You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Christopher Wood christopher.wood@clsa.com +852 2600 8516<br />

Private sector capex accounted for 62% of total fixed asset investment in the first 10 months of<br />

2018. By contrast, residential property investment and infrastructure investment accounted for 13%<br />

and 26% of total investment.<br />

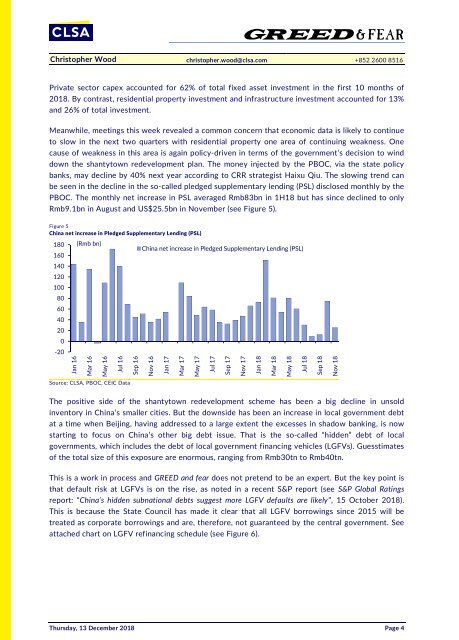

Meanwhile, meetings this week revealed a common concern that economic data is likely to continue<br />

to slow in the next two quarters with residential property one area of continuing weakness. One<br />

cause of weakness in this area is again policy-driven in terms of the government’s decision to wind<br />

down the shantytown redevelopment plan. The money injected by the PBOC, via the state policy<br />

banks, may decline by 40% next year according to CRR strategist Haixu Qiu. The slowing trend can<br />

be seen in the decline in the so-called pledged supplementary lending (PSL) disclosed monthly by the<br />

PBOC. The monthly net increase in PSL averaged Rmb83bn in 1H18 but has since declined to only<br />

Rmb9.1bn in August and US$25.5bn in November (see Figure 5).<br />

Figure 5<br />

China net increase in Pledged Supplementary Lending (PSL)<br />

180<br />

160<br />

(Rmb bn)<br />

China net increase in Pledged Supplementary Lending (PSL)<br />

140<br />

120<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

-20<br />

Jan 16<br />

Mar 16<br />

May 16<br />

Jul 16<br />

Sep 16<br />

Nov 16<br />

Jan 17<br />

Mar 17<br />

May 17<br />

Jul 17<br />

Sep 17<br />

Nov 17<br />

Jan 18<br />

Mar 18<br />

May 18<br />

Jul 18<br />

Sep 18<br />

Nov 18<br />

Source: CLSA, PBOC, CEIC Data<br />

The positive side of the shantytown redevelopment scheme has been a big decline in unsold<br />

inventory in China’s smaller cities. But the downside has been an increase in local government debt<br />

at a time when Beijing, having addressed to a large extent the excesses in shadow banking, is now<br />

starting to focus on China’s other big debt issue. That is the so-called “hidden” debt of local<br />

governments, which includes the debt of local government financing vehicles (LGFVs). Guesstimates<br />

of the total size of this exposure are enormous, ranging from Rmb30tn to Rmb40tn.<br />

This is a work in process and GREED and fear does not pretend to be an expert. But the key point is<br />

that default risk at LGFVs is on the rise, as noted in a recent S&P report (see S&P Global Ratings<br />

report: “China’s hidden subnational debts suggest more LGFV defaults are likely”, 15 October 2018).<br />

This is because the State Council has made it clear that all LGFV borrowings since 2015 will be<br />

treated as corporate borrowings and are, therefore, not guaranteed by the central government. See<br />

attached chart on LGFV refinancing schedule (see Figure 6).<br />

Thursday, 13 December 2018 Page 4