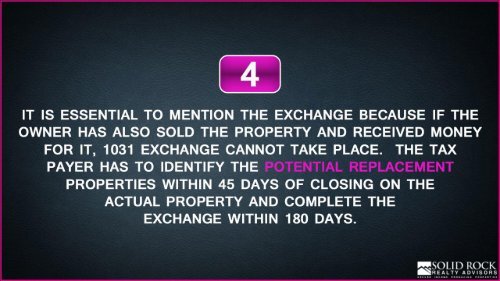

• It <strong>is</strong> essential to mention <strong>the</strong> exchange because if <strong>the</strong> owner has also<br />

sold <strong>the</strong> <strong>property</strong> and received money <strong>for</strong> it, <strong>1031</strong> exchange cannot<br />

take place. The tax payer has to identify <strong>the</strong> potential replacement<br />

properties within 45 days of closing on <strong>the</strong> actual <strong>property</strong> and<br />

complete <strong>the</strong> exchange within 180 days.