NEW Dependent Care Benefits for 2021

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

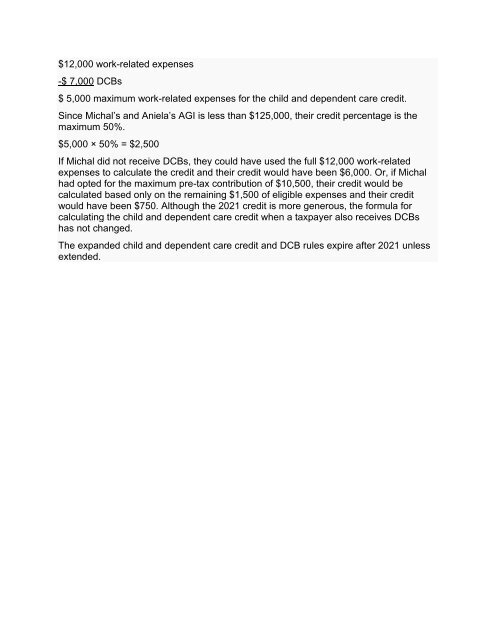

$12,000 work-related expenses<br />

-$ 7,000 DCBs<br />

$ 5,000 maximum work-related expenses <strong>for</strong> the child and dependent care credit.<br />

Since Michal’s and Aniela’s AGI is less than $125,000, their credit percentage is the<br />

maximum 50%.<br />

$5,000 × 50% = $2,500<br />

If Michal did not receive DCBs, they could have used the full $12,000 work-related<br />

expenses to calculate the credit and their credit would have been $6,000. Or, if Michal<br />

had opted <strong>for</strong> the maximum pre-tax contribution of $10,500, their credit would be<br />

calculated based only on the remaining $1,500 of eligible expenses and their credit<br />

would have been $750. Although the <strong>2021</strong> credit is more generous, the <strong>for</strong>mula <strong>for</strong><br />

calculating the child and dependent care credit when a taxpayer also receives DCBs<br />

has not changed.<br />

The expanded child and dependent care credit and DCB rules expire after <strong>2021</strong> unless<br />

extended.