North Hampshire Lifestyle Nov - Dec 2021

At last the Christmas editions are here! With festive fun, gifts and interiors, plus inspiration for decorating the guest bedroom and an interview with the Yorkshire Shepherdess Amanda Owen. Plus, our competition pages return, with staycations, laundry upgrades and festive hampers!

At last the Christmas editions are here! With festive fun, gifts and interiors, plus inspiration for decorating the guest bedroom and an interview with the Yorkshire Shepherdess Amanda Owen. Plus, our competition pages return, with staycations, laundry upgrades and festive hampers!

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Five ways to prepare for<br />

your mortgage application<br />

if you are self-employed or<br />

a contractor.<br />

Recent research by Aldermore Bank revealed<br />

self-employed workers in the UK are pessimistic about<br />

their home buying chances, it seems the pandemic<br />

has intensified their difficulties in getting a foot on the<br />

housing ladder.<br />

However, there are ways. Many specialist mortgage<br />

lenders have lending options which can provide a route<br />

to homeownership for the self-employed. Unlike many<br />

high street banks, specialist lenders can dig into the detail<br />

to understand the income streams and investigate the<br />

mortgage opportunities available.<br />

Our top tip is that you need to be well prepared before<br />

making an application. Make sure you prepare the<br />

documents and information the lender will need to give<br />

your mortgage application its best chance of success.<br />

Here are five ways to prepare for your mortgage<br />

application if you are self-employed or a contractor:<br />

1. Evidence of two-three years of accounts: Lenders<br />

will typically ask to look at two to three years’ worth<br />

of accounts. Since Covid-19, it is also important to<br />

show your business has recovered to pre-pandemic<br />

levels and be able to explain to a lender what<br />

Covid-19 business incentives you took, including<br />

amounts repayable.<br />

2. Get your paperwork in order: You will need to<br />

provide the relevant documentation to prove your<br />

income. Making sure you know which documents<br />

lenders will ask of you and having them to hand<br />

will save time and help speed up the process. See<br />

our Tax Guide at www.newbury.co.uk/filer/<br />

sharing/1619639586/4234/ which explains what<br />

lenders will typically ask to see to prove your income.<br />

3. Evidence a steady stream of work: To prove you’re<br />

a reliable borrower, it’s important to demonstrate a<br />

steady stream of work which has been maintained<br />

over time. It’s also important to show a strong pipeline<br />

of upcoming work.<br />

4. Review and Improve your credit profile: Checking<br />

your credit profile is an important step especially<br />

if you have had credit commitments in the past<br />

and it can be a worthwhile process to check all old<br />

commitments are up to date.<br />

There are several ways to boost your credit profile.<br />

Simple steps such as registering on the electoral roll,<br />

paying off debts and meeting regular payments will<br />

over time make a difference. See our guide at<br />

www.newbury.co.uk/news-knowledge/blog/10-<br />

tips-improve-your-credit-score/<br />

5. Save a larger deposit: Having a larger deposit will<br />

improve your chances of securing a mortgage and<br />

could enable you to buy at a higher price and provide<br />

you with a better mortgage product. Review your<br />

expenditure and see where you can afford to cut<br />

back and put towards your deposit. You could utilise<br />

restricted access savings accounts to benefit from a<br />

more favourable interest rate.<br />

Alton branch: 47 High Street, Alton, GU34 1PF<br />

Call: 01420 84275 Email: alton@newbury.co.uk.<br />

Basingstoke branch: 5-6 Chelsea House,<br />

Festival Place,Basingstoke, RG21 7JR<br />

Call: 01256 816813<br />

Email: basingstoke@newbury.co.uk.<br />

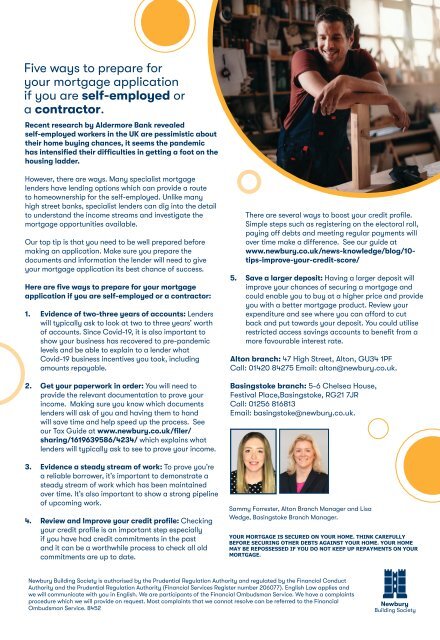

Sammy Forrester, Alton Branch Manager and Lisa<br />

Wedge, Basingstoke Branch Manager.<br />

YOUR MORTGAGE IS SECURED ON YOUR HOME. THINK CAREFULLY<br />

BEFORE SECURING OTHER DEBTS AGAINST YOUR HOME. YOUR HOME<br />

MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON YOUR<br />

MORTGAGE.<br />

Newbury Building Society is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct<br />

Authority and the Prudential Regulation Authority (Financial Services Register number 206077). English Law applies and<br />

we will communicate with you in English. We are participants of the Financial Ombudsman Service. We have a complaints<br />

procedure which we will provide on request. Most complaints that we cannot resolve can be referred to the Financial<br />

Ombudsman Service. 8452<br />

Newbury<br />

Building Society