EQ. Magazine Summer Issue 2019

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Q&A<br />

LENDER SPOTLIGHT<br />

MIKE JAYNES,<br />

PRESIDENT OF HALL<br />

STRUCTURED FINANCE<br />

SAYS HSF IS SLATED<br />

TO LEND OUT $400<br />

MILLION IN <strong>2019</strong><br />

WRITTEN BY Daniel Hilpert<br />

PHOTOGRAPHY BY HALL Group<br />

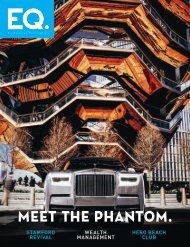

RENDERING OF 284-KEY, DUAL-FLAG ALOFT (144 KEYS) /<br />

ELEMENT (140 EXTENDED STAY KEYS) HOTEL IN ORLANDO, FL<br />

High<br />

VOLUME<br />

UNDER THE UMBRELLA OF DALLAS-BASED HALL<br />

GROUP, founded by Craig Hall, HALL Structured Finance<br />

(HSF) is a direct lender that focuses on providing non-recourse,<br />

fi rst lien construction loans for commercial real estate<br />

projects across the U.S. HSF was the #1 non-bank hotel construction<br />

lender in the country in 2018. HSF works to provide<br />

alternative fi nancing solutions for high-quality projects that<br />

cannot meet their fi nancing needs through a traditional bank<br />

lending platform. Daniel Hilpert, Publisher of <strong>EQ</strong> interviewed<br />

Mike Jaynes, President of HALL Structured Finance about<br />

markets to watch, recent transactions and what’s next for HSF.<br />

What sets Hall Structured Finance apart from other hotel<br />

lenders?<br />

Mike Jaynes: We set ourselves apart from other lenders by<br />

offering non-recourse terms, flexible underwriting standards,<br />

fast execution and up to 75% LTC. Another differentiator is that<br />

our parent company HALL Group is a real estate developer, so<br />

we bring internal expertise in development and construction to<br />

our clients.<br />

What is the overall vision of founder Craig Hall? Where does<br />

he want to take the business?<br />

Craig Hall would like to find ways to integrate new technologies<br />

into our lending program, such as AI that can assist with due<br />

diligence. HSF is a big focus for the company. HALL Group is<br />

also involved in the ownership, management and development<br />

of real estate, financial lending, angel investing and winemaking.<br />

In fact, Craig is a New York Times best-selling author and<br />

he just published his seventh book, titled BOOM: Bridging the<br />

Opportunity Gap to Reignite Startups.<br />

Which markets does Hall currently like—where are you<br />

comfortable investing? How do you feel about New York<br />

City with respect to the hospitality industry and other major<br />

markets such as Miami and LA?<br />

We are targeting good opportunities in all primary and strong<br />

secondary markets across the country. We provided $20 million<br />

in construction financing for an EVEN Hotel in Miami, which just<br />

recently had its grand opening, and we have also financed several<br />

hotels in submarkets surrounding LA. We have an interest<br />

in NYC, and have done loans in the past, but we haven’t found a<br />

38<br />

<strong>EQ</strong>. SUMMER <strong>2019</strong> ISSUE equicapmag.com