South African Business 2021

Welcome to the ninth edition of the South African Business journal. First published in 2011, the publication has established itself as the premier business and investment guide to South Africa. This issue has a focus on economic recovery plans which have been put in place to tackle the challenges thrown up by the global Covid-19 pandemic. National government’s focus on infrastructure and the use of Special Economic Zones is highlighted, together with a feature on the nascent maritime economy. Regular pages cover all the main economic sectors of the South African economy and give a snapshot of each of the country’s provincial economies. South African Business is complemented by nine regional publications covering the business and investment environment in each of South Africa’s provinces. The e-book editions can be viewed online at www.globalafricanetwork.com.

Welcome to the ninth edition of the South African Business journal. First published in 2011, the publication has established itself as the premier business and investment guide to South Africa.

This issue has a focus on economic recovery plans which have been put in place to tackle the challenges thrown up by the global Covid-19 pandemic. National government’s focus on infrastructure and the use of Special Economic Zones is highlighted, together with a feature on the nascent maritime economy. Regular pages cover all the main economic sectors of the South African economy and give a snapshot of each of the country’s provincial economies.

South African Business is complemented by nine regional publications covering the business and investment environment in each of South Africa’s provinces. The e-book editions can be viewed online at www.globalafricanetwork.com.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

SOUTH AFRICAN<br />

BUSINESS<br />

<strong>2021</strong> EDITION<br />

THE GUIDE TO BUSINESS AND INVESTMENT<br />

IN SOUTH AFRICA<br />

JOIN US ONLINE<br />

WWW.GLOBALAFRICANETWORK.COM | WWW.SOUTHAFRICANBUSINESS.CO.ZA

1<br />

0<br />

1<br />

1<br />

0<br />

1<br />

1<br />

0<br />

1<br />

BUY LOCAL<br />

INVEST LOCAL<br />

0<br />

11<br />

1<br />

1<br />

0<br />

1<br />

0<br />

11<br />

0<br />

11<br />

1<br />

1<br />

0<br />

1<br />

0<br />

11<br />

0<br />

11<br />

1<br />

1<br />

0<br />

1<br />

0<br />

11<br />

Let’s come together and heal as a nation.<br />

Let’s focus on Renewing, Restoring and Rebuilding<br />

successful partnerships and investment opportunities so we<br />

can get back to promoting our city as the ideal destination<br />

for business and pleasure to the rest of the world.<br />

Your support coupled with our world-class infrastructure,<br />

innovative business environment and ever evolving<br />

investment opportunities, means we can get back to<br />

‘connecting continents’ in no time.<br />

1<br />

1<br />

0<br />

1<br />

0<br />

11<br />

1<br />

1<br />

0<br />

1<br />

1<br />

1<br />

0<br />

1<br />

0<br />

11<br />

0<br />

11<br />

Tel: +27 31 311 4227<br />

Email: invest@durban.gov.za<br />

web: invest.durban<br />

1

0<br />

0<br />

11<br />

1<br />

0<br />

1<br />

0<br />

11<br />

0<br />

0<br />

11<br />

1<br />

0<br />

1<br />

0<br />

11<br />

The city of<br />

Durban (eThekwini<br />

Municipality) is <strong>South</strong><br />

Africa’s second most<br />

important economic<br />

region<br />

01<br />

1<br />

1<br />

1<br />

0<br />

1<br />

01<br />

1<br />

1<br />

1<br />

0<br />

1<br />

Extensive first-world<br />

road, rail, sea and air<br />

0<br />

11<br />

01<br />

0<br />

11<br />

1<br />

0<br />

11<br />

01<br />

0<br />

11<br />

1<br />

0<br />

01<br />

00<br />

1<br />

001<br />

11<br />

0<br />

0<br />

01<br />

0<br />

11<br />

0<br />

11<br />

00<br />

1 0<br />

01<br />

1<br />

0<br />

3<br />

0<br />

11<br />

1<br />

0<br />

1<br />

0<br />

11<br />

1<br />

1<br />

0<br />

1<br />

0<br />

11<br />

1<br />

0<br />

3<br />

0<br />

11<br />

1<br />

0<br />

1<br />

0<br />

11<br />

1<br />

1<br />

0<br />

1<br />

Dube<br />

TradePort<br />

and King<br />

Shaka<br />

International 1<br />

Airport - 60-<br />

year Master<br />

Plan - driving<br />

growth of<br />

aerotropolis,<br />

or airport<br />

city<br />

0<br />

11<br />

001<br />

11<br />

01<br />

00<br />

Rated in top 5<br />

‘Quality of Living’<br />

cities in Africa and<br />

Middle East by<br />

Mercer Consulting in<br />

2015<br />

Named one of the<br />

New 7 Wonders Cities<br />

by the Swiss-based<br />

New 7 Wonders<br />

Foundation in 2014<br />

1<br />

01<br />

00<br />

1<br />

0<br />

01<br />

00<br />

1

Coega fast-tracking<br />

economic recovery<br />

Cecilia Makiwane Hospital is a large,<br />

provincial, government-funded hospital<br />

situated in the Mdantsane township<br />

of East London, Eastern Cape.<br />

Coega’s expertise in Infrastructure Project Management will help <strong>South</strong> Africa fast-track<br />

economic recovery amid the Covid-19 pandemic.<br />

The Coega Development Corporation (CDC),<br />

developer and operator of the number-one<br />

Special Economic Zone (SEZ) on the <strong>African</strong><br />

continent, namely the Coega SEZ, provides<br />

expertise in the fast and efficient delivery of minor and<br />

mega complex infrastructure development projects<br />

in <strong>South</strong> Africa and the rest of the <strong>African</strong> continent.<br />

The CDC has a 20-year proven record in infrastructure<br />

development and facilities maintenance.<br />

“We can assist all government departments to<br />

fast-track the implementation of their infrastructure<br />

projects, amid the coronavirus pandemic challenges,<br />

to stimulate the local economy, lift local SMMEs,<br />

and create job opportunities.<br />

“We are the infrastructure implementing agency<br />

of choice in the country because of our cuttingedge<br />

customised solutions, international best<br />

practices and methodology. Coega has ISO-certified<br />

systems and processes that guarantee<br />

the effective delivery of the projects<br />

within scope, time and budget. We<br />

can even save our clients money through<br />

our project accounting solutions. Our<br />

record of unqualified audit opinion<br />

by the Auditor General of <strong>South</strong> Africa<br />

on our projects speak for itself,” said<br />

Dr Ayanda Vilakazi, CDC’s Head of<br />

Marketing, Brand and Communications.<br />

Lusikisiki Village Clinic opened by<br />

the President of <strong>South</strong> Africa, HE Cyril<br />

Ramaphosa, in 2019.

The CDC’s Infrastructure Project<br />

Management Services include:<br />

• Project methodology and system.<br />

• Development of reporting and monitoring<br />

services.<br />

Nolitha Kingsburgh Clinic Primary opened School, by the Honourable Premier<br />

• Stakeholder analysis and engagement<br />

of Lovu the Town, Eastern KwaZulu-Natal.<br />

Nolitha Clinic op<br />

Cape, Lubabalo Oscar Mabuyane,<br />

programmes.<br />

of the Eastern C<br />

on 22 November 2019.<br />

• Integrated planning and budgeting.<br />

Eastern Cape Departments of Health. Furthermore, on 22 Novembe<br />

• Development of business plans.<br />

the CDC has worked with other clients outside of<br />

• Procurement of service providers and required these Furthermore, departments to fast-track the CDC the implementation has worked<br />

Nolitha Clinic opened Furthermor by Hon<br />

equipment.<br />

of their with projects. other These clients include, outside among others, of these<br />

of the Eastern Cape, with Lubabalo other O<br />

• On-the-job training and contractor development. Mpumalanga departments Economic Growth to on 22 fast-track Agency<br />

November<br />

(MEGA), the<br />

• Human capital solutions.<br />

Northern Cape Development Agency (NCEDA) department<br />

2019.<br />

implementation of their projects;<br />

and<br />

• Post-implementation monitoring and facilities Richards Bay SEZ.<br />

implementa<br />

these include, Furthermore, amongst others,<br />

maintenance.<br />

On the <strong>African</strong> continent, the CDC is taking these<br />

CDC incl<br />

Mpumalanga Economic full advantage of inter-Africa with trade, other which clients Growth<br />

Mpumalang<br />

has outs<br />

The CDC’s infrastructure project expertise and strategic<br />

solutions are utilised by various government Continental Development Free Trade Agency Area implementation (AfCFTA) (NCEDA), agreement and<br />

Developmen of th<br />

Agency (MEGA),<br />

been made possible by the departments Northern Cape<br />

signing of the <strong>African</strong><br />

Agency to fas ef (M<br />

departments and the private sector, locally and in by Richards <strong>African</strong> countries Bay to promote SEZ. these greater On the include, economic <strong>African</strong><br />

w<br />

INFRASTRUCTURE the rest of the <strong>African</strong> continent. DEVELOPMENT<br />

Richards amon B<br />

INFRASTRUCTURE integration continent, DEVELOPMENT<br />

across the continent. CDC Mpumalanga<br />

To is this taking end, the full<br />

PROJECTS: Our clients (left) include, Cecilia among Makiwane others, the Hospital<br />

Eastern CDC’s International <strong>Business</strong> under Coega Africa<br />

continent, Econom ca<br />

PROJECTS: (left) advantage Cecilia Makiwane of the - Cape a large, and provincial, KwaZulu-Natal government-funded<br />

Agency Hospital Inter-Africa (MEGA), trade,<br />

Departments of Basic Programme is managing the implementation advantage Nor<br />

of<br />

- a large, provincial, which government-funded<br />

has been th<br />

hospital Education, situated Eastern Cape in the and Mdantsane National Departments<br />

township<br />

Development made possible by<br />

infrastructure projects in Zimbabwe, Central <strong>African</strong> which Agency has (<br />

hospital situated the in signing the Mdantsane of the of Public East London, Works and Eastern Infrastructure, Cape and in <strong>South</strong> National Africa;<br />

and Republic and Cameroon, among Richards township Africa Free<br />

other countries. Bay Trade<br />

the ■SEZ. signing On<br />

INFRASTRUCTURE of East DEVELOPMENT<br />

London, Agreement Eastern Cape by in <strong>South</strong> <strong>African</strong> S<br />

(right) and the Kingsburgh Primary School -<br />

continent, Africa; countries the to<br />

Agreement CDC is<br />

PROJECTS: (left) (right) Cecilia and Makiwane the<br />

Lovu Town - in KwaZulu-Natal.<br />

promote Kingsburgh Hospital greater Primary economic School - integration<br />

La Mercy Maths, Science and Technology (MST) Academy advantage in KwaZulu-Natal. of the Inter au<br />

- a large, provincial, Lovu government-funded<br />

Town - in across KwaZulu-Natal.<br />

promote gre<br />

Coega is an Infrastructure Implementing Agency. the continent. which To has this end, been the<br />

hospital situated in the Mdantsane CDC’s township<br />

across made the c<br />

International the <strong>Business</strong> signing under<br />

of<br />

of East London, Eastern Cape Coega in <strong>South</strong> Africa;<br />

CDC’s of the Inter Afric<br />

Programme Agreement is managing<br />

(right) and the Kingsburgh Primary School -<br />

Coega by <strong>African</strong><br />

sp<br />

the implementation of infrastructure<br />

Lovu Town - in KwaZulu-Natal.<br />

promote greater the implem econom<br />

projects in Zimbabwe, across Central the continent. <strong>African</strong><br />

projects in<br />

VTo<br />

Z<br />

Republic, and Cameroon, CDC’s International amongst<br />

Republic, Bu<br />

other countries.<br />

Ba<br />

Lusikisiki Village Clinic opened by the President<br />

Coega Africa other Programm count<br />

of <strong>South</strong> Africa, H.E. Cyril Ramaphosa,<br />

Lusikisiki on 17<br />

Village Clinic opened by the the President implementation of i<br />

September 2019.<br />

of <strong>South</strong> Africa, H.E. Cyril Ramaphosa, on 17<br />

projects in Zimbabwe, C<br />

September 2019.<br />

Republic, and Camero Th<br />

For more information on the CDC’s Project Management Services,<br />

other countries.<br />

M<br />

For please more contact information our<br />

Lusikisiki on expert<br />

Village For the CDC’s in Infrastructure<br />

Clinic more opened information by Project Management Project<br />

the President on the CDC’s Project Managem<br />

Management,<br />

of <strong>South</strong> Africa, H.E. Cyril Ramaphosa, on 17<br />

Services, Mr. Chuma please Mbande INFRASTRUCTURE<br />

please contact<br />

contact on:<br />

our expert in Infrastructure<br />

DEVELOPMENT<br />

our expert in Infrastructure Project M<br />

September 2019. Mr. Chuma Mbande on:<br />

•<br />

Project Management, PROJECTS: Mr Chuma Mbande. La Mercy Maths, Science<br />

For more information on the CDC’s Project Management Services<br />

and<br />

please<br />

Technology<br />

contact our<br />

(MST)<br />

expert in<br />

Academy<br />

Infrastructure<br />

in<br />

Email: chuma.mbande@coega.co.za<br />

Project Management •<br />

Tel:<br />

KwaZulu-Natal.<br />

+27 Mr. 43 Chuma 711 1600 Mbande Coega on: is an Infrastructure<br />

Fax: +27 43 721 0210<br />

E-mail: chuma.mbande@coega.co.za<br />

Telephone: +27 43 711 1600<br />

E-mail: chuma.mbande@coega.co.za<br />

Implementing Agency.<br />

BBBEE LEVEL 2 CONTRIBUTOR<br />

Fax: +27 43 721 0210<br />

Telephone: +27 43 711 1600 ISO 9001:2015 ISO 14001:2015 ISO 45001:2018<br />

PRETORIA OFFICE<br />

Fax: +27 43 721 0210<br />

ISO 20000-1:2011 ISO 27001:2013<br />

•<br />

PRETORIA Address: OFFICE: 145 Herbert Road, East Wood,<br />

145 Herbert Road, East Wood, Arcadia,<br />

PRETORIA OFFICE:<br />

www.coega.co.za<br />

Pretoria, Arcadia, 0083<br />

Pretoria 0083<br />

145 Herbert Road, East Wood, Arcadia, •<br />

Telephone: Tel: +27 12 +27 451 12 8300 451 8300<br />

Pretoria, 0083<br />

The Coega E-mail: Development chuma.mbande@coega.co.za<br />

Telephone: +27 12 451 Corporation<br />

8300<br />

Telephone: +27 43 711 1600<br />

•<br />

BBB<br />

Fax: +27 43 721 0210<br />

ISO 9001:201

CONTENTS<br />

CONTENTS<br />

<strong>South</strong> <strong>African</strong> <strong>Business</strong> <strong>2021</strong> Edition<br />

Introduction<br />

Foreword 8<br />

A unique guide to business and investment in <strong>South</strong> Africa.<br />

Special features<br />

An economic overview of <strong>South</strong> Africa 10<br />

Building a more sustainable future while reducing debt will<br />

require great skill from the country’s leaders.<br />

Provinces of <strong>South</strong> Africa 16<br />

A snapshot of <strong>South</strong> Africa’s nine provinces.<br />

Building infrastructure is a<br />

presidential priority 22<br />

Projects worth R340-billion have been gazetted<br />

for implementation.<br />

The Maritime Economy offers blue<br />

water opportunities 32<br />

Contribution to GDP could rise to R177-billion by 2033.<br />

Economic sectors<br />

Agriculture 40<br />

Berry production is up as exports rise.<br />

Mining 44<br />

Exploration is the next frontier.<br />

Energy 56<br />

Solar and wind projects are regularly coming onstream.<br />

ICT 61<br />

Data centres are booming.<br />

Oil, gas and petrochemicals 62<br />

Exploration for gas off the south-eastern coast is hotting up.<br />

SOUTH AFRICAN BUSINESS <strong>2021</strong><br />

4

SABS_SA-Bus.Journal_09/2020<br />

SABS - 75 Years of dedication to Quality Compliance<br />

The <strong>South</strong> <strong>African</strong> Bureau of Standards supports the industrialisation effort of the dtic.<br />

SABS has an established network of national, regional and international partners that<br />

develop technical solutions adopted as <strong>South</strong> <strong>African</strong> National Standards (SANS), this<br />

in return enables business and government to:<br />

Improve the quality of products and services<br />

Enhance competitiveness and access to markets<br />

Ensure that procurement of products and services meet quality standards<br />

Improve the delivery of services underpinned by best practice<br />

and support policy and regulatory objectives<br />

SABS provides services to assist the implementation of best practice solutions<br />

• More than 7000 <strong>South</strong> <strong>African</strong> National Standards<br />

• Laboratory Testing Services for a diverse range of Products<br />

• Certification of Companies to Management System Standards<br />

• Certification of Products and the Application of the SABS Mark Scheme<br />

• Training of Management and Employees on Implementations of SANS<br />

• Local Content Verification for <strong>South</strong> <strong>African</strong> manufacturing industry<br />

SABS a Trusted Partner in Delivering Quality Assurance.<br />

Contact SABS to establish support for your Standardisation,<br />

Testing, Training and Certification Aspirations.

CONTENTS<br />

Water 66<br />

Infrastructure spending will have to be consistently high.<br />

Engineering 70<br />

Many engineering groups are selling off assets.<br />

Construction and property 72<br />

Logistics property is strongly placed for growth.<br />

Manufacturing 74<br />

TFG plans to double manufacturing capacity..<br />

Food and beverages 76<br />

Starch mills are changing hands.<br />

Automotive 78<br />

The automotive sector makes up a third of<br />

<strong>South</strong> Africa’s manufacturing capacity.<br />

Transport and logistics 80<br />

Decongestion of ports is a priority.<br />

Tourism and events 82<br />

The MICE sector faces special challenges.<br />

Banking and financial services 84<br />

Investors are getting behind fintech.<br />

Development finance and SMME support 86<br />

A new fund aims to make R5-billion available at a fair price.<br />

References<br />

Key sector contents 38<br />

Overviews of the main economic sectors of <strong>South</strong> Africa.<br />

Index 88<br />

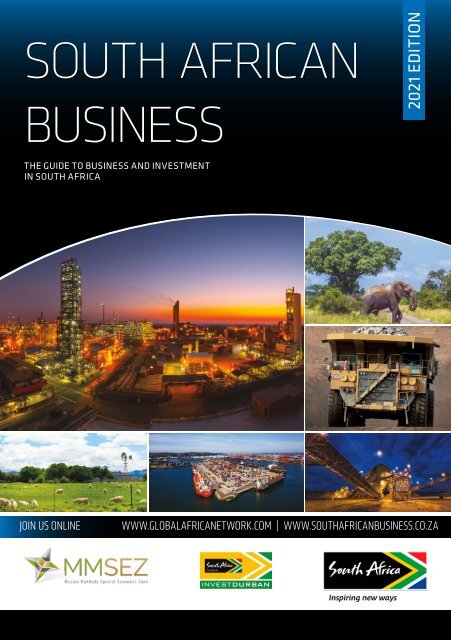

ABOUT THE COVER:<br />

Sasol One at Sasolburg was established in<br />

1950 and converted from coal gasification<br />

in 2004. It now uses more efficient natural<br />

gas in its production processes of products<br />

such as ammonia, ammonium nitrate,<br />

catalyst, ethylene, mining chemicals,<br />

phenolics, solvents and wax. With more<br />

than 25 000 employees, Sasol is a global<br />

integrated chemicals and energy company<br />

active in 33 countries.<br />

SOUTH AFRICAN BUSINESS <strong>2021</strong><br />

6

FOCUS<br />

FOCUS<br />

reliability The reliability of forehead of forehead infrared infrared<br />

thermometers in <strong>South</strong> in Africa <strong>South</strong> Africa<br />

blic can check The public with the can National check with Metrology the National Institute Metrology of <strong>South</strong> Institute Africa. of <strong>South</strong> Africa.<br />

e screening The of people screening using non-contact of people using The non-contact National Metrology The National Institute Metrology of <strong>South</strong> Institute of <strong>South</strong><br />

hermometers has thermometers become one of has the become Africa one (NMISA), of the has established Africa (NMISA), a platform has established where a a platform where a<br />

any striking images many to come striking out images of the to come Team of out Experts, of the representing Team of Experts, the relevant representing public the relevant public<br />

ovid-19 crisis in <strong>South</strong> Covid-19 Africa. crisis in <strong>South</strong> Africa. entities as well as private entities calibration as well as laboratories,<br />

private calibration laboratories,<br />

d (forehead) Infrared thermometers (forehead) are thermometers widely are able are to widely review and are able provide to review reliable and responses provide reliable responses<br />

creen people used for to high screen fever, people one for of the high fever, to topical one temperature of the to topical screening temperature related questions. screening related questions.<br />

s of the coronavirus, symptoms of to the identify coronavirus, people to identify A video people on temperature A video screening on temperature is available screening is available<br />

be infected that thereby may be reducing infected the thereby risk reducing and the the Team risk of Experts and the can Team be of contacted Experts can at: be contacted at:<br />

ing the virus of spreading workplaces, the virus schools in workplaces, and www.nmisa.org/Pages/Temperature.aspx.<br />

schools and www.nmisa.org/Pages/Temperature.aspx.<br />

as. Since an public elevated areas. temperature Since an elevated does temperature does<br />

lusively indicate not conclusively a Covid-19 indicate infection, a Covid-19 About infection, NMISA About NMISA<br />

edical evaluation further medical is necessary evaluation to is Mandated necessary by to the Measurement<br />

Mandated by the Measurement<br />

if a person determine is infected. if a person is infected. Units and Measurement<br />

Units and Measurement<br />

Standards Act, 2006, Standards NMISA Act, 2006, NMISA<br />

provides for the accuracy provides and for the accuracy and<br />

international recognition international of recognition of<br />

local measurement local results. measurement results.<br />

This enables trade, This component enables trade, component<br />

manufacturing, legal manufacturing, acceptance legal acceptance<br />

of measurement of results measurement for results for<br />

law enforcement, law accurate enforcement, accurate<br />

measurement in environment<br />

measurement in environment<br />

and safety, and is and crucial safety, for and is crucial for<br />

healthcare. healthcare.<br />

NMISA is part of the NMISA Department is of of the Trade, Department of Trade,<br />

Industry and Competition’s Industry (the and dtic) Competition’s family of the (the dtic) family of the<br />

Technical Infrastructure Technical (TI) Institutes, Infrastructure which (TI) also Institutes, which also<br />

includes the <strong>South</strong> includes <strong>African</strong> Bureau the <strong>South</strong> of Standards <strong>African</strong> Bureau of Standards<br />

ver, many questions However, have many been questions raised by have (SABS), been raised National by (SABS), Regulator National for Compulsory Regulator for Compulsory<br />

s about the businesses reliability of about the measurement<br />

the reliability of the Specification measurement (NRCS) Specification and the <strong>South</strong> (NRCS) <strong>African</strong> and the <strong>South</strong> <strong>African</strong><br />

btained results from such obtained thermometers. from such thermometers.<br />

National Accreditation National System Accreditation (SANAS) that System (SANAS) that<br />

ctors influence Several the factors accuracy influence of these<br />

accuracy together of provide these for together confidence provide in local for goods confidence and in local goods and<br />

ment results, measurement including results, the type including of products the type and allows of products for successful and allows prosecution for successful in prosecution in<br />

t used, the instrument accuracy of used, the thermometer accuracy of the cases thermometer of non-compliance. cases of ■non-compliance. ■<br />

through (obtained calibration), through the measurement<br />

calibration), the measurement<br />

followed, procedure ambient conditions, followed, ambient etc. conditions, etc.<br />

details Contact details<br />

12 841 4152Tel: + 27 12 841 4152<br />

fo@nmisa.org Email: info@nmisa.org<br />

: www.nmisa.org Website: www.nmisa.org<br />

RICAN BUSINESS<br />

SOUTH AFRICAN <strong>2021</strong> BUSINESS <strong>2021</strong>56<br />

56

FOREWORD<br />

<strong>South</strong> <strong>African</strong> <strong>Business</strong><br />

A unique guide to business and investment in <strong>South</strong> Africa.<br />

Credits<br />

Publishing director:<br />

Chris Whales<br />

Editor: John Young<br />

Managing director: Clive During<br />

Online editor: Christoff Scholtz<br />

Designer: Simon Lewis<br />

Production: Lizel Olivier<br />

Ad sales:<br />

Gavin van der Merwe<br />

Sam Oliver<br />

Jeremy Petersen<br />

Gabriel Venter<br />

Vanessa Wallace<br />

Shiko Diala<br />

Administration & accounts:<br />

Charlene Steynberg<br />

Kathy Wootton<br />

Printing: FA Print<br />

Welcome to the ninth edition of the <strong>South</strong><br />

<strong>African</strong> <strong>Business</strong> journal. First published in<br />

2011, the publication has established itself<br />

as the premier business and investment<br />

guide to <strong>South</strong> Africa, supported by an e-book edition at<br />

www.southafricanbusiness.co.za.<br />

This issue has a focus on economic recovery plans which<br />

have been put in place to tackle the challenges thrown up<br />

by the global Covid-19 pandemic. National government’s<br />

focus on infrastructure and the use of Special Economic<br />

Zones is highlighted, together with a feature on the nascent<br />

maritime economy. Regular pages cover all the main<br />

economic sectors of the <strong>South</strong> <strong>African</strong> economy and give<br />

a snapshot of each of the country’s provincial economies.<br />

<strong>South</strong> <strong>African</strong> <strong>Business</strong> is complemented by nine regional<br />

publications covering the business and investment<br />

environment in each of <strong>South</strong> Africa’s provinces. The e-book<br />

editions can be viewed online at www.globalafricanetwork.<br />

com. These unique titles are supported by a monthly<br />

business e-newsletter with a circulation of over 23 000.<br />

In 2020, the inaugural <strong>African</strong> <strong>Business</strong> joined the Global<br />

<strong>African</strong> Network stable of publications. ■<br />

Chris Whales<br />

Publisher, Global Africa Network Media | Email: chris@gan.co.za<br />

DISTRIBUTION<br />

<strong>South</strong> <strong>African</strong> <strong>Business</strong> is distributed internationally on outgoing<br />

and incoming trade missions, through trade and investment<br />

agencies; to foreign offices in <strong>South</strong> Africa’s main trading<br />

partners around the world; at top national and international<br />

events; through the offices of foreign representatives in<br />

<strong>South</strong> Africa; as well as nationally and regionally via chambers<br />

of commerce, tourism offices, airport lounges, provincial<br />

government departments, municipalities and companies.<br />

COPYRIGHT | <strong>South</strong> <strong>African</strong> <strong>Business</strong> is an independent publication<br />

published by Global Africa Network Media (Pty) Ltd. Full copyright to<br />

the publication vests with Global Africa Network Media (Pty) Ltd.<br />

No part of the publication may be reproduced in any form without<br />

the written permission of Global Africa Network Media (Pty) Ltd.<br />

PHOTO CREDITS | Africamps at Ingwe, Amatola Water, AngloAmerican,<br />

Betterect,Buckler’s Africa Lodge, Council for Geoscience, Data Centre<br />

Map, De Beers Group, ELIDZ, Equites, 5M2T, Fortress Fund, Implats,<br />

Khobab Wind Farm, Nissan, Perdekraal East Wind Farm, Port of Cape<br />

SOUTH AFRICAN BUSINESS <strong>2021</strong><br />

Town, SA Furniture Forum, SA Heavy Haul Association, SANRAL, SASOL,<br />

THEGIFT777/iStock, TNPA, Tongaat Hulett, Utopia_88/iStock.<br />

.<br />

DISCLAIMER | While the publisher, Global Africa Network Media (Pty) Ltd,<br />

has used all reasonable efforts to ensure that the information contained in<br />

<strong>South</strong> <strong>African</strong> <strong>Business</strong> is accurate and up-to-date, the publishers make no<br />

representations as to the accuracy, quality, timeliness, or completeness of<br />

the information. Global Africa Network will not accept responsibility for any<br />

loss or damage suffered as a result of the use of or any reliance placed on<br />

such information.<br />

8<br />

PUBLISHED BY<br />

Global Africa Network Media (Pty) Ltd<br />

Company Registration No: 2004/004982/07<br />

Directors: Clive During, Chris Whales<br />

Physical address: 28 Main Road, Rondebosch 7700<br />

Postal address: PO Box 292, Newlands 7701<br />

Tel: +27 21 657 6200 | Fax: +27 21 674 6943<br />

Email: info@gan.co.za | Website: www.gan.co.za<br />

Member of the Audit Bureau<br />

of Circulations ISSN 2221-4194

Early engagement with<br />

the private sector is vital<br />

INTERVIEW<br />

Jason Lightfoot, Portfolio Manager at Futuregrowth, assesses the latest moves to<br />

attract the private sector to invest in infrastructure.<br />

What is constraining infrastructure investment in <strong>South</strong> Africa?<br />

The concern is that a lot of noise has been made previously around<br />

government’s infrastructure plans which have in few instances<br />

resulted in real opportunities for investors to play a role. Many of these<br />

issues have been around policy certainty and also ensuring that such<br />

projects actually reach a level of bankability for such investors to make<br />

an investment that will offer a proper risk-adjusted return. Perhaps this<br />

time is different with the recent engagement with the private sector.<br />

Jason Lightfoot<br />

BIOGRAPHY<br />

Jason is the Portfolio Manager of the<br />

flagship Futuregrowth Infrastructure<br />

& Development Bond Fund, as well<br />

as the Yield Enhanced ALBI benchmarked<br />

range of portfolios. In addition,<br />

he plays a mentoring role within<br />

the Credit team and is involved in<br />

various aspects of risk assessment<br />

within the investment process.<br />

Do you mean the Sustainable Infrastructure Development<br />

Symposium of <strong>South</strong> Africa (SIDSSA)?<br />

This is a step in the right direction. It crowds in potential private sector<br />

investors in a much more coordinated manner and includes them in<br />

assessing how these various initiatives can be funded.<br />

Why is gross fixed capital formation an important benchmark?<br />

This measure captures how much money as a proportion of total<br />

economic activity is being invested in capital goods, such as<br />

equipment, tools, transportation assets and electricity and various<br />

measurable outputs of these. The extent of infrastructure spending<br />

in an economy is reflected in the level of gross fixed capital formation<br />

(GFCF) as a percentage of Gross Domestic Product (GDP) which is an<br />

important precursor of economic growth.<br />

What can be learnt from the Renewable Energy Independent<br />

Power Producer Procurement Programme (REIPPPP)?<br />

Before capital market players invest, they need to have confidence<br />

that the policy environment is stable and that such potential<br />

investments will offer sufficiently attractive risk-related returns. To a<br />

great extent, the Renewable Energy Independent Power Producer<br />

Procurement Programme (REIPPPP) met these criteria, enabling the<br />

private sector to play an important role. REIPPPP is an important<br />

success story.<br />

Of the major infrastructure projects being discussed at the<br />

moment, which are the most significant?<br />

Energy generation remains of utmost importance in an environment<br />

where a massive strain on the system remains and the launch of<br />

Emergency Procurement round of up to 2000MW will address that. ■<br />

41 9<br />

SOUTH AFRICAN BUSINESS <strong>2021</strong>

AN ECONOMIC OVERVIEW OF<br />

SOUTH AFRICA<br />

Building a more sustainable future while reducing debt will require<br />

great skill from the country’s leaders.<br />

By John Young<br />

Build back better has become the new<br />

catchphrase. There is a lot of building to<br />

do for the <strong>South</strong> <strong>African</strong> economy after<br />

two recessions, a decade of looting of state<br />

resources and a health crisis that all but shut down<br />

the economy for several months.<br />

The Chief Executive Officer of the<br />

Johannesburg Stock Exchange, Leila Fourie,<br />

wrote in June 2020 that she wants to “contribute<br />

towards a better, fairer, more sustainable<br />

world” (<strong>Business</strong> Day). As co-chair of the Global<br />

Investors for Sustainable Development (GISD)<br />

Alliance, a grouping of banks, bourses and asset<br />

managers, Fourie has been working to promote<br />

investment in Covid-19 bonds, the Sustainable<br />

Development 500 fund and renewable energy.<br />

This kind of thinking informs many of the plans<br />

that were put forward by business, labour and<br />

political parties as the Covid-19 lockdown served<br />

to focus the minds of all <strong>South</strong> <strong>African</strong>s about the<br />

need to plot a better way forward. The National<br />

Economic Development and Labour Council<br />

(Nedlac) came up with an agreement which<br />

focussed on infrastructure investment, creating a<br />

supportive policy environment and the promotion<br />

of “strategic localisation” and exports. An umbrella<br />

business body, <strong>Business</strong> for SA (B4SA), identified<br />

12 initiatives which, if accompanied by policy<br />

reforms, would boost the economy significantly.<br />

The <strong>African</strong> National Congress (ANC) produced its<br />

own economic recovery document.<br />

Having consulted with all these bodies,<br />

President Cyril Ramaphosa on 15 October<br />

revealed government’s recovery plan. The<br />

Economic Reconstruction and Recovery Plan<br />

(EcoRRP) names infrastructure investment and<br />

building up the country’s manufacturing base as<br />

priorities. The plan intends to unlock R1-trillion in<br />

private investment. Furthermore, a commitment<br />

is made to improving the capability of the state<br />

SOUTH AFRICAN BUSINESS <strong>2021</strong><br />

10

SPECIAL FEATURE<br />

and to remove barriers to doing business or<br />

investing in the country.<br />

Soon afterwards, Finance Minister Tito<br />

Mboweni announced the medium-term budget<br />

policy statement where the most significant<br />

promise related to reducing the state’s wage<br />

bill. Mboweni is a former Reserve Bank Governor<br />

and Labour Minister. The President is a former<br />

miner and trade unionist. Both men have been<br />

engaged for years in drafting the economic policy<br />

of the ANC but it remains to be seen if they can<br />

persuade the unions representing workers in the<br />

public sector to accept a three-year freeze on<br />

wage increases. This will be a major test because<br />

<strong>South</strong> Africa’s debt to GDP ratio is high. The cost of<br />

servicing debt is equal to nearly 14% of revenue.<br />

A step that President Ramaphosa took in<br />

July did not receive many headlines, but his<br />

amendment of the regulations governing the<br />

enquiry into state capture made a big difference<br />

to the work of the National Prosecuting Authority<br />

(NPA). Enabled by the amendment to work with<br />

the evidence presented to the commission,<br />

prosecutors quickly finalised cases and arrests<br />

started happening. After a decade in which<br />

it seemed that immunity was guaranteed for<br />

corrupt officials and employees of state-owned<br />

enterprises, the tide started to turn.<br />

Prosecutions obviously do not provide<br />

certainty against future corruption, but at least<br />

the prospect of arrest might be a deterrent. One<br />

of the biggest obstacles to economic recovery<br />

is <strong>South</strong> Africa’s level of debt, and that is caused<br />

largely by the state electricity utility, Eskom,<br />

where corruption was rife for years.<br />

The government’s directory lists 131 stateowned<br />

entities but there are said to be about 700<br />

altogether, at various levels of government. The<br />

three biggest, all of which fall under the Department<br />

of Public Enterprises, are Eskom, <strong>South</strong> <strong>African</strong><br />

Airways (SAA) and Transnet, with five large divisions<br />

covering ports, railways and logistics. Eskom and<br />

SAA are significant drains on the country’s finances<br />

and getting control of all of the country’s SOEs is<br />

another major priority.<br />

Agriculture was one industry that saw<br />

some positives during the Covid-19 lockdown.<br />

Although sectors like wine suffered badly, a<br />

reported increase in maize exports, as well as<br />

greater international demand for citrus fruits and<br />

pecan nuts, helped the industry expand by 15%<br />

(StatsSA). Grain crops such as maize, wheat, barley<br />

and soya beans are among the county’s most<br />

important crops. Only rice is imported. Wine, corn<br />

and sugar are other major exports.<br />

Basing economic growth on a devaluing<br />

currency is not always the best long-term method<br />

of boosting economic growth, but high-value<br />

agricultural exports and increased numbers of highspending<br />

international tourists hold some promise<br />

for helping to get the <strong>South</strong> <strong>African</strong> economy back<br />

on a growth path. Horticulture in particular is seen<br />

as holding great potential not only for increased<br />

earnings, but for creating jobs.<br />

New economic sectors<br />

Another new area that holds great potential for the<br />

<strong>South</strong> <strong>African</strong> economy is the Oceans Economy.<br />

<strong>South</strong> Africa has 3 000km of coastline and the<br />

extent of the country’s territorial waters is greater<br />

than its land size. And yet the country does not<br />

have a merchant marine fleet and only scrapes<br />

the surface in terms of the percentage of repair<br />

and maintenance of boats and oilrigs which could<br />

potentially bring work to its ports.<br />

The introduction of renewable energy into the<br />

<strong>South</strong> <strong>African</strong> energy market via the Renewable<br />

Energy Independent Power Producer Procurement<br />

Programme (REIPPPP) was successful but the<br />

programme stalled.<br />

Hopes were raised with the publication of<br />

a new Integrated Resource Plan (IRP) because<br />

investors crave certainty. The IRP is a road map<br />

for <strong>South</strong> Africa’s electricity generation and the<br />

previous administration seemed determined<br />

to push for an expensive nuclear programme.<br />

The latest plan confirms that the already hugely<br />

successful drive for renewable energy will be<br />

continued and expanded.<br />

<strong>South</strong> Africa’s traditional strength in minerals<br />

still holds good. Although gold mining is<br />

declining in volumes (even while prices rise), the<br />

major investment of Vedanta Zinc International<br />

in a project in the Northern Cape and Sibanye-<br />

11<br />

SOUTH AFRICAN BUSINESS <strong>2021</strong>

SPECIAL FEATURE<br />

New roads such as this link to the North West from Gauteng are important parts of infrastructural<br />

development. Credit: SANRAL<br />

Stillwater’s acquisition drive in the platinum group<br />

metals (PGM) sector are significant economic<br />

drivers. Coal and iron ore continue to be exported<br />

in large volumes through the Richards Bay<br />

Coal Terminal on the east coast and the Port of<br />

Saldanha on the west coast.<br />

Automotive manufacturing and automotive<br />

components continue to thrive, with large<br />

investments by most of the major marques and<br />

increased exports a feature of the sector. There<br />

has been inward investment in recent years, most<br />

notably by the Beijing Automotive International<br />

Corporation (BAIC) in the Coega Special Economic<br />

Zone outside Port Elizabeth. The Tshwane<br />

Automotive Special Economic Zone (TASEZ) has<br />

been launched at Silverton in Pretoria.<br />

A new SEZ has been formally declared in the<br />

northern part of Limpopo, the Musina-Makhado<br />

SEZ. The Namakwa SEZ in the Northern Cape<br />

is awaiting its licence, as is the Tubatse SEZ in<br />

eastern Limpopo.<br />

Geography<br />

<strong>South</strong> Africa’s location between the Atlantic and<br />

Indian oceans ensures a generally temperate<br />

climate. The 2 954km coastline stretches from the<br />

border with Namibia on the Atlantic to the border<br />

with Mozambique in the east. The cold Benguela<br />

current sweeps along the western coast while the<br />

warm Indian Ocean ensures that the Mozambique/<br />

Agulhas current is temperate.<br />

<strong>South</strong> Africa’s coastal plain is separated from<br />

the interior by several mountain ranges, most<br />

notably the Drakensberg which runs down the<br />

country’s eastern flank. Smaller ranges in the<br />

south and west mark the distinction between the<br />

fertile coastal strip and the dry interior known as<br />

the Karoo.<br />

The city of Johannesburg is located on the<br />

continental divide, whereby water runs south of<br />

the city towards the Atlantic Ocean while waters<br />

to the north drain towards the north and east.<br />

Johannesburg is 1 753m above sea-level.<br />

Most of the country has summer rainfall but<br />

the Western Cape, which has a Mediterranean<br />

climate, receives its rain in winter. Droughts<br />

are not uncommon and although the national<br />

average is 464mm, most of the country receives<br />

less than 500mm of rain every year. The Western<br />

Cape experienced a severe drought which was<br />

broken in 2018. The Orange and Vaal rivers play<br />

important roles in water schemes and irrigation<br />

and the Limpopo River defines the country’s<br />

northern boundary. ■<br />

SOUTH AFRICAN BUSINESS <strong>2021</strong><br />

12

10 REASONS<br />

WHY YOU SHOULD INVEST IN SOUTH AFRICA<br />

01.<br />

HOT EMERGING<br />

MARKET<br />

Growing middle class, affluent consumer<br />

base, excellent returns on investment.<br />

02.<br />

MOST DIVERSIFIED<br />

ECONOMY IN AFRICA<br />

<strong>South</strong> Africa (SA) has the most industrialised economy in Africa.<br />

It is the region’s principal manufacturing hub and a leading<br />

services destination.<br />

LARGEST PRESENCE OF MULTINATIONALS<br />

ON THE AFRICAN CONTINENT<br />

SA is the location of choice of multinationals in Africa.<br />

03.<br />

Global corporates reap the benefits of doing business in<br />

SA, which has a supportive and growing ecosystem as a<br />

hub for innovation, technology and fintech.<br />

05.<br />

FAVOURABLE ACCESS TO<br />

GLOBAL MARKETS<br />

ADVANCED FINANCIAL SERVICES<br />

& BANKING SECTOR<br />

SA has a sophisticated banking sector with a major<br />

footprint in Africa. It is the continent’s financial hub,<br />

with the JSE being Africa’s largest stock exchange by<br />

market capitalisation.<br />

The <strong>African</strong> Continental Free Trade Area will boost<br />

intra-<strong>African</strong> trade and create a market of over one<br />

billion people and a combined gross domestic product<br />

(GDP) of USD2.2-trillion that will unlock industrial<br />

development. SA has several trade agreements in<br />

place as an export platform into global markets.<br />

YOUNG, EAGER LABOUR FORCE<br />

09.<br />

SA has a number of world-class universities and colleges<br />

producing a skilled, talented and capable workforce. It<br />

boasts a diversified skills set, emerging talent, a large pool<br />

of prospective workers and government support for training<br />

and skills development.<br />

07.<br />

04.<br />

06.<br />

08.<br />

PROGRESSIVE<br />

CONSTITUTION<br />

& INDEPENDENT<br />

JUDICIARY<br />

SA has a progressive Constitution and an independent judiciary. The<br />

country has a mature and accessible legal system, providing certainty<br />

and respect for the rule of law. It is ranked number one in Africa for the<br />

protection of investments and minority investors.<br />

ABUNDANT NATURAL<br />

RESOURCES<br />

SA is endowed with an abundance of natural resources. It is the leading producer<br />

of platinum-group metals (PGMs) globally. Numerous listed mining companies<br />

operate in SA, which also has world-renowned underground mining expertise.<br />

WORLD-CLASS<br />

INFRASTRUCTURE<br />

AND LOGISTICS<br />

A massive governmental investment programme in infrastructure development<br />

has been under way for several years. SA has the largest air, ports and logistics<br />

networks in Africa, and is ranked number one in Africa in the World Bank’s<br />

Logistics Performance Index.<br />

10.<br />

SA offers a favourable cost of living, with a diversified cultural, cuisine and<br />

sports offering all year round and a world-renowned hospitality sector.<br />

EXCELLENT QUALITY<br />

OF LIFE<br />

Page | 2<br />

19<br />

SOUTH AFRICAN BUSINESS 2020

Why Invest<br />

in Space<br />

OUR IMPACT is derived from our national capacity, experience<br />

and expertise in space science and technology through six thematic focus areas:<br />

• Earth Observation - SANSA collects, assimilates and disseminates<br />

Earth observation data to support <strong>South</strong> Africa’s policy making,<br />

economic growth and sustainable development initiatives. Earth<br />

observation data is used for human settlement growth mapping,<br />

infrastructure monitoring, as well as disaster and water resource<br />

management. Earth observation satellite data contributes to<br />

monitoring environmental variables in the water cycle such as<br />

water quantity, quality, soil erosion and vegetative health which<br />

ensures water safety and security for the country.<br />

• Space Operations - SANSA provides global competitive space<br />

operations and applications, tracking, telemetry and command<br />

services while managing ground stations for international clients.<br />

Space Operations provides world class launch support for space<br />

missions (from Earth into our solar system) and ensures satellites<br />

are continuously monitored when they are travelling over <strong>African</strong><br />

skies.<br />

• Space Science - SANSA conducts cutting edge space science<br />

research, development and magnetic technology innovation.<br />

Space science research is vital for gaining a deeper understanding<br />

of our space environment in order to protect essential<br />

infrastructure such as power grids and communication and<br />

navigation systems on Earth and in space. SANSA operates the<br />

Space Weather Regional Warning Centre for Africa, providing<br />

forecasts and warnings on space weather conditions. Extreme<br />

space weather may impact technological systems such as<br />

satellites, power grids, avionics and radio communication.<br />

• Space Engineering – SANSA aims to provide access to state-ofthe-art<br />

satellite assembly, integration and testing services, as well<br />

as satellite systems coordination and development, to ensure<br />

an environment conducive to industrial participation in satellite<br />

programmes.<br />

• Human Capital Development - SANSA aims to advance human<br />

capital development to grow the knowledge economy and<br />

create awareness about opportunities in engineering, science and<br />

technology. This is achieved through scarce skills development,<br />

summer and winter schools, the supervision of MSc and PhD<br />

students, and teaching at partner universities.<br />

• Science Advancement and Public Engagement - SANSA<br />

promotes science advancement and public engagement through<br />

participation in national science awareness events and through<br />

using the fascination of space to drive a greater uptake of studies<br />

in science, maths, engineering and technology.

SANSA<br />

provides stateof-the-art<br />

ground<br />

station facilities and<br />

services including<br />

satellite tracking, launch<br />

support, mission<br />

control and space<br />

navigation.<br />

SANSA monitors<br />

the Earth’s magnetic<br />

field and space weather<br />

storms to assist in<br />

protecting technology<br />

on Earth and in space.<br />

Satellite imagery<br />

helps manage food<br />

and water security as<br />

well as natural disasters<br />

on Earth like floods,<br />

droughts and fires.<br />

In a country faced with numerous challenges in<br />

housing, crime, poverty and the provision of basic<br />

necessities, you may ask why invest in space?<br />

The answer is clear.<br />

Space investment is essential<br />

for economic sustainability<br />

and development!<br />

Without space applications we would not be able to mitigate<br />

disasters or effectively manage our resources such as water, food, land<br />

and housing. Mobile phones, internet, GPS, ATMs, meteorological<br />

forecasting and safe land and sea travel all rely on satellites positioned<br />

in space. Government, industry and academia also rely on space<br />

data to deliver on their priorities through the creation of applied<br />

knowledge, products and services.<br />

SANSA provides value-added products and services that are utilised<br />

in both space and non-space applications. Space information<br />

enables everyday decision making at all levels of society. SANSA has<br />

contributed towards goals within the National Development Plan<br />

(NDP) and the goals of the Department of Science and Technology<br />

(DST) by delivering products and services to its stakeholders and the<br />

public.<br />

<strong>South</strong> Africa’s next earth observation satellite is an example of one of<br />

these deliverables and is also one of the incredible opportunities to<br />

showcase the importance of investment in space science, engineering<br />

and technology and for <strong>South</strong> Africa to take its place in the global<br />

space arena.<br />

@SANSA7<br />

<strong>South</strong> <strong>African</strong> National Space Agency<br />

<strong>South</strong> <strong>African</strong> National Space Agency<br />

Enterprise Building, Mark Shuttleworth Street, Innovtion Hub, Pretoria, 0087<br />

T: 012 844 0500 | F: 012 844 0396 | information@sansa.org.za | www.sansa.org.za

SPECIAL FEATURE<br />

Provinces of <strong>South</strong> Africa<br />

A snapshot of <strong>South</strong> Africa’s nine provinces.<br />

Eastern Cape<br />

Capital: Bhisho<br />

Main towns: Port Elizabeth, East<br />

London, Uitenhage, Graaff-<br />

Reinet, Mthatha, Grahamstown<br />

(Makhanda)<br />

Population: 6 916 200 (2015)<br />

Area: 168 966km² (13.8%<br />

of <strong>South</strong> Africa)<br />

Premier:<br />

Lubabalo Oscar Mabuyane (ANC)<br />

Key sectors: Automotive,<br />

agriculture, agri-processing,<br />

forestry, finance, retail, tourism,<br />

renewable energy.<br />

Infrastructure: Coega Industrial<br />

Development Zone, East London<br />

Industrial Development Zone,<br />

ports of East London, Port<br />

Elizabeth and Ngqura, airports at<br />

Port Elizabeth and East London.<br />

Notable tourism assets: Addo<br />

Elephant National Park, Mountain<br />

Zebra National Park, Wild Coast,<br />

Jeffreys Bay, National Arts Festival.<br />

Provincial government website:<br />

www.ecprov.gov.za<br />

Eastern Cape Development<br />

Corporation: www.ecdc.co.za<br />

Free State<br />

Capital: Bloemfontein<br />

Main towns: Welkom, Sasolburg,<br />

Parys, Kroonstad<br />

Population: 2 817 900 (2015)<br />

Area: 129 825km² (10.6%<br />

of <strong>South</strong> Africa)<br />

Premier:<br />

Sefora Hixsonia Ntombela (ANC)<br />

Key sectors: Agriculture,<br />

agri-processing, chemical<br />

manufacturing, mining, transport<br />

and logistics.<br />

Infrastructure: Maluti-A-Phofung<br />

Special Economic Zone, Bram<br />

Fischer International Airport,<br />

University of the Free State,<br />

Central University of Technology,<br />

N8 Corridor.<br />

Notable tourism assets: Vaal<br />

River, Gariep Dam, Golden Gate<br />

Highlands National Park, Cherry<br />

Festival, Mangaung <strong>African</strong><br />

Cultural Festival (Macufe).<br />

Provincial government website:<br />

www.freestateonline.fs.gov.za<br />

Free State Development<br />

Corporation: www.fdc.co.za<br />

Gauteng<br />

Capital: Johannesburg<br />

Main towns: Tshwane<br />

(including Pretoria), Ekurhuleni,<br />

Vanderbijlpark, Roodepoort<br />

Population: 13 200 300 (2015)<br />

Area: 18 178km² (1.5%<br />

of <strong>South</strong> Africa)<br />

Premier:<br />

David Makhura (ANC)<br />

Key sectors: Financial and<br />

banking, manufacturing, trade,<br />

creative industries, media.<br />

Infrastructure: OR Tambo<br />

International Airport, Gautrain,<br />

major universities and research<br />

institutions, large convention<br />

centres, FNB Stadium (Soccer City).<br />

Notable tourism assets: Cradle of<br />

Humankind, Apartheid Museum,<br />

Constitution Hill, Magaliesberg,<br />

Soweto tours, Dinokeng.<br />

Provincial government website:<br />

www.gauteng.gov.za<br />

Gauteng Growth and<br />

Development Agency:<br />

www.ggda.co.za<br />

SOUTH AFRICAN BUSINESS <strong>2021</strong> 2020 16 20

SPECIAL<br />

SPECIAL FEATURE<br />

KwaZulu-Natal<br />

Capital: Pietermaritzburg<br />

Main towns: Durban, Newcastle,<br />

Ballito, Port Shepstone,<br />

Empangeni, Ulundi<br />

Population: 10 919 100 (2015)<br />

Area: 125 755km² (7.7%<br />

of <strong>South</strong> Africa)<br />

Premier:<br />

Sihle Zikalala (ANC)<br />

Key sectors: Chemicals, dissolving<br />

pulp manufacture, sugar, forestry,<br />

automotive, textiles and footwear,<br />

mining, oil and gas, logistics.<br />

Infrastructure: King Shaka<br />

International Airport, Dube TradePort,<br />

Richards Bay Industrial Development<br />

Zone, ports of Richards Bay and<br />

Durban, Albert Luthuli International<br />

Convention Centre Complex.<br />

Notable tourism assets: HluhluweiMfolozi<br />

Park, the Drakensberg<br />

mountains, iSimangilso Wetlands<br />

Park, Durban beaches, <strong>South</strong> Coast,<br />

Zulu cultural heritage, historical<br />

battlefields.<br />

Provincial government website:<br />

www.kznonline.gov.za<br />

Trade and Investment KwaZulu-<br />

Natal: www.tikzn.co.za<br />

Limpopo<br />

Capital: Polokwane<br />

Main towns: Musina,<br />

Ba-Phalabora, Bela-Bela,<br />

Steelpoort, Tzaneen, Thohoyandou<br />

Population: 5 726 800 (2015)<br />

Area: 125 755km² (10.2%<br />

of <strong>South</strong> Africa)<br />

Premier:<br />

Chupu Stanley Mathabatha (ANC)<br />

Key sectors: Mining, agriculture,<br />

tourism, logistics.<br />

Infrastructure: Musina-Makhado<br />

Special Economic Zone, N1<br />

highway and rail network, new<br />

Medupi power station.<br />

Notable tourism assets: Kruger<br />

National Park, Mapungubwe<br />

Heritage Site, Makapans Valley,<br />

Marula Festival, Waterberg<br />

Biosphere.<br />

Provincial government website:<br />

www.limpopo.gov.za<br />

Limpopo Economic<br />

Development Agency:<br />

www.lieda.gov.za<br />

Mpumalanga<br />

Capital: Mbombela<br />

Main towns: Emalahleni,<br />

Middelburg, Sabie, Lydenburg<br />

Population: 4 283 900 (2015)<br />

Area: 76 495km² (6.3%<br />

of <strong>South</strong> Africa)<br />

Premier:<br />

Refilwe Mtshweni-Tsipane (ANC)<br />

Key sectors: Agriculture, forestry,<br />

mining, steel manufacturing,<br />

petrochemicals, pulp and paper,<br />

power generation, tourism.<br />

Infrastructure: Nkomazi Special<br />

Economic Zone, Mbombela<br />

International Fresh Produce<br />

Market, Maputo Development<br />

Corridor, Kruger Mpumalanga<br />

International Airport.<br />

Notable tourism assets: Kruger<br />

National Park, Blyde River Canyon,<br />

Barberton Makhonjwa Mountains<br />

(a UNESCO World Heritage Site).<br />

Provincial government website:<br />

www.mpumalanga.gov.za<br />

Mpumalanga Economic Growth<br />

Agency: www.mega.gov.za<br />

17 SOUTH AFRICAN BUSINESS <strong>2021</strong><br />

SOUTH AFRICAN BUSINESS 2020<br />

21

SPECIAL FEATURE<br />

Northern Cape<br />

Capital: Kimberley<br />

Main towns: Douglas, Upington,<br />

De Aar, Port Nolloth, Colesberg<br />

Population: 1 185 600 (2015)<br />

Area: 372 889km² (30.5%<br />

of <strong>South</strong> Africa)<br />

Premier:<br />

Dr Zamani Saul (ANC)<br />

Key sectors: Agriculture, mining,<br />

renewable energy, astronomy.<br />

Infrastructure: Upington Special<br />

Economic Zone, Sol Plaatje<br />

University, Vaalharts Irrigation<br />

Scheme.<br />

Notable tourism assets: Six<br />

national parks including the<br />

Kgalagadi Transfrontier Park,<br />

Orange River, spring flower<br />

displays, diamond routes.<br />

Provincial government website:<br />

www.northern-cape.gov.za<br />

Department of Economic<br />

Development and Tourism:<br />

www.northern-cape.gov.za/dedat<br />

North West<br />

Capital: Mahikeng<br />

Main towns: Klerksdorp,<br />

Rustenburg, Brits, Potchefstroom<br />

Population: 3 707 000 (2015)<br />

Area: 104 882km² (8.6%<br />

of <strong>South</strong> Africa)<br />

Premier: Professor Tebogo Job<br />

Mokgoro (ANC)<br />

Key sectors: Mining, agriculture,<br />

agri-processing, automotive<br />

components.<br />

Infrastructure: Hartbeespoort<br />

Dam, Pelindaba nuclear research<br />

unit, North West University,<br />

Bakwena Platinum Highway.<br />

Notable tourism assets: Sun City,<br />

Mmbatho Palms Hotel Casino<br />

Convention Resort, Pilanesberg<br />

National Park, 18 luxury lodges in<br />

Madikwe Game Reserve.<br />

Provincial government website:<br />

www.nwpg.gov.za<br />

North West Development<br />

Corporation: www.nwdc.co.za<br />

Western Cape<br />

Capital: Cape Town<br />

Main towns: Stellenbosch,<br />

George, Plettenberg Bay, Beaufort<br />

West, Oudtshoorn, Worcester,<br />

Malmesbury<br />

Population: 6 200 100 (2015)<br />

Area: 129 462km² (10.6%<br />

of <strong>South</strong> Africa)<br />

Premier:<br />

Alan Winde (DA)<br />

Key sectors: Agriculture, agriprocessing,<br />

wine and grapes,<br />

financial services, manufacturing,<br />

tourism, oil and gas, boatbuilding.<br />

Infrastructure: Ports of Cape<br />

Town, Saldanha and Mossel Bay,<br />

Mossgas oil-to-gas refinery, Cape<br />

Town International Airport, Cape<br />

Town International Convention<br />

Centre, Koeberg nuclear power<br />

station.<br />

Notable tourism assets: Table<br />

Mountain, Garden Route National<br />

Park, Karoo National Park, West<br />

Coast National Park, Kirstenbosch<br />

Botanical Gardens, Cape Point,<br />

V&A Waterfront, Plettenberg<br />

Bay, Route 62, Zeitz Museum of<br />

Contemporary Art.<br />

Provincial government website:<br />

www.westerncape.gov.za<br />

Wesgro: www.wesgro.co.za<br />

SOUTH AFRICAN BUSINESS <strong>2021</strong> 2020 18 22

An ExtrAordinAry<br />

BusinEss EvEnts dEstinAtion<br />

northern Cape, south Africa<br />

An award winning business and incentive destination, this ageless land offers<br />

a seamless fusion of first world technologies and infrastructure with ancient<br />

authentic cultures, dramatic natural beauty and awesome adventure. This is<br />

the Northern Cape. Now come and experience it for yourself…<br />

For more information do visit<br />

www.experiecenortherncape.com<br />

businessevents@experiencenortherncape.com<br />

Northern Cape Tourism @NorthernCapeSA northerncapetourism northerncapesa

FOCUS<br />

Sectoral strengths of<br />

<strong>South</strong> <strong>African</strong> provinces<br />

SECTORAL STRENGTHS OF<br />

SOUTH AFRICA’S PROVINCES<br />

A wide variety of investments are available.<br />

Gauteng:<br />

• Financial and business services<br />

• Information and communications<br />

technology<br />

• Transport and logistics<br />

• Basic iron and steel, steel products<br />

• Fabricated metal products<br />

• Motor vehicles, parts and accessories<br />

• Appliances<br />

• Machinery and equipment<br />

• Chemical products, pharmaceuticals<br />

North West:<br />

• Agro-processing<br />

• Mining<br />

• Agriculture and agro-processing<br />

• Tourism<br />

• Metal products<br />

• Machinery and equipment<br />

• Renewable energy (solar)<br />

Northern Cape:<br />

• Mining<br />

• Agriculture and agro-processing<br />

• Fisheries and aquaculture<br />

• Renewable energy (solar, wind)<br />

• Jewellery manufacturing<br />

Limpopo:<br />

• Mining<br />

• Fertilisers<br />

• Tourism<br />

• Agriculture<br />

• Agro-processing<br />

• Energy, including<br />

renewables (solar)<br />

Mpumalanga:<br />

• Mining<br />

• Tourism<br />

• Forestry, paper and paper<br />

products, wood and wood<br />

products<br />

• Agriculture and agroprocessing<br />

• Metal products<br />

FOCUS<br />

KwaZulu-Natal:<br />

• Transport and logistics<br />

• Tourism<br />

• Motor vehicles, parts and<br />

accessories<br />

• Petrochemicals<br />

• Aluminium<br />

• Clothing and textiles<br />

• Machinery and equipment<br />

• Agriculture and agroprocessing<br />

• Forestry, pulp and paper,<br />

wood and wood products<br />

Western Cape:<br />

• Tourism<br />

• Financial and business services<br />

• Transport and logistics<br />

• ICT<br />

• Agriculture and agro-processing<br />

• Fisheries and aquaculture<br />

• Petrochemicals<br />

• Basic iron and steel<br />

• Clothing and textiles<br />

• Renewable energy (solar, wind)<br />

Free State:<br />

• Agriculture and agro-processing<br />

• Mining<br />

• Petrochemicals<br />

• Machinery and equipment<br />

• Tourism<br />

Eastern Cape:<br />

• Motor vehicles, parts and<br />

accessories<br />

• Forestry, wood and wood products<br />

• Clothing and textiles<br />

• Pharmaceuticals<br />

• Leather and leather products<br />

• Tourism<br />

• Renewable energy (wind)<br />

Source: Industrial Development Corporation (IDC); The Case for Investing in <strong>South</strong> Africa, Executive Summary<br />

Source: Industrial Development Corporation (IDC)<br />

(<strong>South</strong> <strong>African</strong> Investment Conference, 2018).<br />

Page | 40<br />

SOUTH AFRICAN BUSINESS <strong>2021</strong><br />

20 23 SOUTH AFRICAN BUSINESS 2020

Gert Sibande<br />

District Municipality<br />

A national leader in job creation through the EPWP programme.<br />

PROFILE<br />

Executive Mayor Councillor<br />

Muzi Chirwa<br />

Gert Sibande District<br />

Municipality received<br />

an unqualified audit<br />

opinion from the<br />

Auditor-General for the 2018/19<br />

financial year for the second<br />

consecutive year. Running a<br />

clean municipality in terms<br />

of financial management and<br />

governance has been a priority<br />

for the current administration<br />

since coming into office in 2016.<br />

Gert Sibande District<br />

Municipality (GSDM) has a<br />

comprehensive and credible<br />

Integrated Development Plan.<br />

The 2020/21 IDP document is<br />

in line with the Municipal<br />

Systems Act which makes<br />

community participation in<br />

the affairs of the municipality a<br />

legal obligation. The municipality<br />

has been consultative<br />

and transparent in its approach.<br />

GSDM cannot govern alone; the developmental agenda must be<br />

determined by residents.<br />

The impact of Covid-19 has put a huge strain on the economy.<br />

Having been placed as a leading district in <strong>South</strong> Africa in terms<br />

of job creation through the EPWP programme, GSDM commits to<br />

grow this programme and to find more innovative ways to create<br />

sustainable and dignified jobs. Further interventions are planned in<br />

the agricultural and forestry sector, informal traders, construction,<br />

manufacturing, mining and the tourism industry as we rejuvenate<br />

our economy and the realise the economic freedom for our people.<br />

Gert Sibande District Municipality is the largest of the three<br />

districts in Mpumalanga Province at 31 841km², covering 40% of<br />

the province’s land mass. According to Stats SA, Gert Sibande’s<br />

population increased from 1 043 194 in 2011 to 1 135 409 people in<br />

2016. This makes it the smallest district in population.<br />

Name of Local Main Admin Area Population<br />

Municipality Location (km²) Size (2016)<br />

Chief Albert Luthuli Carolina 5 559 187 630<br />

Dipaleseng Balfour 2 616 45 232<br />

Dr Pixley Isaka Ka Seme Volksrust 5 227 85 395<br />

Govan Mbeki Secunda 2 955 340 091<br />

Lekwa Standerton 4 585 123 419<br />

Mkhondo Piet Retief 4 882 189 036<br />

Msukaligwa Ermelo 6 017 164 608<br />

Vision<br />

A community-driven district of excellence and development.<br />

Mission<br />

To support and coordinate our local municipalities to provide<br />

excellent services and development.<br />

Contact details<br />

Tel: +27 17 801 7000<br />

Email: records@gsibande.gov.za | Website: www@gsibande.gov.za<br />

Follow us on Facebook & Twitter @GertSibandeDM<br />

105 21<br />

SOUTH AFRICAN BUSINESS <strong>2021</strong>

SPECIAL FEATURE<br />

Building infrastructure is a<br />

presidential priority<br />

Projects worth R340-billion have been gazetted for implementation.<br />

young people will be employed to digitise<br />

government information, including hospital<br />

files and police dockets.<br />

• Student accommodation.<br />

• SA Connect Phase 1B, broadband expansion.<br />

Richards Bay SEZ.<br />

The two central planks of the <strong>South</strong> <strong>African</strong><br />

government’s post-Covid rebuilding<br />

programme are infrastructure and<br />

industrialisation.<br />

To promote and monitor the first priority, an<br />

Investment and Infrastructure Office has been<br />

created in the Presidency. It is headed by the<br />

former Gauteng MEC for Economic Development,<br />

Dr Kgosientso Ramokgopa. In 2020 national<br />

government gazetted 51 priority infrastructure<br />

projects, with a total investment value of more than<br />

R340-billion.<br />

Sectors targeted for intervention include energy,<br />

housing, transport, water and sanitation, agriculture,<br />

agro-processing and digital infrastructure. Some<br />

of the “special projects” that fall outside sector<br />

categories include:<br />

• Rural pedestrian bridges and rural roads.<br />

• Energy and water savings on government<br />

buildings.<br />

• Digitising of government information: 10 000<br />

A reconstituted Council of the Presidential<br />

Infrastructure Coordinating Commission met<br />

for the first time in July 2020. With President<br />

Cyril Ramaphosa in the chair, the commission<br />

includes national ministers, provincial premiers,<br />

mayors of big cities and representatives of the<br />

<strong>South</strong> <strong>African</strong> Local Government Association.<br />

Where the council intends doing things<br />

differently is by paying close attention to:<br />

• Preventing corruption through transparent<br />

tender processes and strong due diligence.<br />

• Community involvement in planning and<br />

implementation.<br />

• Emphasis on local employment and procurement<br />

and targeted involvement of SMMEs.<br />

• Blended financing through the Infrastructure<br />

Fund to mobilise more resources from the<br />

private sector, multilateral development banks<br />

and development finance institutions.<br />

A World Bank report has shown that a 10%<br />

increase in infrastructure spending results in a<br />

1% growth in GDP. A study carried out by KMPG<br />

for the Gauteng Province found that spending<br />

on infrastructure resulted in additional economic<br />

activity worth R26-billion in the province and<br />

created 92 000 direct jobs.<br />

In the country’s biggest province in<br />

terms of economic activity, the Provincial<br />

Government of Gauteng spent R30-billion on<br />

infrastructure between 2013 and 2016. The<br />

Gauteng Infrastructure Master Plan is expected<br />

to account for expenditure of about R1.8-trillion<br />

over a 15-year period.<br />

SOUTH AFRICAN BUSINESS <strong>2021</strong><br />

22

SPECIAL FEATURE<br />

Special Economic Zones<br />

A key component of the strategy to boost the value<br />

of the country’s products is to develop infrastructure<br />

where manufacturing can take place, namely<br />

Special Economic Zones (SEZs) and industrial parks.<br />

Each province has been allocated SEZs that<br />

play to regional strengths. Described as “major<br />

catalytic projects” for the northern province of<br />

Limpopo, the Musina-Makhado SEZ (MMSEZ), the<br />

proposed Tubatse SEZ and several industrial parks<br />

are central to the strategy of expanding Limpopo’s<br />

manufacturing capacity.<br />

As of February 2020, Shaanxi CEI Investment<br />

Holdings had committed to a $5-billion investment<br />

in a vanadium and titanium smelter project at<br />

the MMSEZ and a further $1.1-billion had been<br />

pledged from other sources. The first-phase focus<br />

is on energy and metallurgical processes but agroprocessing,<br />

logistics and general manufacturing are<br />

expected to follow.<br />

In the Pretoria area, already home to several<br />

Original Equipment Manufacturers (OEMs), the<br />

Tshwane Automotive Special Economic Zone<br />

(TASEZ) has been launched. It is a joint project of<br />

the Gauteng Province, the Department of Trade,<br />

Industry and Competition, and the City of Tshwane.<br />

The implementing agent is the Coega Development<br />

Corporation (CDC), the developer and operator of<br />

the Coega Special Economic Zone (SEZ).<br />

The Coega SEZ is at the Port of Ngqura near Port<br />

Elizabeth and it too has an automotive component,<br />

recently strengthened by the large investment of<br />