Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

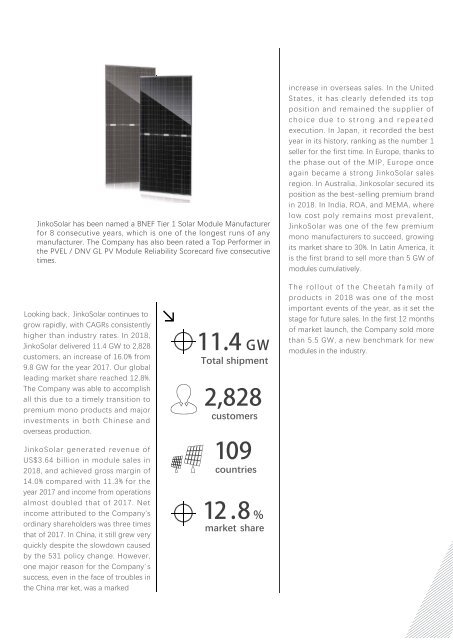

JinkoSolar has been named a BNEF Tier 1 Solar Module Manufacturer<br />

for 8 consecutive years, which is one of the longest runs of any<br />

manufacturer. The Company has also been rated a Top Performer in<br />

the PVEL / DNV GL PV Module Reliability Scorecard five consecutive<br />

times.<br />

increase in overseas sales. In the United<br />

States, it has clearly defended its top<br />

position and remained the supplier of<br />

choice due to strong and repeated<br />

execution. In Japan, it recorded the best<br />

year in its history, ranking as the number 1<br />

seller for the first time. In Europe, thanks to<br />

the phase out of the MIP, Europe once<br />

again became a strong JinkoSolar sales<br />

region. In Australia, <strong>Jinkosolar</strong> secured its<br />

position as the best-selling premium brand<br />

in 2018. In India, ROA, and MEMA, where<br />

low cost poly remains most prevalent,<br />

JinkoSolar was one of the few premium<br />

mono manufacturers to succeed, growing<br />

its market share to 30%. In Latin America, it<br />

is the first brand to sell more than 5 GW of<br />

modules cumulatively.<br />

Looking back, JinkoSolar continues to<br />

grow rapidly, with CAGRs consistently<br />

higher than industry rates. In 2018,<br />

JinkoSolar delivered 11.4 GW to 2,828<br />

customers, an increase of 16.0% from<br />

9.8 GW for the year 2017. Our global<br />

leading market share reached 12.8%.<br />

The Company was able to accomplish<br />

all this due to a timely transition to<br />

premium mono products and major<br />

investments in both Chinese and<br />

overseas production.<br />

JinkoSolar generated revenue of<br />

US$3.64 billion in module sales in<br />

2018, and achieved gross margin of<br />

14.0% compared with 11.3% for the<br />

year 2017 and income from operations<br />

almost doubled that of 2017. Net<br />

income attributed to the Company's<br />

ordinary shareholders was three times<br />

that of 2017. In China, it still grew very<br />

quickly despite the slowdown caused<br />

by the 531 policy change. However,<br />

one major reason for the Company’s<br />

success, even in the face of troubles in<br />

the China mar ket, was a marked<br />

<br />

Total shipment<br />

<br />

customers<br />

<br />

countries<br />

<br />

market share<br />

The rollout of the Cheetah family of<br />

products in 2018 was one of the most<br />

important events of the year, as it set the<br />

stage for future sales. In the first 12 months<br />

of market launch, the Company sold more<br />

than 5.5 GW, a new benchmark for new<br />

modules in the industry.