A breakup of the euro provides the best hope for a durable recovery ...

A breakup of the euro provides the best hope for a durable recovery ...

A breakup of the euro provides the best hope for a durable recovery ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

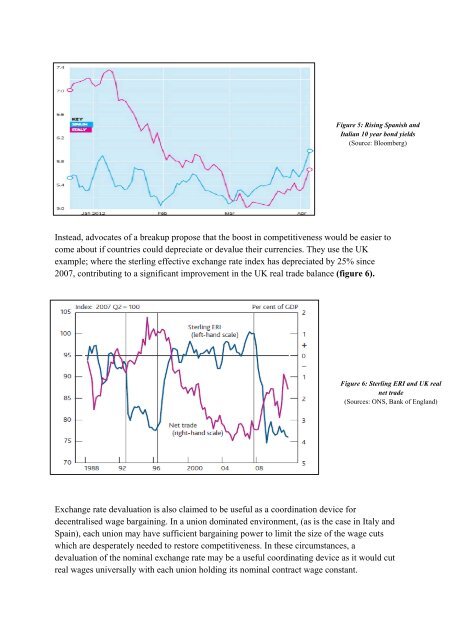

Figure 5: Rising Spanish and<br />

Italian 10 year bond yields<br />

(Source: Bloomberg)<br />

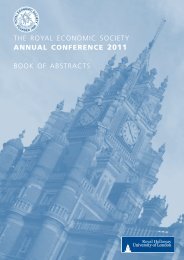

Instead, advocates <strong>of</strong> a <strong>breakup</strong> propose that <strong>the</strong> boost in competitiveness would be easier to<br />

come about if countries could depreciate or devalue <strong>the</strong>ir currencies. They use <strong>the</strong> UK<br />

example; where <strong>the</strong> sterling effective exchange rate index has depreciated by 25% since<br />

2007, contributing to a significant improvement in <strong>the</strong> UK real trade balance (figure 6).<br />

Figure 6: Sterling ERI and UK real<br />

net trade<br />

(Sources: ONS, Bank <strong>of</strong> England)<br />

Exchange rate devaluation is also claimed to be useful as a coordination device <strong>for</strong><br />

decentralised wage bargaining. In a union dominated environment, (as is <strong>the</strong> case in Italy and<br />

Spain), each union may have sufficient bargaining power to limit <strong>the</strong> size <strong>of</strong> <strong>the</strong> wage cuts<br />

which are desperately needed to restore competitiveness. In <strong>the</strong>se circumstances, a<br />

devaluation <strong>of</strong> <strong>the</strong> nominal exchange rate may be a useful coordinating device as it would cut<br />

real wages universally with each union holding its nominal contract wage constant.