Insurance Guide for Online

The Insurance Careers guide to the Insurance Profession is produced in partnership with the Chartered Insurance Institute (CII). Within, the guide is broken down into the following chapters: The Profession Finding the Right Job Intern Profiles Graduate Profiles Senior Profiles The Institute and Qualifications There then follows an Employer A-Z and Job Finder table giving an overview of company facts and job deadlines.

The Insurance Careers guide to the Insurance Profession is produced in partnership with the Chartered Insurance Institute (CII).

Within, the guide is broken down into the following chapters:

The Profession

Finding the Right Job

Intern Profiles

Graduate Profiles

Senior Profiles

The Institute and Qualifications

There then follows an Employer A-Z and Job Finder table giving an overview of company facts and job deadlines.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

FINANCIAL LINES DEVELOPMENT<br />

UNDERWRITER<br />

ZURICH<br />

GRADUATE PROFILES<br />

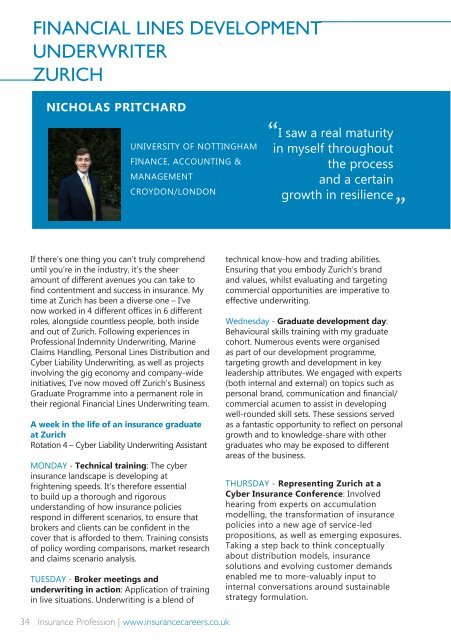

NICHOLAS PRITCHARD<br />

UNIVERSITY OF NOTTINGHAM<br />

FINANCE, ACCOUNTING &<br />

MANAGEMENT<br />

CROYDON/LONDON<br />

“I saw a real maturity<br />

in myself throughout<br />

the process<br />

and a certain<br />

growth in resilience<br />

”<br />

FRIDAY<br />

Project-focussed day: A combination of<br />

cyber-specific projects and projects involving<br />

the wider Zurich community. From a cyberperspective,<br />

this included the delivery of an<br />

impact analysis <strong>for</strong> a switch in underwriting<br />

rating tools. More generally, during this<br />

stage of my role as a Zurich graduate, I was<br />

also involved in a project that centred on<br />

increasing awareness of different areas of the<br />

business, in order to remove communication<br />

barriers and to improve idea-sharing to foster<br />

innovative mind-sets.<br />

of different friends and family – you’ll find<br />

that they’ve all had different interviewing<br />

experiences and so ask you a wide array of<br />

questions from a number of perspectives, which<br />

should help your preparation <strong>for</strong> interviews (be<br />

they video or telephone) or assessment days.<br />

For the latest graduate jobs:<br />

www.insurancecareers.co.uk/jobs<br />

If there’s one thing you can’t truly comprehend<br />

until you’re in the industry, it’s the sheer<br />

amount of different avenues you can take to<br />

find contentment and success in insurance. My<br />

time at Zurich has been a diverse one – I’ve<br />

now worked in 4 different offices in 6 different<br />

roles, alongside countless people, both inside<br />

and out of Zurich. Following experiences in<br />

Professional Indemnity Underwriting, Marine<br />

Claims Handling, Personal Lines Distribution and<br />

Cyber Liability Underwriting, as well as projects<br />

involving the gig economy and company-wide<br />

initiatives, I’ve now moved off Zurich’s Business<br />

Graduate Programme into a permanent role in<br />

their regional Financial Lines Underwriting team.<br />

A week in the life of an insurance graduate<br />

at Zurich<br />

Rotation 4 – Cyber Liability Underwriting Assistant<br />

MONDAY - Technical training: The cyber<br />

insurance landscape is developing at<br />

frightening speeds. It’s there<strong>for</strong>e essential<br />

to build up a thorough and rigorous<br />

understanding of how insurance policies<br />

respond in different scenarios, to ensure that<br />

brokers and clients can be confident in the<br />

cover that is af<strong>for</strong>ded to them. Training consists<br />

of policy wording comparisons, market research<br />

and claims scenario analysis.<br />

TUESDAY - Broker meetings and<br />

underwriting in action: Application of training<br />

in live situations. Underwriting is a blend of<br />

technical know-how and trading abilities.<br />

Ensuring that you embody Zurich’s brand<br />

and values, whilst evaluating and targeting<br />

commercial opportunities are imperative to<br />

effective underwriting.<br />

Wednesday - Graduate development day:<br />

Behavioural skills training with my graduate<br />

cohort. Numerous events were organised<br />

as part of our development programme,<br />

targeting growth and development in key<br />

leadership attributes. We engaged with experts<br />

(both internal and external) on topics such as<br />

personal brand, communication and financial/<br />

commercial acumen to assist in developing<br />

well-rounded skill sets. These sessions served<br />

as a fantastic opportunity to reflect on personal<br />

growth and to knowledge-share with other<br />

graduates who may be exposed to different<br />

areas of the business.<br />

THURSDAY - Representing Zurich at a<br />

Cyber <strong>Insurance</strong> Conference: Involved<br />

hearing from experts on accumulation<br />

modelling, the trans<strong>for</strong>mation of insurance<br />

policies into a new age of service-led<br />

propositions, as well as emerging exposures.<br />

Taking a step back to think conceptually<br />

about distribution models, insurance<br />

solutions and evolving customer demands<br />

enabled me to more-valuably input to<br />

internal conversations around sustainable<br />

strategy <strong>for</strong>mulation.<br />

You can’t truly comprehend...<br />

the sheer amount of<br />

avenues you can take to find<br />

contentment<br />

and success in insurance<br />

What was the application process like – any<br />

advice?<br />

I found the Zurich application process to be<br />

very similar to other financial service schemes.<br />

As expected, it was multi-staged, and whilst,<br />

at the time I was dreading the thought of<br />

expending so much ef<strong>for</strong>t in something where<br />

the chances of success were so slim, it should<br />

be treated as a journey. Whilst that sounds<br />

incredibly cheesy, until you’ve gone through<br />

the process of evaluating your strengths and<br />

weaknesses and demonstrating your ability to<br />

act upon these, the likelihood is that you aren’t<br />

yet ready to work in a demanding environment<br />

that places great responsibility on you from<br />

the get-go. I saw a real maturity in myself<br />

throughout the process and a certain growth<br />

in resilience.<br />

In terms of advice, practice makes perfect. It<br />

may make you feel uncom<strong>for</strong>table, but test<br />

your interviewing capabilities with a number<br />

What skills are useful in this profession?<br />

Obviously, you could end up in any number<br />

of different roles – to name a few: actuarial<br />

analyst, market underwriter, marketing<br />

ambassador, portfolio manager, claims<br />

handler, project manager, operational<br />

consultant, data consultant – and each role<br />

will carry different requirements in skill-sets.<br />

However, some traits are universally<br />

important. Adaptability is vital when<br />

working in such an integrated environment<br />

that continues to grow in diversity – at some<br />

point, you will undoubtedly be exposed<br />

to differing managerial styles, customer<br />

groups, brokers, internal teams working<br />

at changing intensities. Holistic thinking<br />

is essential as it will enable you to make<br />

crucial links between your role and how<br />

this interacts with wider strategy of your<br />

business unit and company.<br />

Additionally, it can aid your responses in<br />

a number of tricky situations – dealing<br />

with a disgruntled customer, entering into<br />

negotiations and presentation delivery.<br />

Finally, the ability to appropriately identify<br />

and seize opportunities – this will not only<br />

make you indispensable to your team, but<br />

from a purely selfish perspective, can lead<br />

to the opening of many doors. •<br />

34 <strong>Insurance</strong> Profession | www.insurancecareers.co.uk<br />

<strong>Insurance</strong> Profession | www.insurancecareers.co.uk<br />

35