Highlights of Karnataka State Budget 2010-11 - CHARTERED ...

Highlights of Karnataka State Budget 2010-11 - CHARTERED ...

Highlights of Karnataka State Budget 2010-11 - CHARTERED ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

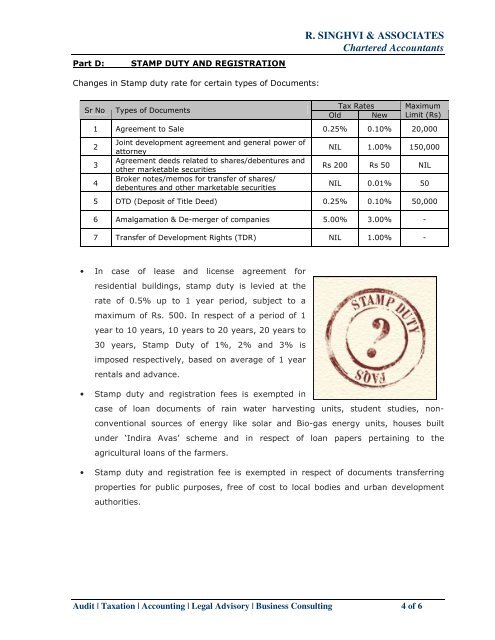

Part D: STAMP DUTY AND REGISTRATION<br />

Changes in Stamp duty rate for certain types <strong>of</strong> Documents:<br />

Sr No Types <strong>of</strong> Documents<br />

• In case <strong>of</strong> lease and license agreement for<br />

residential buildings, stamp duty is levied at the<br />

rate <strong>of</strong> 0.5% up to 1 year period, subject to a<br />

maximum <strong>of</strong> Rs. 500. In respect <strong>of</strong> a period <strong>of</strong> 1<br />

year to 10 years, 10 years to 20 years, 20 years to<br />

30 years, Stamp Duty <strong>of</strong> 1%, 2% and 3% is<br />

imposed respectively, based on average <strong>of</strong> 1 year<br />

rentals and advance.<br />

• Stamp duty and registration fees is exempted in<br />

R. SINGHVI & ASSOCIATES<br />

Chartered Accountants<br />

case <strong>of</strong> loan documents <strong>of</strong> rain water harvesting units, student studies, non-<br />

conventional sources <strong>of</strong> energy like solar and Bio-gas energy units, houses built<br />

under ‘Indira Avas’ scheme and in respect <strong>of</strong> loan papers pertaining to the<br />

agricultural loans <strong>of</strong> the farmers.<br />

• Stamp duty and registration fee is exempted in respect <strong>of</strong> documents transferring<br />

properties for public purposes, free <strong>of</strong> cost to local bodies and urban development<br />

authorities.<br />

Tax Rates<br />

Old New<br />

Audit | Taxation | Accounting | Legal Advisory | Business Consulting 4 <strong>of</strong> 6<br />

Maximum<br />

Limit (Rs)<br />

1 Agreement to Sale 0.25% 0.10% 20,000<br />

2<br />

3<br />

4<br />

Joint development agreement and general power <strong>of</strong><br />

attorney<br />

Agreement deeds related to shares/debentures and<br />

other marketable securities<br />

Broker notes/memos for transfer <strong>of</strong> shares/<br />

debentures and other marketable securities<br />

NIL 1.00% 150,000<br />

Rs 200 Rs 50 NIL<br />

NIL 0.01% 50<br />

5 DTD (Deposit <strong>of</strong> Title Deed) 0.25% 0.10% 50,000<br />

6 Amalgamation & De-merger <strong>of</strong> companies 5.00% 3.00% -<br />

7 Transfer <strong>of</strong> Development Rights (TDR) NIL 1.00% -