Sonder Annual Report 2018/19

A highlight of Sonder's achievements from the previous financial year

A highlight of Sonder's achievements from the previous financial year

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

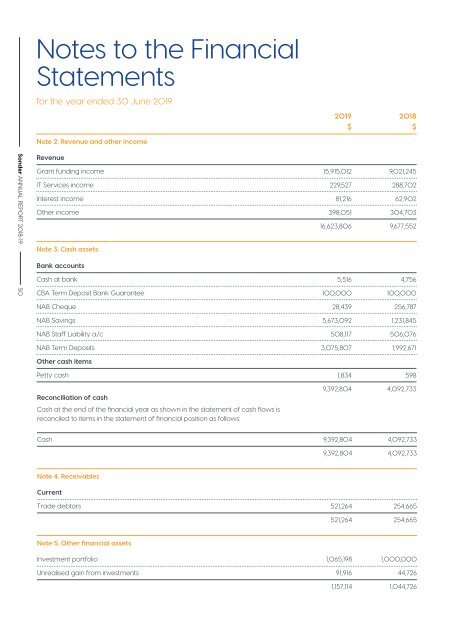

Notes to the Financial<br />

Statements<br />

for the year ended 30 June 20<strong>19</strong><br />

20<strong>19</strong><br />

$<br />

<strong>2018</strong><br />

$<br />

20<strong>19</strong><br />

$<br />

<strong>2018</strong><br />

$<br />

Note 2. Revenue and other income<br />

Note 6. Other current assets<br />

<strong>Sonder</strong> ANNUAL REPORT <strong>2018</strong>-<strong>19</strong> 50<br />

Revenue<br />

Grant funding income<br />

IT Services income<br />

Interest income<br />

Other income<br />

Note 3. Cash assets<br />

Bank accounts<br />

Cash at bank<br />

CBA Term Deposit Bank Guarantee<br />

NAB Cheque<br />

NAB Savings<br />

15,915,012<br />

229,527<br />

81,216<br />

398,051<br />

16,623,806<br />

5,516<br />

100,000<br />

28,439<br />

5,673,092<br />

9,021,245<br />

288,702<br />

62,902<br />

304,703<br />

9,677,552<br />

4,756<br />

100,000<br />

256,787<br />

1,231,845<br />

Prepayments<br />

Other<br />

Note 7. Property, plant and equipment<br />

Motor vehicles<br />

At cost<br />

Less: accumulated depreciation<br />

Computer equipment<br />

At cost<br />

Less: accumulated depreciation<br />

41,172<br />

40,022<br />

200<br />

200<br />

41,372<br />

40,222<br />

34,6<strong>19</strong><br />

34,6<strong>19</strong><br />

(34,6<strong>19</strong>)<br />

(31,6<strong>19</strong>)<br />

<strong>19</strong>7,508<br />

(9,875)<br />

187,632 3,000<br />

NAB Staff Liability a/c<br />

508,117<br />

506,076<br />

Note 8. Payables<br />

NAB Term Deposits<br />

Other cash items<br />

Petty cash<br />

Reconciliation of cash<br />

Cash at the end of the financial year as shown in the statement of cash flows is<br />

reconciled to items in the statement of financial position as follows:<br />

3,075,807<br />

1,834<br />

9,392,804<br />

1,992,671<br />

598<br />

4,092,733<br />

Unsecured<br />

Trade creditors<br />

Other creditors<br />

Committed Funds<br />

306,428<br />

178,326<br />

2,700,332<br />

3,185,086<br />

133,251<br />

144,470<br />

484,464<br />

762,185<br />

Cash 9,392,804<br />

Note 4. Receivables<br />

Current<br />

9,392,804<br />

Trade debtors 521,264<br />

Note 5. Other financial assets<br />

Investment portfolio<br />

Unrealised gain from investments<br />

521,264<br />

1,065,<strong>19</strong>8<br />

91,916<br />

1,157,114<br />

4,092,733<br />

4,092,733<br />

254,665<br />

254,665<br />

1,000,000<br />

44,726<br />

1,044,726<br />

Note 9. Borrowings<br />

Current<br />

Unsecured<br />

Credit Cards 15,368<br />

15,368<br />

Note 10. Tax liabilities<br />

Current<br />

GST clearing<br />

609,495<br />

Amounts withheld from salary and wages<br />

150,704<br />

760,<strong>19</strong>9<br />

17,481<br />

17,481<br />

125,893<br />

122,746<br />

248,639<br />

<strong>Sonder</strong> ANNUAL REPORT <strong>2018</strong>-<strong>19</strong> 51